Welcome to Elevate’s 2026 Toronto Real Estate Market Guide — your no-fluff breakdown of where the market’s really heading this year.

If you’re serious about building long-term wealth through real estate, this is your roadmap. We’ll cover Toronto housing prices, rent trends, policy shifts, and where the best investing opportunities are right now.

This is for educational purposes only; it does not guarantee future performance or serve as financial or tax advice.

Toronto Real Estate in 2026: The Big Picture

Toronto’s market has shifted — fast.

After two years of higher rates and slower sales, 2026 is shaping up to be the year of the reset. Prices have come down a bit more, borrowing costs are easing, and investors who know their numbers are quietly buying while the crowd hesitates.

Quick Stats As Of October 2025

- Renters: ≈ 47% of Toronto Households

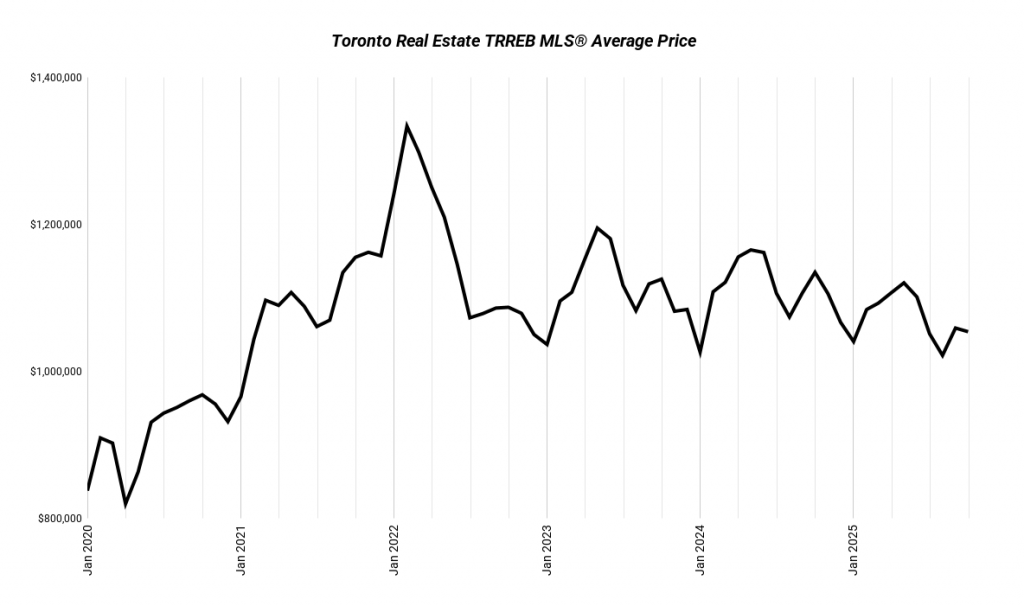

- GTA Average Price: ≈ $1.05 M (-7% YoY)

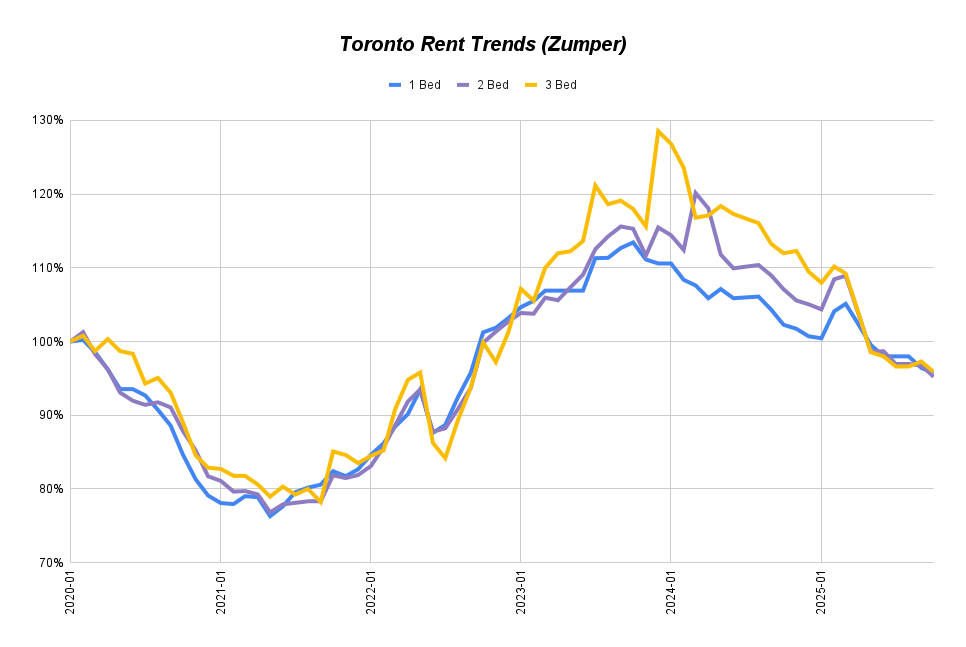

- 1-Bed Rent: ≈ $2,150 (-6% YoY)

- 3-Year Fixed Mortgage Rate ≈ 4% (-15% YoY)

- Multiplex Cash Flows ≈ +55% YoY

That jump in multiplex cash flow tells you all you need to know — numbers now favour investors who buy for income, not speculation.

Population Growth and the Rental Shift

Toronto’s population sits around 2.8 million and keeps climbing, even with slower immigration. Nearly half of all residents rent — and that share is rising.

The GTA expects over 230,000 new renter households in the next decade, but supply is trailing badly with only about 111,000 new purpose-built rentals expected.

➡️ That’s a shortfall of 120,000+ units — and rising.

Short-term, rents may flatten as new completions hit the market. But long-term, the fundamentals haven’t changed — strong demand, limited land, and tighter supply mean rental pressure will keep building.

Toronto Housing Policies: The Density Revolution

Toronto is done pretending single-family zoning works. In the past few years, the city has quietly opened the door for more “missing middle” density — and it’s creating massive opportunity for investors who understand the system.

These rules are turning old single-family homes into cash flow machines. If you’re not looking at these zoning changes, you’re missing the biggest play Toronto’s had in 20 years.

| Policy | Year | What It Means for Investors |

|---|---|---|

| Secondary Suites | 2000 | Legal basement apartments |

| Laneway Suites | 2018–2019 | Backyard homes on laneways |

| Garden Suites | 2022 | Backyard homes without laneways |

| Multiplexes | 2023 | Up to 4 units per lot city-wide |

| Rooming Houses | 2024 | Legal shared housing across Toronto |

| Major Streets Project | 2024/2025 | Up to 6 storeys / 60 units on major streets approved then appealed. OLT resolved appeal in September 2025 so it's now in full force. |

| Sixplexes (9 Wards) | 2025 | Allows up to 6 units as-of-right in 9 wards |

| Retail in Neighbourhoods | 2025 | Adds small-scale shops and services to residential zones |

Where Prices Are Heading in 2026

Toronto home prices dropped about 7% in 2025, but when you zoom out, they’ve basically been stuck in the same range since 2022. Economists expect the market to bottom out around mid-2026, then start climbing again as affordability improves and rate cuts kick in.

We’ll likely see a bit more softening through late 2025, followed by stabilization and modest recovery by the end of 2026.

In plain terms:

- More listings and less competition mean buyers have leverage — and fewer bidding wars.

- Falling rates mean stronger cash flow and better refinance options.

If you’ve been waiting for a window to buy without the chaos, this is that window.

| BoC FORECAST (Oct 2025) | NOW | YE 2025 | YE 2026 |

|---|---|---|---|

| TD | 2.25% | 2.25% | 2.25% |

| CIBC | 2.25% | 2.25% | 2.25% |

| BMO | 2.25% | 2.25% | 2.00% |

| RBC | 2.25% | 2.25% | 2.25% |

| Scotiabank | 2.25% | 2.25% | 2.75% |

Toronto Rents vs. Interest Rates: The Cash Flow Equation

Rents and rates move in sync. When rates spike, rents follow. Now that rates are falling, rent growth is cooling — but not collapsing.

Multiplex cash flows are up +55% year-over-year, thanks to falling purchase prices and investors leveraging conversions and density bonuses.

That’s why cash flow-focused multiplex investors are outperforming everyone else — they’re earning while they wait for appreciation to return.

The Investor Playbook for 2026

Here’s what works now — and what doesn’t:

- ✅ Buy for cash flow and control. Focus on properties where you can influence income, not rely on luck.

- ✅ Target missing-middle projects. Duplexes, triplexes, and fourplexes hit the sweet spot of rentability, financing, and appreciation.

- ✅ Use rate cuts strategically. Refinance mid-2026 to lock in better terms.

- ✅ Renovate for ROI. Add units, boost rents, or reposition the property — active investors win this cycle.

- ✅ Stick to the fundamentals. Location, structure, and numbers still rule.

What doesn’t work:

- ❌ Overpaying for condos with negative cash flow.

- ❌ Betting on appreciation alone.

- ❌ Waiting for “the bottom” — it never announces itself.

Why Multiplexes Still Win in Toronto

Even in a slower market, multiplexes are outperforming everything else:

- More units = more income stability

- Better rent per dollar spent than single-family homes

- +55% YoY cash flow improvement in 2025

- Policy tailwinds that boost value through legal conversions

- Long-term appreciation potential once the next housing cycle starts

This is where the math — not the media — proves the opportunity.

How Elevate Realty Can Help

Toronto’s 2026 market is not about chasing quick flips. It’s about buying assets that cash flow, hold value, and scale up over time. Investors who understand that — and buy while others wait — will look very smart two years from now.

We’re not your average Toronto brokerage. We’re multiplex investors first, realtors second — and we use the same playbook we share with our clients.

We’ll help you:

- Find high-potential multiplexes and value-add opportunities

- Run real numbers so you know exactly what to expect

- Plan renovations to lift rents and property value

- Lease and manage units for hands-off income

If you want to invest smarter in 2026, book a free call with us and let’s talk strategy.