Exclusive multiplex investment opportunity in Toronto for UNDER $900,000, boasting MASSIVE $2,000 monthly cash flows and NO OFFER DATE! Intrigued? Check out these impressive financial projections first:

Why We Love This Deal!

- 🚀 Value Boost: Add units and upgrade finishes to get value-add lift

- 💰 Cash Flow King: Strong positive cash flows, even after refinancing

- 🌟 Great Location: Up-and-coming area with 24-hour streetcar access

- 🏆 Investor-Friendly: Sub-$1M price potentially qualifies for CMHC financing with lower downpayment options

How Do You Make Money On An Investment Property?

There are four ways to make money with an investment property:

- Principal Paydown: Gradually Owning More of Your Property

- Cash Flows: Extra Cash in Your Pocket Each Month

- Long-Term Appreciation: A Growing Asset Over Time

- Value-Add Gain: Boosting Your Property’s Worth Through Smart Renovations

Principal Paydown

A part of every mortgage payment goes towards paying down your loan principal (so you owe less to the bank and own more of the investment property).

It’s like part of your rental income from your investment property goes into a forced savings plan that adds up over time, and this part boosts your total investment property returns.

Cash Flows

Cash flow is the extra money you might get each month you get after paying all the property bills and the mortgage.

We like to be smart about it, aiming for at least breaking even (net zero cash flows), so we don’t have to worry about covering monthly property payments (negative cash flows). The more money you make from your investment property, the better your cash flows can be, which can mean better overall real estate investment returns too.

This is the main deal for some real estate investors – those looking for financial freedom and a break from the 9-5 grind often work towards getting big cash flows from their rental properties.

Their goal? To have these real estate investments bring in enough income to eventually replace their day job pay.

Long-Term Appreciation

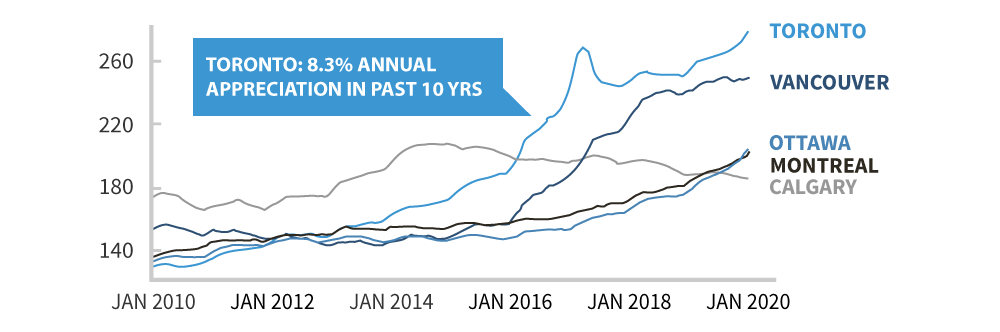

Over time, real estate tends to appreciate, despite short-term ups and downs.

In Toronto, entering the investment property market can be pricier, typically requiring a minimum of $250,000 of investment capital for a house (for a 20% downpayment and closing costs).

But if real estate investors can afford this, many are drawn to Toronto due to its strong and stable appreciation, averaging around 7% per year over the past two decades.

This consistent growth makes Toronto’s real estate means better returns and lower risk when you want to cash out and take profit.

While good rental income is always important, experienced real estate investors often prioritize better appreciation potential.

Why? When selling, only half of the capital gains are taxed, offering a better tax structure. And when you don’t want to sell your investment property, you can access the gains through mortgage refinancing without facing substantial transaction fees or paying taxes.

What's Happening In Toronto's Real Estate Market?

Value-Add Gain

Adding value to your investment property through renovations is called value-add gain, and it can be quite rewarding.

But here’s the thing – it’s not for everyone. It takes time, effort, and renovation risk.

The amount of value-add gain you get depends on the renovations you choose (aim for maximum return), the people you hire, and how well the project is managed (which gets better with experience).

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!

What Do Our Clients Say?

mia chenJune 14, 2024.We had the great pleasure of working with Nick to purchase our first house, and we were absolutely thrilled with our experience. His expertise and attention to detail were evident, and he guided us through every step of the way and answered any questions we had. He was always genial, punctual and gave prompt responses. We appreciated how he took the time to understand our specific needs and preferences. His knowledge of properties, of neighborhoods and of the market helped us find the house we wanted in just a couple weeks. Moreover, Nick has an extensive network of reliable professionals: the inspector, lawyer and contractors he suggested made us feel safe and secure in purchasing our house and turning it into our home. We are thankful to not only have an agent with exceptional professional acumen from whom we learned a lot, but also a friend who took care of us and celebrated each milestone with us. We wholeheartedly recommend Nick and the team at Elevate.

mia chenJune 14, 2024.We had the great pleasure of working with Nick to purchase our first house, and we were absolutely thrilled with our experience. His expertise and attention to detail were evident, and he guided us through every step of the way and answered any questions we had. He was always genial, punctual and gave prompt responses. We appreciated how he took the time to understand our specific needs and preferences. His knowledge of properties, of neighborhoods and of the market helped us find the house we wanted in just a couple weeks. Moreover, Nick has an extensive network of reliable professionals: the inspector, lawyer and contractors he suggested made us feel safe and secure in purchasing our house and turning it into our home. We are thankful to not only have an agent with exceptional professional acumen from whom we learned a lot, but also a friend who took care of us and celebrated each milestone with us. We wholeheartedly recommend Nick and the team at Elevate. umang shahJune 5, 2024.KATE's dedication and hard work during the house-hunting process were outstanding. The entire process, from our first meeting to moving day, was easy and stress-free. Her expertise, patience, and attention to detail made the experience pleasant and simple.

umang shahJune 5, 2024.KATE's dedication and hard work during the house-hunting process were outstanding. The entire process, from our first meeting to moving day, was easy and stress-free. Her expertise, patience, and attention to detail made the experience pleasant and simple. Stephanie SheppardMay 30, 2024.I had the pleasure of working with Karina on securing a rental property, and I can't recommend her highly enough! From the very beginning, she was incredibly helpful and responsive. She answered all my questions promptly and provided clear, thorough information at every step. Karina guided me through the entire process with ease, making what could have been a stressful experience feel seamless and straightforward. Her professionalism and dedication were evident in every interaction, and she truly went above and beyond to ensure everything was taken care of. If you're looking for an agent who is knowledgeable, responsive, and genuinely cares about their clients, I highly recommend reaching out to Karina!

Stephanie SheppardMay 30, 2024.I had the pleasure of working with Karina on securing a rental property, and I can't recommend her highly enough! From the very beginning, she was incredibly helpful and responsive. She answered all my questions promptly and provided clear, thorough information at every step. Karina guided me through the entire process with ease, making what could have been a stressful experience feel seamless and straightforward. Her professionalism and dedication were evident in every interaction, and she truly went above and beyond to ensure everything was taken care of. If you're looking for an agent who is knowledgeable, responsive, and genuinely cares about their clients, I highly recommend reaching out to Karina! Neil PalancaMay 23, 2024.Kate was our leasing agent, and we couldn't have asked for a better experience. From the start, she was incredibly patient and understanding, taking the time to thoroughly explain every step of the rental process. Kate clarified all the details we needed to know and was always available to answer our questions. Her professionalism and friendly demeanor made the entire experience smooth and stress-free. We felt well-informed and supported throughout. Highly recommend Kate for anyone looking to rent a place! Thank you, Kate! 5 stars for you ⭐️⭐️⭐️⭐️⭐️

Neil PalancaMay 23, 2024.Kate was our leasing agent, and we couldn't have asked for a better experience. From the start, she was incredibly patient and understanding, taking the time to thoroughly explain every step of the rental process. Kate clarified all the details we needed to know and was always available to answer our questions. Her professionalism and friendly demeanor made the entire experience smooth and stress-free. We felt well-informed and supported throughout. Highly recommend Kate for anyone looking to rent a place! Thank you, Kate! 5 stars for you ⭐️⭐️⭐️⭐️⭐️ Joy WangMay 15, 2024.We have been with Elevate for almost 5 years, their property management team keeps delivering outstanding service. Especially Laryssa Maneja, she use to be a property manager and then become the head of property management team, now a . She gained lots of knowledge and experience regarding property investment, leasing, tenants profile, renovation over the past a few years. She is knowledgeable, organized and good at communications. Love working with her!

Joy WangMay 15, 2024.We have been with Elevate for almost 5 years, their property management team keeps delivering outstanding service. Especially Laryssa Maneja, she use to be a property manager and then become the head of property management team, now a . She gained lots of knowledge and experience regarding property investment, leasing, tenants profile, renovation over the past a few years. She is knowledgeable, organized and good at communications. Love working with her! Pradip & Raksha BhattMay 8, 2024.A big thankyou to Spiro Vrysellas at Elevate for his excellent & efficient service. Highly recommended and he is with you every step of the way. Made the process seamless.

Pradip & Raksha BhattMay 8, 2024.A big thankyou to Spiro Vrysellas at Elevate for his excellent & efficient service. Highly recommended and he is with you every step of the way. Made the process seamless. Sophie GuilbaultApril 29, 2024.We had a wonderful experience working with Laryssa for the leasing and property management of our home. She has demonstrated great knowledge of the market, creative problem solving and high responsiveness through our entire experience working with her and we couldn’t be more grateful. There are few people I would not hesitate recommending to friends and family when it comes to real estate matters but Laryssa is one of them. I trust that anyone working with her will have a similar positive experience!

Sophie GuilbaultApril 29, 2024.We had a wonderful experience working with Laryssa for the leasing and property management of our home. She has demonstrated great knowledge of the market, creative problem solving and high responsiveness through our entire experience working with her and we couldn’t be more grateful. There are few people I would not hesitate recommending to friends and family when it comes to real estate matters but Laryssa is one of them. I trust that anyone working with her will have a similar positive experience!