This is for educational purposes only; it does not guarantee future performance or serve as financial or tax advice.

Interest rates aren’t moving, the economy is shaky, and condos are sitting empty. So what’s really driving Toronto real estate this fall in 2025? And where can investors still make solid returns?

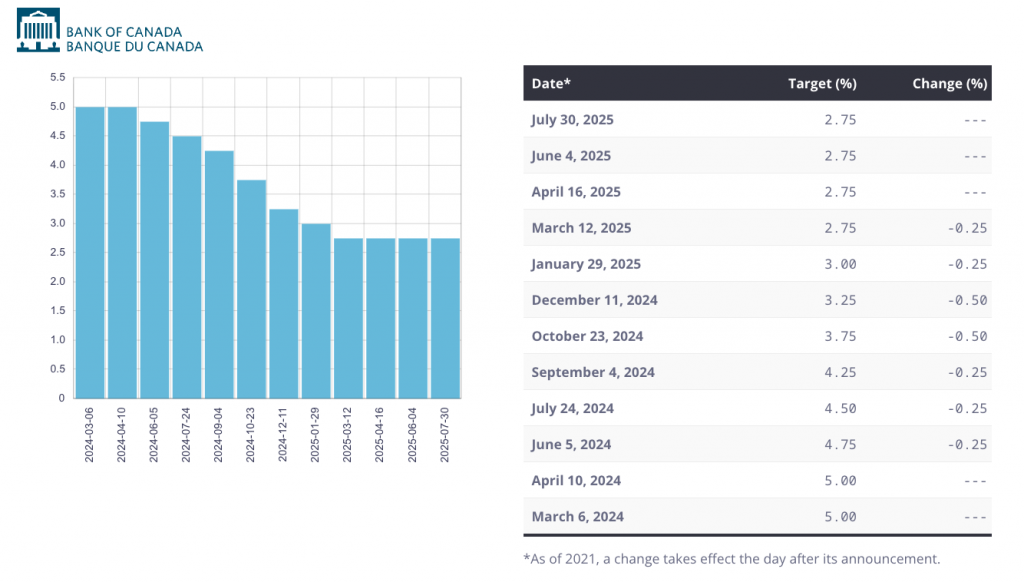

Why Rate Cuts Aren’t Driving the Market In 2025

Lower interest rates help affordability, but they aren’t the main driver anymore. Confidence is key. Buyers and sellers know that prices don’t always go up. Many sellers are hesitant to list, while buyers are cautious in a down market.

Confidence is tied closely to the economy — specifically labour, inflation, and economic growth. Here’s the latest data:

-

Labour: Canada lost over 40,000 jobs in July, pushing unemployment to 6.9%, a multi-year high. Contrast this with June, when 83,000 jobs were added.

-

Inflation: Core inflation numbers coming soon will determine how much room the Bank of Canada has to cut rates without letting prices rise.

-

Growth: GDP data expected August 29 is flat or slightly down. Weak growth plus low inflation could justify a rate cut, but if GDP falls too far, recession fears may keep real estate sluggish.

Rate cuts aren’t a magic fix.

We’ve already dropped 225 basis points and Toronto real estate prices haven’t moved significantly. Even if another cut occurs, it only boosts borrowing power by about 3%, less than typical monthly market swings.

Most buyers are on fixed rates, so only variable-rate borrowers feel any difference.

Supply and Demand: The Toronto Market Driver In 2025

Toronto’s submarkets are behaving very differently:

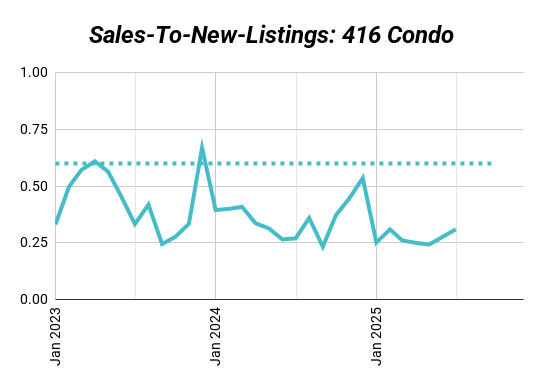

Condos: Oversupplied. New small units flood the market, but buyers aren’t interested. Speculation is dead, so condo prices will continue to lag.

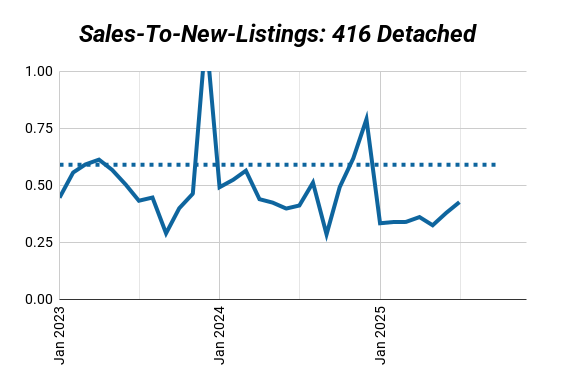

Houses: Strong demand, especially for starter homes in affordable neighbourhoods. Families need space, and with limited land in Toronto, supply is constrained. Steady demand plus limited supply keeps a floor under house prices.

Fall 2025 Toronto Real Estate Market Outlook

Don’t expect a big rebound. Rate cuts might help investors using variable-rate mortgages, but for most buyers, confidence and economic health will determine activity.

If the economy stays weak but avoids recession, we could see modest market pickup. If sellers flood the market and buyers don’t follow, downward pressure on prices will continue.

| Bank | Now | Sep 2025 | Year-End 2025 | Year-End 2026 |

|---|---|---|---|---|

| TD (Updated Jun 2025) | 2.75% | 2.25% | 2.25% | 2.25% |

| CIBC (Updated Jul 2025) | 2.75% | 2.50% | 2.25% | 2.25% |

| BMO (Updated Jul 2025) | 2.75% | 2.50% | 2.25% | 2.00% |

| RBC (Updated Jul 2025) | 2.75% | 2.75% | 2.75% | 2.75% |

| Scotia (Updated Jul 2025) | 2.75% | 2.75% | 2.75% | 2.50% |

Best Multiplex Investment Strategy For Fall 2025

Forget chasing flashy 6-plexes or backyard suites. Half the best deals today require less than $350,000 in capital.

Here’s our proven approach:

- Buy distressed single-family homes and invest around $150,000 to split the property into three units.

- Generate roughly $2,000/month in cash flow.

- Refinance to pull most of your initial capital back.

- Add a laneway or garden suite to increase cash flow over $4,000/month, or refinance again to maintain $3,000+/month cash flow.

These aren’t hypothetical numbers. We’ve done this ourselves and guided hundreds of clients. Lower capital. Lower risk. Solid returns.

Take Action and Crunch the Numbers

If you want full support in Toronto multiplex investing, our team can help you:

- Find high-potential properties

- Crunch the numbers

- Coach renovations

- Lock in great tenants

- Offer property management

Want to see what’s possible for you? Book a strategy session with us here.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!