This is for educational purposes only; it does not guarantee future performance or serve as financial or tax advice.

Everybody loves to obsess over timing the Toronto real estate market. Is this the bottom? Should you wait until interest rates drop? The truth is, most investors don’t lose money because the market crashed. They lose money because they walked straight into avoidable mistakes.

And when it comes to multiplex investing in Toronto, those mistakes aren’t small. We’re talking tens of thousands, sometimes hundreds of thousands, wiped off the table.

These aren’t abstract “what-ifs” either — they’re the rookie errors we see all the time, along with the traps that even seasoned investors fall for. If you’re serious about building long-term wealth in Toronto real estate, knowing what not to do is just as important as knowing what to do.

The Rookie Trap: Going Too Big Too Soon

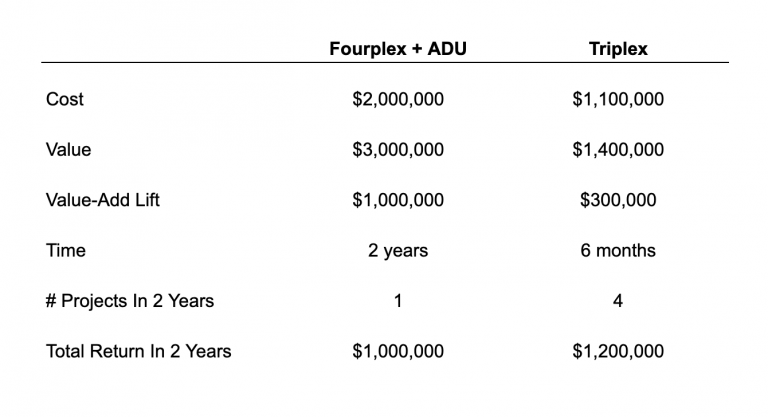

It’s tempting. You see a sixplex with a $1M+ value-add lift on paper, and your eyes light up. But big projects come with big risks. Larger properties need more capital, bigger loans, and the surprises hit harder.

Here’s the math nobody likes to face: go 20% over budget on a $1M project, and you’re suddenly short $200K. Go 20% over on a $100K renovation, and it’s $20K. Painful, yes, but manageable. One wipes out investors, the other teaches lessons you can recover from. The smarter play? Start with a duplex or triplex conversion.

Prove yourself, gain experience, and stack small wins. Five “boring” successful projects beat one failed “big” one every time — plus, smaller multiplexes are far easier to sell if you ever need an exit.

The Flipping Illusion

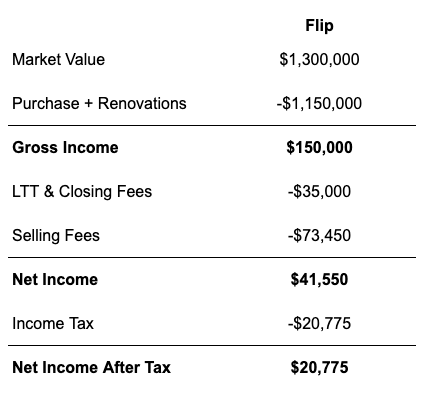

Flipping looks shiny on paper. Buy low, renovate, sell high, cash out fast. The reality? It’s usually a wealth killer. Every sale comes with transaction costs that eat up about 10% of your property value — realtor fees, legal fees, closing costs. Then comes tax. Best case: capital gains. Worst case: CRA calls it business income, and now you’re paying full tax rates.

Think you cleared $150K? After fees and taxes, that might be closer to $20K. Refinancing, on the other hand, builds portfolios. Renovate, increase value, refinance, pull out equity tax-free, and keep the rents and appreciation rolling. Flips make cheques. Refinances build wealth.

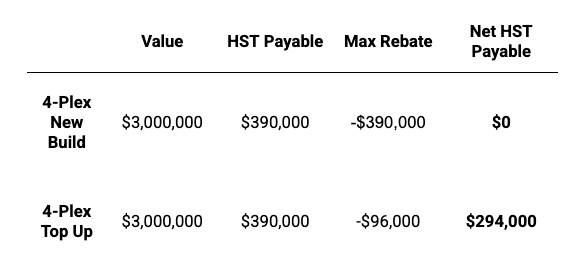

HST: The Silent Killer

One of the most expensive surprises? HST. If you buy and gut-renovate a house, you might trigger HST on the full project. That can mean hundreds of thousands gone, with CRA knocking after the fact. Meanwhile, new fourplex builds for rental often qualify for rebates.

Understanding the rules before you swing a hammer can literally save your deal. Investors who ignore this often only learn the lesson when it’s too late.

The Rental Income Myth

Plenty of investors avoid high-rent properties because they think “the taxes will kill me.” Wrong. With Canada’s capital cost allowance (CCA), you can offset rental income with depreciation and significantly defer taxes.

Walking away from strong cash flow because of tax myths is like saying no to free growth. It’s not the income that hurts you — it’s poor planning.

Financing: The Hard Truth

Banks don’t care about your dreams of passive income. They lend based on today’s income, not tomorrow’s potential. Too many investors waste months chasing deals they can’t qualify for.

On the flip side, a properly rented duplex you already own might actually unlock the financing for your next purchase. That’s why getting pre-approved first isn’t just a good idea — it’s mandatory. Build your strategy on numbers, not guesswork.

Execution: Why DIY Costs More

Trying to save money by DIY-ing renovations or using discount agents is one of the fastest ways to lose it. Projects drag, holding costs double, and mistakes pile up. Renovations become disasters, and cheap agents often miss the difference between a “nice house” and a true investment-grade property.

Multiplex investing is a team sport. The right mortgage broker, contractors, and agent can add far more to your bottom line than you’ll ever save cutting corners.

Ready to Invest in Toronto Multiplexes?

Multiplex investing in Toronto works — but only if you play it smart. The investors who win focus on cash flow, value-add, and scaling strategically. That’s how wealth is built in Toronto real estate.

At Elevate Realty, we help investors avoid these pitfalls and make decisions that actually build wealth. From sourcing the right deals to structuring financing, from renovations to management — we’re with you every step of the way.

Our brokerage specializes in Toronto multiplexes. We’ll help you find deals, crunch the numbers, and guide you through renovations and management. If you want full support in Toronto multiplex investing, our team can help you:

- Find high-potential properties

- Crunch the numbers so you know exactly where you stand

- Coach you through renovations to maximize returns

- Lock in great tenants

- Provide full property management so your investment runs smoothly

Book a strategy session with us here and let’s map out the smartest move for your portfolio.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!