This is for educational purposes only; it does not guarantee future performance or serve as financial or tax advice.

Toronto’s real estate market feels confusing right now. You’ve probably seen the headlines: rents are falling, the housing market is flat, and prices keep sliding. If you’re a new investor, it’s natural to wonder whether this is the wrong time to get in.

But here’s the truth: falling rents aren’t a sign of collapse — they’re part of the normal cycle. What’s unusual is that home prices are still sliding even as rates ease.

That overlap doesn’t happen often, and for investors who understand the numbers, it creates one of the best buying windows we’ve seen in years.

Why Falling Rents Are Normal in Toronto

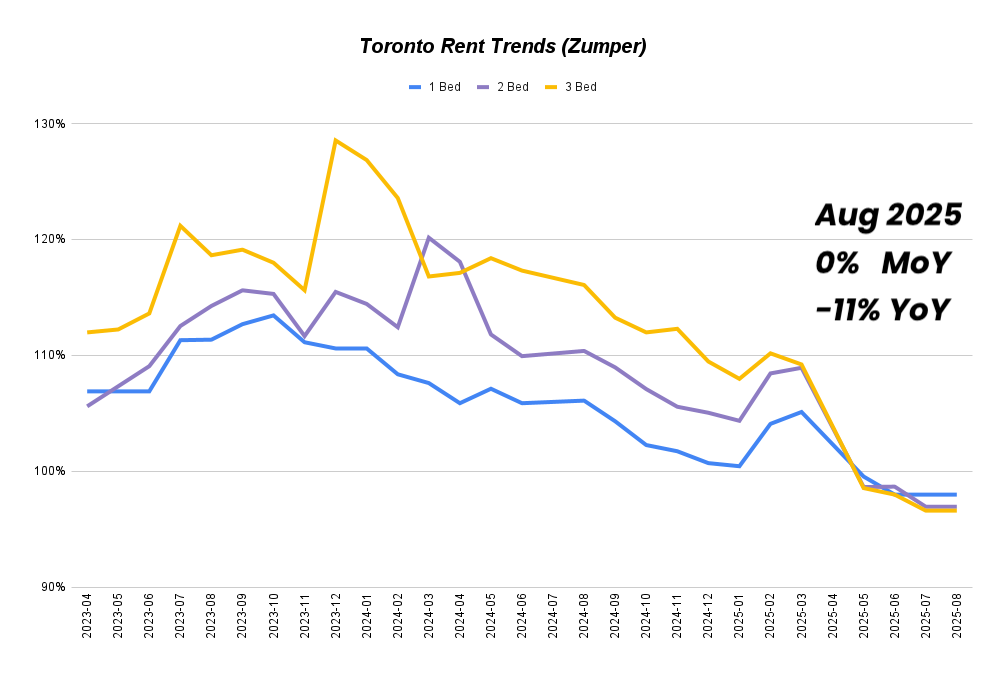

At first glance, falling rents sound scary. But this is exactly what happens when the cycle shifts. Immigration has slowed, the job market has softened, and tenants are stretched. At the same time, a flood of new condo completions has added supply to the rental pool. More supply plus weaker demand means tenants have options — and landlords lose some leverage.

This isn’t new. During the pandemic, low rates let more renters buy, so rents eased.

When rates spiked, renters were locked out of ownership, demand exploded, and rents surged.

Now that rates are easing again, rent softness is what we should expect. And since spring 2025, rents have actually stabilized, proving this isn’t a crash — just the cycle at work.

Why Prices Sliding Is Not Normal

Normally, this is when the market flips. Lower rates bring buyers back, confidence rises, and prices bounce. But right now, confidence is gone. The economy looks shaky, recession fears are real, and buyers don’t believe we’ve hit bottom.

For the first time in years, we have lower rates, rents down year-over-year, and prices still falling. That combination doesn’t line up with the usual cycle — and that’s exactly what makes this window so unique for investors.

The Sweet Spot for Multiplex Investors

Not all rentals are affected equally. Three-bedroom units are the most volatile because families are stretched thin in a weak economy.

One-bedrooms face the heaviest competition since most new condo supply is in that format. Two-bedrooms, on the other hand, are the sweet spot: dual-income tenants want space for a home office, a dog, or a nursery, and they’re not over-supplied or over-stretched.

That’s why our go-to multiplex setup is three two-bedroom units in Toronto’s best pockets. It’s where tenant demand is strongest, rents are most stable, and long-term cash flow holds up best.

How the Numbers Have Shifted Since 2021

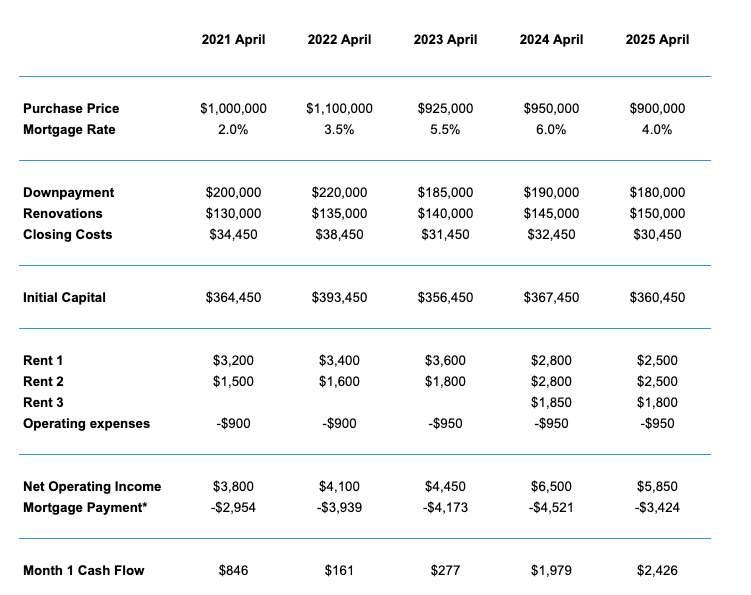

Looking back at the same type of starter multiplex conversion from 2021 to 2025 shows just how dramatically the numbers have changed.

2021: Around $1M purchase price, ~2% mortgage rates, close to $1,000 monthly cash flow.

2022: Market peak at $1.1M with mid-3% mortgage rates, rents up but debt costs killed cash flow.

2023: Prices cooled to $925K, rates higher, but stronger rents nudged cash flow better than the prior years.

2024: Fourplex zoning opened up. Prices flat, rates ticking up, but higher rents made three-unit setups much stronger.

2025: Rents softened slightly, but rates eased, and prices dropped further — delivering the best cash flow yet, close to $2,500/month.

Today’s setup is one of the rare times where prices, rents, and rates have all shifted in a way that favours cash flow investors.

Final Takeaway for Investors

Rents falling isn’t the red flag the headlines make it out to be — it’s the normal rental cycle. What’s unusual is that prices are still sliding even as rates ease. For investors, this is the kind of break in the cycle that creates real opportunity.

At Elevate Realty, we help investors spot these windows and make the smartest move for their goals.

Whether it’s building, converting, or buying multiplexes, the key is understanding where the numbers work today — and setting yourself up before confidence returns and prices move up again.

Need Help Finding the Right Toronto Multiplex Investment?

Our brokerage specializes in Toronto multiplexes. We’ll help you find deals, crunch the numbers, and guide you through renovations and management.

If you want full support in Toronto multiplex investing, our team can help you:

- Find high-potential properties

- Crunch the numbers so you know exactly where you stand

- Coach you through renovations to maximize returns

- Lock in great tenants

- Provide full property management so your investment runs smoothly

Want to see what’s possible for you? Book a strategy session with us here.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!