This is for educational purposes only; it does not guarantee future performance or serve as financial or tax advice.

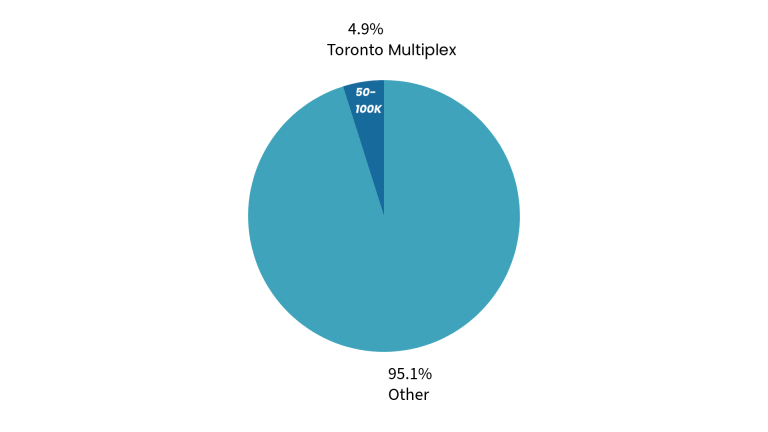

Toronto has a massive housing shortage, and all eyes are on the “missing middle” to help fill the gap. Ontario wants 1.5 million new homes built over the next decade, with 50,000 to 100,000 of them expected to come from multiplexes. That’s roughly 5,000 units per year from the multiplex category alone.

But the reality doesn’t match the promise. In the past year and a half, Toronto only added around 400 multiplex and garden suite units. The policy changes are new, and fourplexes and sixplexes are still working their way into the system, but the gap between targets and reality is staggering. For investors, this disconnect creates opportunity — if you know where to look.

Ontario’s Housing Goals vs. Multiplex Reality

The provincial government has aggressive housing goals, but actual progress in the multiplex space has been underwhelming. Even though multiplexes represent only a small percentage of the overall target, the current pace is nowhere close to meeting expectations. This leaves room for investors to step in where the city isn’t moving fast enough.

The good news is that policy has shifted to encourage fourplexes and sixplexes, and laneway and garden suites are finally making their way into the market. But so far, the numbers prove that policy change alone isn’t enough. Investors who can navigate the system efficiently are positioned to benefit while supply lags behind demand.

Fourplex vs. Sixplex: What’s Working for Investors

Sixplexes may now be allowed, but they don’t always make financial sense. The city’s building rules cap sixplexes at 55 feet in depth and three storeys, the same as fourplexes. That means developers are cramming more, smaller one-bedroom units into the same footprint instead of creating the larger family-friendly rentals Toronto actually needs.

Builders are finding that fourplexes are more practical. They offer better layouts, stronger tenant demand, and fewer headaches when it comes to financing and parking requirements. While sixplexes sound good on paper, fourplexes continue to be the more attractive choice for both builders and small-scale investors.

Why Conversions Still Dominate

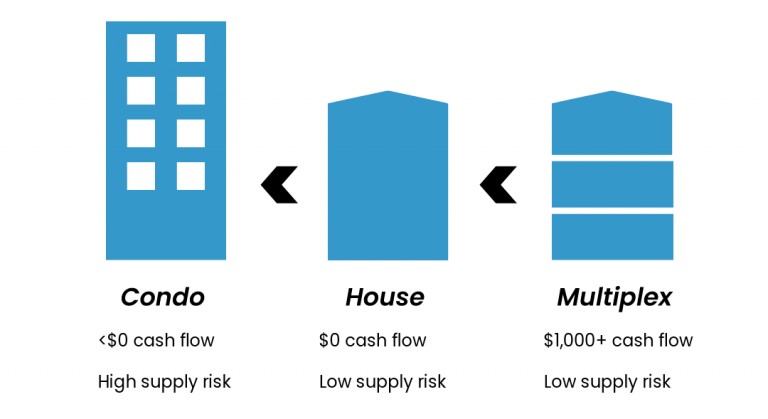

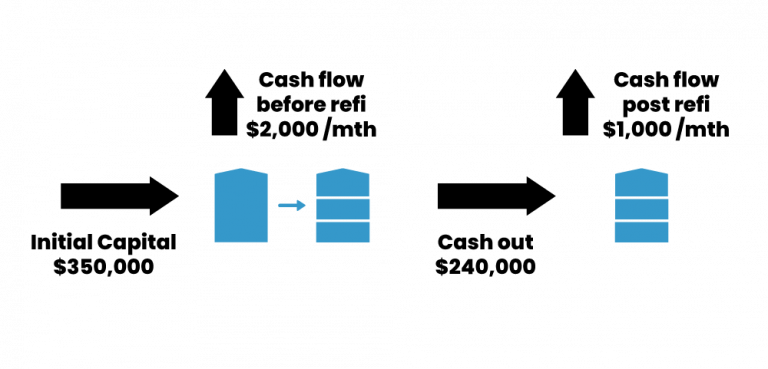

Conversions remain the go-to strategy for most investors. They offer faster timelines, lower entry costs, and stronger cash flow compared to ground-up builds. A triplex or fourplex conversion not only allows for refinancing down the road but also creates flexibility to add additional dwelling units later.

This phased approach works especially well for mom-and-pop investors who may already own a property and want to maximize its value. Many start with a triplex, refinance once it’s stable, and then use the capital to add a laneway suite or basement unit. This strategy spreads out costs and reduces risk, making it far more manageable than jumping straight into a new sixplex build.

Rental Demand for Larger Units Is Strong

Tenants are shifting away from tiny downtown condos and dated, low-quality rentals. Instead, they want bright, modern, family-sized multiplex units with room to grow. The sweet spot is two- and three-bedroom layouts, which appeal to young professionals, couples, small families, and even groups of roommates.

The rise of remote work has added to this demand, as tenants need home offices and extra space for life transitions like pets or children. This is exactly the kind of housing stock the missing middle was meant to create, and investors who deliver these larger, well-designed rentals will see strong demand and premium rents.

The Bedroom Cap: Policy vs. Reality

Toronto’s cap on bedroom counts in multiplexes was meant to prevent them from becoming rooming houses. In practice, it doesn’t change much. Designers simply relabel bedrooms as “dens” or “libraries,” and investors often find that going beyond three bedrooms isn’t financially efficient anyway.

The policy creates paperwork hurdles, but it hasn’t changed the fundamentals. Investors still focus on creating balanced unit mixes with two- and three-bedroom rentals, which is what the market wants most.

The Smart Play in Toronto Multiplexes

The takeaway is simple: Toronto’s housing targets won’t be met any time soon, and that creates opportunity. Investors who can deliver quality, family-sized rental housing will have a strong advantage in the years ahead.

At Elevate Realty, we’ve built our entire business around this opportunity. We help new and experienced investors alike navigate conversions, evaluate build options, and choose the smartest path for their portfolio.

Our brokerage specializes in Toronto multiplexes. We’ll help you find deals, crunch the numbers, and guide you through renovations and management. If you want full support in Toronto multiplex investing, our team can help you:

- Find high-potential properties

- Crunch the numbers so you know exactly where you stand

- Coach you through renovations to maximize returns

- Lock in great tenants

- Provide full property management so your investment runs smoothly

Want to see what’s possible for you? Book a strategy session with us here.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!