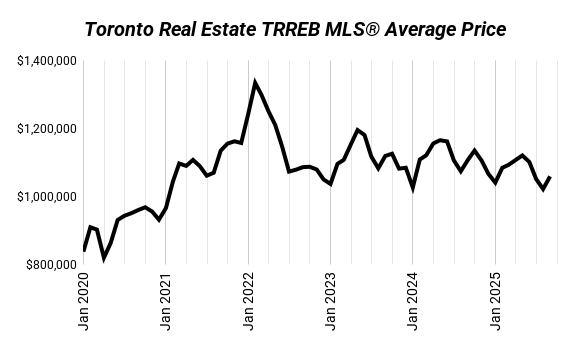

Toronto’s housing market picked up in September, but the recovery isn’t as strong as it looks at first glance. Sales were higher, average prices jumped from August, and you’ll see headlines calling this a rebound.

But the truth is the market loosened, not tightened. A surge of new listings gave buyers more choice and kept sellers under pressure.

| Metric | Sep 2024 | Aug 2025 | Sep 2025 | YoY | MoM |

|---|---|---|---|---|---|

| Average Price | $1,107,291 | $1,022,143 | $1,059,377 | -4% | +4% |

| Sales | 4,996 | 5,211 | 5,592 | +12% | +7% |

| New Listings | 18,089 | 14,038 | 19,260 | +6% | +37% |

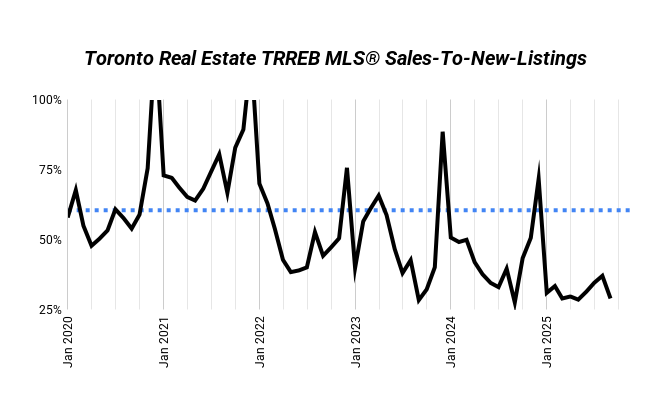

| SNLR | 28% | 37% | 29% | +5% | -22% |

Sales activity picked up compared to last year and last month, and prices moved higher than they were in August. But the real story is supply.

A flood of new listings hit the market, and buyers didn’t keep pace. That means conditions actually tilted further in favour of buyers in September 2025.

At first glance, September looks like a rebound. Average prices jumped 4% month-over-month. But context matters — this wasn’t a real tightening of the market.

The price jump came from a timing mismatch. Buyers rushed back right after the Bank of Canada cut rates in the summer, closing deals before the surge of new listings hit. Those sales — especially detached homes — pulled the average higher. But the real supply flood came later in September, and the effect on prices will show up in October and beyond.

Inventory tells the real story. New listings spiked to over 19,000 — up more than 5,000 from August. That’s the sharpest monthly surge we’ve seen since COVID. Sellers who sat on the sidelines in summer came rushing in, hoping the rate cut would bring stronger fall demand.

But buyers aren’t fooled. They know this is a loose market with more supply than sales. Choice kills urgency. Every extra listing is another reason to wait, negotiate harder, or lowball. That’s why the SNLR dropped to 29% — proof the market actually weakened even as the headline price number ticked up.

Why Prices Went Up in a Weaker Market

At first glance, September looks like a rebound. Average prices jumped 4% month-over-month. But context matters — this wasn’t a real tightening of the market.

The price jump came from a timing mismatch. Buyers rushed back right after the Bank of Canada cut rates in the summer, closing deals before the surge of new listings hit. Those sales — especially detached homes — pulled the average higher. But the real supply flood came later in September, and the effect on prices will show up in October and beyond.

Inventory tells the real story. New listings spiked to over 19,000 — up more than 5,000 from August. That’s the sharpest monthly surge we’ve seen since COVID. Sellers who sat on the sidelines in summer came rushing in, hoping the rate cut would bring stronger fall demand.

But buyers aren’t fooled. They know this is a loose market with more supply than sales. Choice kills urgency. Every extra listing is another reason to wait, negotiate harder, or lowball. That’s why the SNLR dropped to 29% — proof the market actually weakened even as the headline price number ticked up.

| Metric | Sep 2025 | MoM | Trend |

|---|---|---|---|

| Average Price | $1,059,377 | +4% | ↑ |

| Sales | 5,592 | +7% | ↑ |

| New Listings | 19,260 | +37% | ↑ |

| SNLR | 29% | -22% | ↓ |

416 Market: Toronto Semis Holding On Strongest

Detached houses in Toronto looked stronger on the surface because their prices bounced back. But that momentum is more about the type of homes selling than true buyer competition. The reality is there’s still plenty of choice and buyers can afford to be picky.

Semis continue to be the most stable segment. They’re cheaper than detached, useful for both end-users and investors, and they attract steady interest. They’re not immune to weakness, but they’re holding up far better than other property types.

| Segment | Sep 2024 | Aug 2025 | Sep 2025 | YoY | MoM | SNLR |

|---|---|---|---|---|---|---|

| 416 Detached | $1,685,755 | $1,524,066 | $1,686,013 | +0% | +11% | 28% |

| 416 Semi | $1,299,324 | $1,131,498 | $1,181,672 | -9% | +4% | 37% |

| 416 Condo | $707,917 | $667,660 | $681,115 | -4% | +2% | 27% |

| 905 Detached | $1,333,394 | $1,251,686 | $1,247,895 | -6% | -0% | 29% |

Why Condos Look Stronger Than They Are

Condos show the weakest market in the GTA, yet on paper their prices haven’t fallen as much as detached houses. That doesn’t mean they’re holding up better — it means the pain is hidden.

Most condo owners are investors who bought on thin margins, and many of those units were heavily overvalued at the peak. Now, instead of selling at a loss, sellers are sitting. They rent them out, re-list them, or simply pull them off the market.

That creates a “frozen market” effect. The weakest units don’t transact at all, so they never show up in the sales data. The condos that do sell are usually the stronger buildings or better layouts, which props up the averages.

In reality, absorption is terrible, and supply keeps piling up. Condo prices haven’t cratered because sellers refuse to take the hit — but the market is showing its weakness in high inventory, long days on market, and low SNLR.

905 Detached: Suburbs Still Struggling

The suburbs are under the most pressure. Detached homes outside Toronto are still far below their peak values, and buyers aren’t in a rush. With more land and more new construction competing with resales, suburban homes have the weakest outlook of any segment.

What is SNLR (Sales-to-New-Listings Ratio) and Why It Matters

The Sales-to-New-Listings Ratio (SNLR) shows how hot or cold the market is by measuring how many homes are selling compared to how many are being listed.

- Seller’s Market (SNLR above the dotted line): More buyers than sellers. Homes move fast, competition heats up, and prices usually rise.

- Buyer’s Market (SNLR below the dotted line): More listings than buyers. Homes sit longer, buyers have leverage, and prices tend to soften.

- Balanced Market (SNLR near the dotted line): Supply and demand are in sync. Prices stay relatively stable.

Every market has its own version of that dotted line, but the trend matters most — if SNLR is rising, the market’s tightening. If it’s falling, buyers are gaining ground.

| Segment | Peak Price | Sep 2025 Price | Change from Peak | YoY | MoM | SNLR |

|---|---|---|---|---|---|---|

| 416 Detached | $2,073,989 | $1,686,013 | -19% | +0% | +11% | 28% |

| 416 Semi | $1,545,447 | $1,181,672 | -24% | -9% | +4% | 37% |

| 416 Condo | $831,351 | $681,115 | -18% | -4% | +2% | 27% |

| 905 Detached | $1,727,963 | $1,247,895 | -28% | -6% | -0% | 29% |

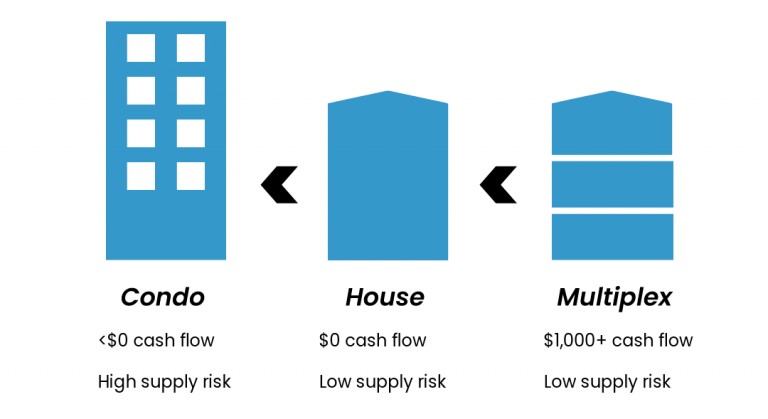

What This Means for Investors

Weakest Short-Term: Condos

Oversupply, investor exits, and poor absorption make condos the softest part of the market right now. Prices haven’t fallen as much on paper only because the weakest units simply aren’t selling, not because demand is holding up.

Weakest Long-Term: 905 Detached

Even though families will always want suburban homes, they face structural headwinds: less desirable locations compared to the city, higher prices than Toronto condos, and endless new supply from builders. That combination makes recovery slower and long-run appreciation weaker.

End-User Stable: 416 Detached

City detached homes will always have an end-user base, which creates a natural floor. But as investments, they don’t work well for cash flow. They only make sense if you’re unlocking value through multiplex conversions.

The Standout: 416 Semis

Semis hit the sweet spot. End-users like them for affordability and space. Investors like them for stronger rent yields and conversion potential. That dual demand makes semis the most resilient and the smartest play in today’s market.

Bottom line: Condos are weakest in the short run, 905 detached struggle most long term, 416 detached are safe for end-users but thin for investors, and 416 semis are the clear winner.

How We Can Help

Markets like this look messy, but smart investors know it’s an opportunity. The focus shouldn’t be on guessing price trends — it should be on finding properties that cash flow today and have upside tomorrow.

That’s where we specialize: buying right, adding value, and building portfolios that survive any market cycle.

Want to see what’s possible for you? Book a strategy session with us here.