This is for educational purposes only; it does not guarantee future performance or serve as financial or tax advice.

By January 2026, OSFI — Canada’s banking regulator — is tightening mortgage rules with a new classification called IPRRE: income-producing residential real estate. On the surface, this has left many investors worried that scaling portfolios will become impossible.

But here’s the reality: while these rules will affect some markets across Canada, Toronto’s investment fundamentals are different. If you’re investing here, the impact is far less severe than the headlines suggest. Let’s break down what’s changing, who’s really being targeted, and why Toronto multiplex investors remain well positioned.

What Are OSFI’s New Mortgage Rules?

OSFI has created a new IPRRE category to classify mortgages where more than half of the income used to qualify comes from the property’s rents. When a loan is flagged as IPRRE, banks must treat it as higher risk.

That means three things for borrowers: banks must hold more capital, they pass that cost back through higher interest rates, and they issue tighter terms. There’s also no double-counting. If you already used rental income or salary to qualify for one mortgage, you can’t reuse the same income for another property. This is where many investors feel the pinch.

Why Smaller Markets Are the Target

The rules hit hardest in markets with low property values and high cap rates. Take Calgary as an example. A duplex priced at $300,000 might generate $2,400 a month in rent. If the borrower’s salary is only $20,000 a year, more than half of the qualifying income comes from the property. That triggers IPRRE classification, and the income used on Property 1 can’t be recycled for Property 2. Scaling slows down fast.

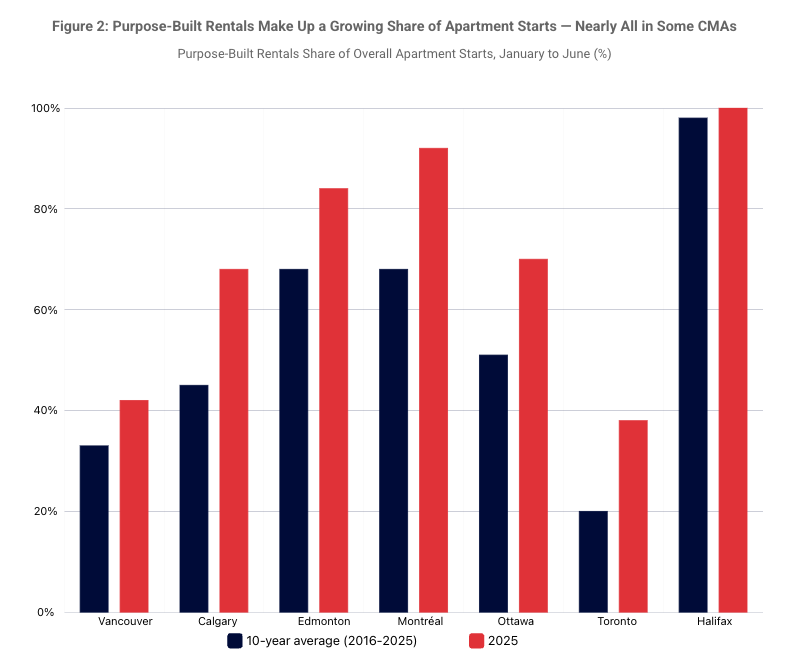

OSFI’s focus is clear: markets like Calgary, Edmonton, and Halifax, where cheap homes and strong rent yields allow portfolios to grow quickly on rental income alone. Those markets have seen rental supply increase at a faster pace than demand, and regulators want to cool it down.

Why Toronto Is Different

Toronto’s fundamentals don’t fit that mold. Here, purchase prices are high relative to rents. To classify a $1 million property as IPRRE, you’d need over $10,000 in qualifying rent per month — essentially a 7.5% cap rate. That doesn’t exist in Toronto.

Instead, buyers need strong personal income plus rents to qualify, which keeps most properties out of IPRRE territory. Toronto’s investment model isn’t about maxing out leverage on day-one cash flow. It’s about balanced returns: steady appreciation, consistent rent growth, and value-add potential through multiplex conversions. This balance makes the portfolio more resilient, even under tighter mortgage rules.

The Advantage of a Balanced Strategy

Avoiding the IPRRE label is only part of the story. Toronto’s balanced approach actually reduces investor risk. By relying on multiple return drivers — appreciation, rental income, and value-add lift — your portfolio isn’t exposed to sudden changes in mortgage policy or rental oversupply.

This is why Toronto multiplex investing remains one of the most fundamentally sound strategies in the country. It’s not speculation, it’s not chasing high cap rates in thin markets. It’s building long-term wealth in a city where real demand is stable and growing.

How We Can Help

OSFI’s new mortgage crackdown is real, but Toronto investors aren’t the target. In fact, a balanced strategy in this city makes your portfolio safer and stronger over the long run.

At Elevate Realty, we specialize in helping investors scale the right way. We’re not just real estate agents — we’re advisors who help you run the numbers, evaluate deals, plan renovations, and manage properties. If you want to keep growing your portfolio without worrying about these new rules, we can help.

Our brokerage specializes in Toronto multiplexes. We’ll help you find deals, crunch the numbers, and guide you through renovations and management.

If you want full support in Toronto multiplex investing, our team can help you:

- Find high-potential properties

- Crunch the numbers so you know exactly where you stand

- Coach you through renovations to maximize returns

- Lock in great tenants

- Provide full property management so your investment runs smoothly

Want to see what’s possible for you? Book a strategy session with us here.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!