This is for educational purposes only; it does not guarantee future performance or serve as financial or tax advice.

Toronto’s real estate market looks like it’s recovering — sales are up, prices ticked higher, but listings are flooding back. So if you look closer, the numbers tell a different story. This isn’t a comeback; it’s a correction in slow motion.

Many condo investors are stuck right now. Rents aren’t keeping up with carrying costs, cash flow is negative, and selling feels like taking a loss. But what if taking that loss now is actually the smartest move you can make? The truth is, the investors winning in this market aren’t waiting for prices to rebound — they’re repositioning strategically while others sit still.

| Metric | Sep 2025 | MoM | Trend |

|---|---|---|---|

| Average Price | $1,059,377 | +4% | ↑ |

| Sales | 5,592 | +7% | ↑ |

| New Listings | 19,260 | +37% | ↑ |

| SNLR | 29% | -22% | ↓ |

Toronto’s Market Is Loosening — Not Recovering

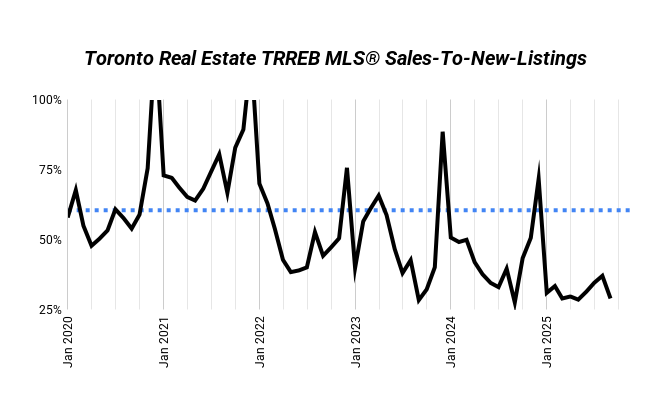

Despite what the headlines say, Toronto’s 2025 market is still deep in buyer territory. Yes, sales are up compared to last year, but new listings jumped even faster — over 37% in a single month. The sales-to-new-listings ratio (SNLR) sits around 20%, meaning only one in five properties is selling.

That’s not strength; that’s oversupply. And in markets like this, sellers chasing last year’s prices get burned. Properties listed too high sit for months, while smart sellers who price strategically move on to stronger opportunities — often picking up better deals on their next purchase in the process.

Why Waiting Hurts More Than Selling

Many condo investors are holding out for a “rebound,” hoping to sell once the market climbs again. But here’s the problem: while they wait, the gap between what they’re earning and what they’re paying widens. Negative cash flow doesn’t just hurt your monthly budget — it kills your borrowing power and slows your ability to grow.

If you’re planning to move up into a house or multiplex, waiting can backfire. Sure, you might get a slightly higher price for your condo later, but the property you want to buy could rise by even more. In a buyer’s market, the math flips: you might lose a bit on the sale, but you save more on the buy side. Net, you come out ahead.

Turning a Small Loss Into a Bigger Win

Here’s a real example. Say your condo’s worth $700,000 and rents for $3,000 a month. After expenses, you’re losing around $350 every month — and that’s assuming nothing breaks. If you sell now and walk away with $350,000 in equity, you could buy a $900,000 house and put $150,000 into converting it into a legal multiplex.

Now you’re cash flowing $2,000 a month instead of bleeding money. You’ve also forced $150,000 in appreciation through renovation. Once you refinance, you could pull out roughly $240,000 and still stay cash flow positive. That’s capital you can reinvest into your next property. It’s not luck — it’s leverage.

Where Smart Money Is Moving

Savvy investors aren’t just buying anything — they’re targeting undervalued areas and high-upside properties.

Two types of locations stand out:

Prime neighbourhoods at a discount. Places like Seaton Village or Trinity Bellwoods that used to sell for $2 million can now be had for closer to $1.3–$1.4 million. That’s a rare entry point for top-tier real estate.

Up-and-coming pockets near infrastructure. Along Eglinton West, near Dufferin and Caledonia, the new LRT is unlocking opportunity. The area’s mid-gentrification — meaning prices are low now, but the fundamentals are improving fast.

These are the properties you can hold long-term, cash flow on day one, and still have upside through redevelopment or refinancing.

Why Smart Investors Buy When Others Freeze

Buying now doesn’t mean ignoring risk — it means understanding it better than everyone else. Most people are waiting for “certainty,” but by the time the market feels safe again, prices and competition will have already returned.

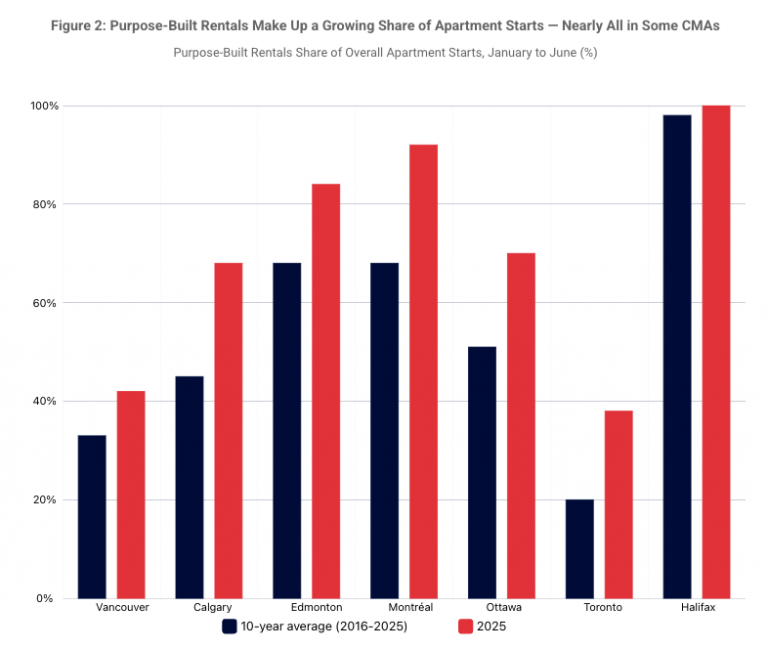

Toronto’s fundamentals haven’t changed: strong population growth, tight rental supply, and a diversified job base. Meanwhile, cities that investors flocked to for quick cash flow — like Calgary and Edmonton — are already showing oversupply risk. Toronto’s long-term value comes from scarcity and demand, not speculation.

Ready to Invest in Toronto Multiplexes?

Waiting for the perfect market means missing the perfect setup. Selling your condo might sting, but if it frees you to buy something with real income potential, you’re not losing — you’re repositioning. The smartest investors understand that long-term growth starts with making hard moves when others hesitate.

If you’re stuck deciding whether to hold or sell, or trying to figure out what your next move should be, we can help you make the numbers work in your favour. We help Toronto investors reposition from weak assets into strong ones — with clear strategies that improve cash flow and build long-term wealth.

Our brokerage specializes in Toronto multiplexes. We’ll help you find deals, crunch the numbers, and guide you through renovations and management. If you want full support in Toronto multiplex investing, our team can help you:

- Find high-potential properties

- Crunch the numbers so you know exactly where you stand

- Coach you through renovations to maximize returns

- Lock in great tenants

- Provide full property management so your investment runs smoothly

Book a strategy session with us here and let’s map out the smartest move for your portfolio.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!