This is for educational purposes only; it does not guarantee future performance or serve as financial or tax advice.

You’ll hear a lot of investors brag about big wins in Toronto real estate — but the ones who actually build wealth are the ones quietly keeping more after tax.

Before we dive in, let’s make this clear: this isn’t tax advice. We’re not accountants. We’re real estate investors who’ve built and scaled our own portfolios right here in Toronto. What we’re sharing here is practical knowledge that every investor needs to understand if you don’t want to overpay the CRA.

Understanding How Real Estate Income Is Taxed in Toronto

When you hold real estate personally, your income falls into two main categories: rental income and capital gains.

Rental income is simple — it’s your rent minus expenses like property tax, maintenance, insurance, and the interest portion of your mortgage. Whatever’s left gets added to your personal income and taxed at your marginal rate.

| Income Level | Approx. Marginal Tax Rate (Ontario 2025) | Effective Tax on Capital Gain |

|---|---|---|

| $60,000–$100,000 | ~30% | ~15% of the total gain |

| $100,000–$220,000 | ~43% | ~21.5% of the total gain |

| $220,000+ | ~53% | ~26.5% of the total gain |

Capital gains, on the other hand, only apply when you sell. You’re taxed on half your profit, not the full amount, and that taxable half is added to your income for that year.

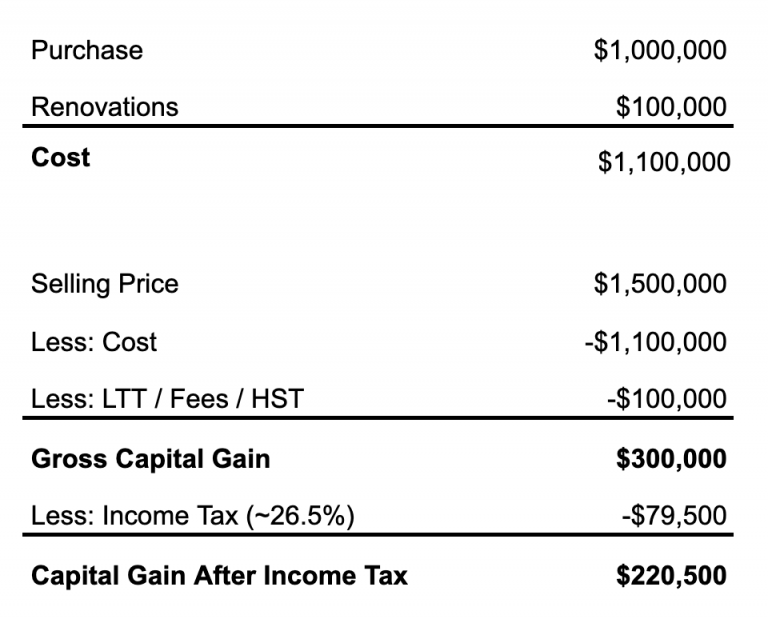

For example, if you buy a multiplex for $1 million, spend $100,000 fixing it up, and sell it for $1.5 million, your gain is $300,000 after fees. Half of that — $150,000 — is taxable. If you’re in the top Ontario tax bracket, that’s about $80,000 in tax. You still keep roughly $220,000 after tax — not bad, but it’s worth asking if there’s a smarter way to manage it.

Why Refinancing Beats Selling for Tax Efficiency

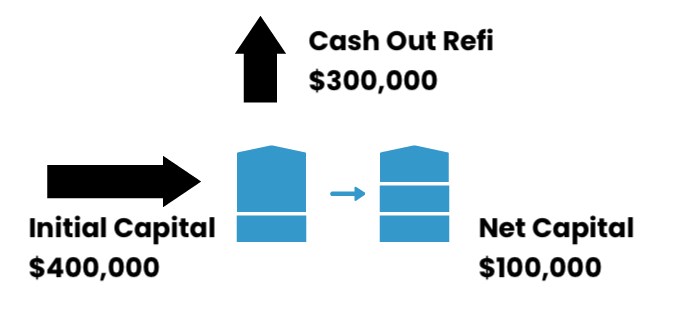

Unlike stocks, where you usually need to sell to access your gains, real estate gives you more flexibility. Through refinancing, you can pull out equity tax-free, since borrowed money isn’t considered income.

That’s how experienced investors scale faster — they keep the property, access the equity, and reinvest it into new opportunities without triggering a capital gains tax bill. It’s one of the most powerful tools Toronto investors can use to grow their portfolio while keeping more money working for them.

Depreciation: The Power of Deferring Taxes with CCA

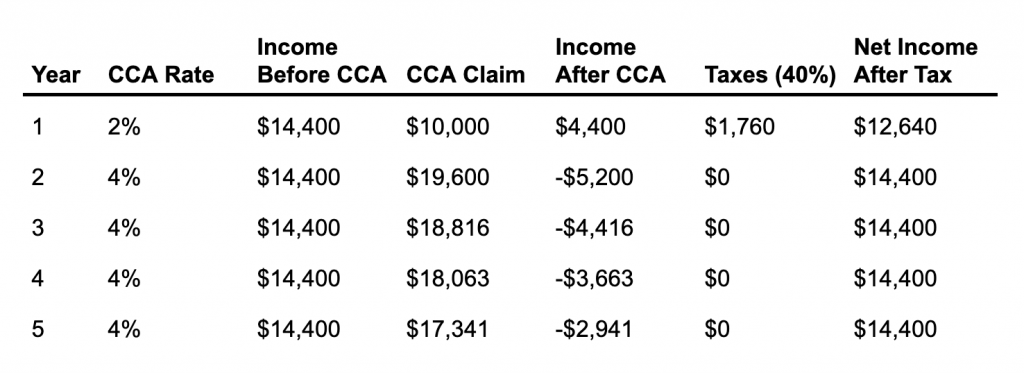

Another smart move is using depreciation, also known as Capital Cost Allowance (CCA). This allows you to write off a portion of your building’s value each year, lowering your taxable income today.

You’ll pay it back when you sell, but in the meantime, you get to reinvest that money into new opportunities. It’s not tax avoidance — it’s smart timing. By deferring tax payments, you’re essentially growing your portfolio with funds that would’ve otherwise gone to the CRA, compounding your returns on a larger, pre-tax base.

Don’t Ignore the Small Deductions

A lot of investors leave money on the table by ignoring smaller deductions. It’s not just about maintenance and repairs — if you own at least two investment properties, you can also expense mileage when you drive to manage them.

These small, legitimate deductions may seem insignificant on their own, but over a year, they can add up to thousands in savings. And that money can go straight back into improving your properties or funding your next purchase.

Timing and Ownership Matter

Timing can also make a big difference. Selling a property in a lower-income year — such as during a sabbatical, parental leave, or retirement — can reduce your overall tax bill.

If you’re investing with a spouse who earns less, consider splitting ownership. When structured properly and both partners contribute equally, dividing rental income and capital gains can lower your combined tax burden and improve overall efficiency.

The Truth About Holding Real Estate in a Corporation

Many investors assume owning real estate through a corporation automatically means paying less tax, but that’s a common misconception. The small business tax rate only applies to active business income — not rental income.

Because real estate income is considered passive, it’s typically taxed at a higher rate within a corporation. That means holding properties personally may actually be more tax-efficient, especially if you’re in a lower personal tax bracket. That said, corporations still have advantages: they offer liability protection, make it easier to raise capital, and provide flexibility for scaling larger portfolios.

Need Help Finding the Right Toronto Multiplex Investment?

You can’t avoid paying taxes — but you can be smart about when and how much you pay. Understanding how to leverage refinancing, depreciation, and timing strategies can help you grow faster and keep more of your profits in the long run.

At Elevate Realty, we don’t just talk about investing — we do it. We own, manage, and scale our own portfolios right here in Toronto, so every strategy we share comes from real-world experience.

If you want to grow efficiently and maximize your after-tax returns, you need a team that knows how to put these strategies into action. We help Toronto investors buy smarter, scale faster, and build portfolios that last. Our team can help you:

- Find high-potential properties

- Crunch the numbers so you know exactly where you stand

- Coach you through renovations to maximize returns

- Lock in great tenants

- Provide full property management so your investment runs smoothly

Want to see what’s possible for you? Book a strategy session with us here.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!