This is for educational purposes only; it does not guarantee future performance or serve as financial or tax advice.

Toronto’s housing problem isn’t just about supply—it’s about the wrong supply. For decades, the city built detached homes and condo towers, with almost nothing in between. That “in between” is what we call the Missing Middle: duplexes, triplexes, fourplexes, and backyard suites that fit seamlessly into existing neighbourhoods and create more housing options where people actually want to live.

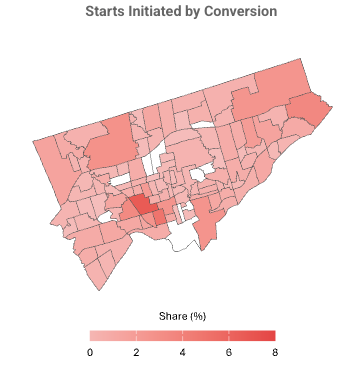

On paper, Toronto should be seeing a boom in this kind of housing. The city finally loosened its zoning laws, allowing up to four units per lot, plus laneway or garden suites in most areas. But in reality, few of these projects are getting built—and the reasons have little to do with red tape anymore.

The Real Bottleneck: Cost, Land, and Financing

Zoning changes may have opened the door, but most investors can’t walk through it. Land costs remain sky-high, and the price of construction has climbed faster than rents. In Toronto, small builders can’t easily access commercial financing, and residential lenders hesitate to fund large conversions unless you have exceptional income or capital on hand.

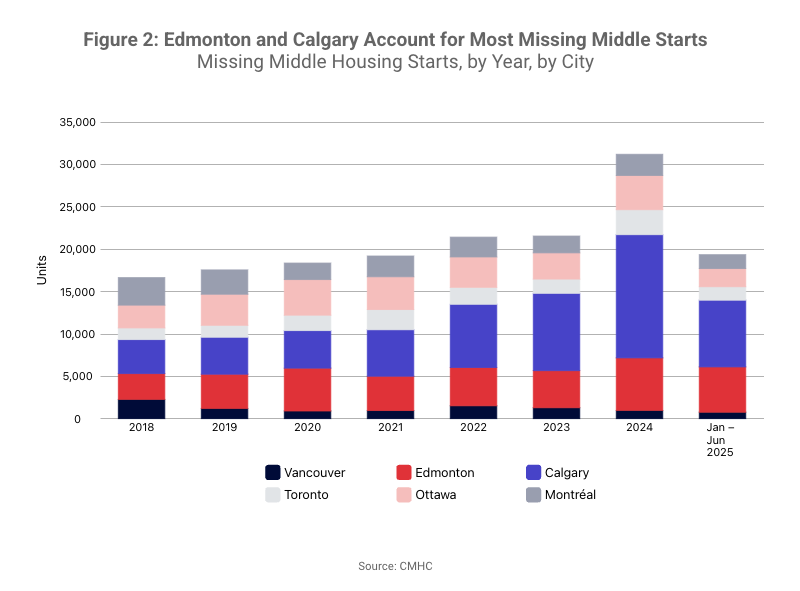

Compare that to markets like Edmonton or Calgary, where land is cheaper, rent yields are higher, and small builders can still make the math work. That’s why we’re seeing the Missing Middle grow out west while Toronto continues to lag behind.

Why Big Developers and Small Investors Both Sit It Out

Large developers ignore the Missing Middle because the numbers don’t scale. They’d rather build 200-unit condo towers with institutional financing and predictable margins.

Meanwhile, smaller investors often find these projects intimidating. Conversions come with complex planning, multiple contractors, and lender hurdles. The result? Toronto’s most needed housing type—multi-unit homes in family-friendly neighbourhoods—gets caught in the middle, with almost no one building it.

The Sweet Spot: Conversions That Actually Work

Here’s where savvy investors step in. The smartest plays aren’t new builds—they’re conversions. Take a midtown fixer-upper at around $900,000. Add $200,000 in renovation costs to create three legal units, and you’ve got a property worth roughly $1.3 million. That’s a $200,000 lift in value—plus roughly $2,000 a month in positive cash flow.

Once stabilized, you can refinance, pull most of your capital back out, and redeploy it into the next project. You’re not just chasing appreciation—you’re manufacturing it. That’s how Toronto investors can still win in a market that feels impossible to crack.

What This Means for Investors

Toronto’s Missing Middle is no longer a policy problem—it’s a business model problem. But for those who understand financing, construction, and long-term rental strategy, it’s the best opportunity in the city. While others wait for developers to “fix” the housing crisis, investors who act now are quietly building the kind of housing Toronto actually needs—and getting paid for it.

Ready to Invest in Toronto Multiplexes?

The takeaway: the Missing Middle isn’t missing for everyone. Investors who know how to run the numbers and take on conversions are capturing real equity growth and solid cash flow—right here in Toronto.

At Elevate Realty, we understand how tough these calls can be. That’s why we specialize in helping Toronto investors sell smarter and reinvest better. From analyzing the numbers to finding high-performing multiplexes, we help you make moves that actually grow your wealth.

Our brokerage specializes in Toronto multiplexes. We’ll help you find deals, crunch the numbers, and guide you through renovations and management. If you want full support in Toronto multiplex investing, our team can help you:

- Find high-potential properties

- Crunch the numbers so you know exactly where you stand

- Coach you through renovations to maximize returns

- Lock in great tenants

- Provide full property management so your investment runs smoothly

Book a strategy session with us here and let’s map out the smartest move for your portfolio.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!