This is for educational purposes only; it does not guarantee future performance or serve as financial or tax advice.

A surprising trend is emerging in Toronto: even high earners are still renting. The average renter now earns around $142,000 a year and pays roughly $2,600 per month in rent. With those numbers, most people assume homeownership simply doesn’t make financial sense — or that only those with massive savings can afford to buy.

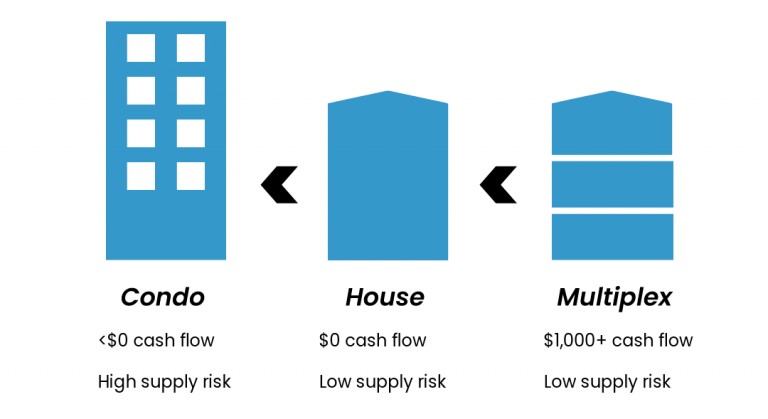

But that’s based on traditional single-family ownership thinking. In today’s market, the smartest investors are using income-producing multiplexes to make homeownership not only affordable, but profitable. By approaching real estate strategically — and using rental income to offset carrying costs — homeownership becomes an investment asset, not a liability.

Is Homeownership Really Out of Reach in Toronto?

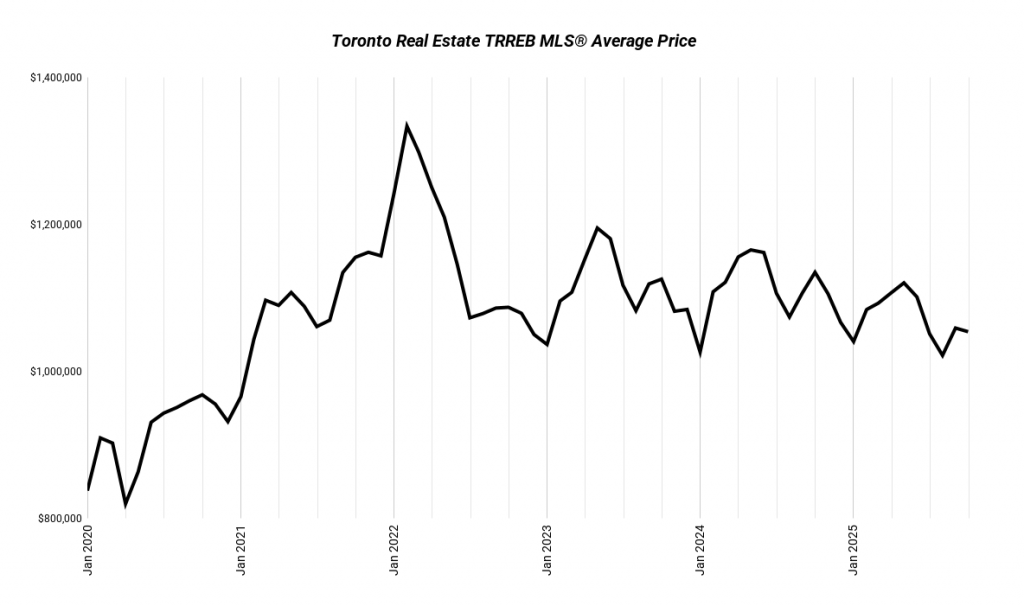

When you look at conventional buying strategies, it’s easy to understand why many people avoid ownership. Buying a $1 million home with 20 percent down requires around $235,000 in savings and leads to monthly mortgage payments of roughly $4,700 — almost double what the average renter pays.

On that basis, most people stop exploring ownership. But that view ignores the long-term benefit of wealth building. At just 2 percent annual appreciation, a $1 million home generates $20,000 in value gain per year. Add approximately $14,000 in principal paydown annually, and you’re keeping roughly $34,000 in equity growth each year — even if your monthly payments seem high.

Multiplex Ownership: Turning Housing Into an Income Stream

Instead of buying a traditional single-family home, consider purchasing a property with multiple units. If you live in one unit and rent out the others, rental income can cover most of your costs. In a typical three-unit setup, the other two units can bring in around $4,000 per month.

That changes everything. Your out-of-pocket drops to roughly $700 per month — lower than average rent — while you still capture appreciation and equity growth. Rather than costing you money, your home could generate over $2,400 per month in effective financial benefit.

Lowering the Barrier: Minimum Down Payment Strategy

One of the biggest barriers is upfront cash. Most people don’t have $235,000 sitting in their account. The solution? Using an insured mortgage with a minimum down payment. On a $1 million purchase, that brings the required savings down to around $110,000 — less than half the traditional amount.

Payments increase slightly, but with multiplex rental income offsetting most of the carrying cost, the strategy still leaves your out-of-pocket around $1,300 per month — still lower than renting. In this case, your home generates approximately $2,000 per month in additional financial value once appreciation and principal paydown are included.

Who Can Use This Strategy Effectively?

Even though this strategy makes ownership financially viable, it’s not possible for everyone. Toronto prices are still high, and qualification is a key factor. In the minimum-down scenario, you’ll need about $130,000 in household income to qualify. To allow for better options and buffer for renovations, aim for a range of $150,000 in income and $150,000 in savings.

These figures align closely with the average renter profile, which means many high-income renters are closer to ownership than they think — they simply haven’t been shown the right strategy. This is how many of our clients bought their first home and then scaled into additional properties.

Homeownership in Toronto Isn’t Dead — It Just Needs a New Playbook

In today’s market, success doesn’t come from guessing where prices are going. The days of buying and waiting are over. Instead, market stability and improved rental economics are now rewarding those who structure their investments to generate income immediately.

Toronto’s highest-performing real estate investors build wealth by using rental income to reduce carrying costs, leveraging multiple units, and reinvesting equity created through appreciation and mortgage paydown. When approached with the right structure, owning real estate becomes more cost-effective than renting — even at current price levels.

From Renting To Owning: Your Next Steps!

The key takeaway is simple: homeownership in Toronto still makes financial sense when approached strategically. Multiplex investing turns housing from an expense into a cash-flowing asset that builds long-term wealth.

If you’re considering buying or selling and want to evaluate whether this strategy is right for you, we can help you assess the numbers and structure your next move.

Our brokerage specializes in Toronto multiplexes. We’ll help you find deals, crunch the numbers, and guide you through renovations and management. If you want full support in Toronto multiplex investing, our team can help you:

- Find high-potential properties

- Crunch the numbers so you know exactly where you stand

- Coach you through renovations to maximize returns

- Lock in great tenants

- Provide full property management so your investment runs smoothly

Book a strategy session with us here and let’s map out the smartest move for your portfolio.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!