This is for educational purposes only; it does not guarantee future performance or serve as financial or tax advice.

It’s the start of 2026, and if you’re waiting for dramatic headlines or massive price swings, Toronto real estate probably feels underwhelming. No chaos. No frenzy. No panic. Just… quiet.

That’s usually when smart investors lean in.

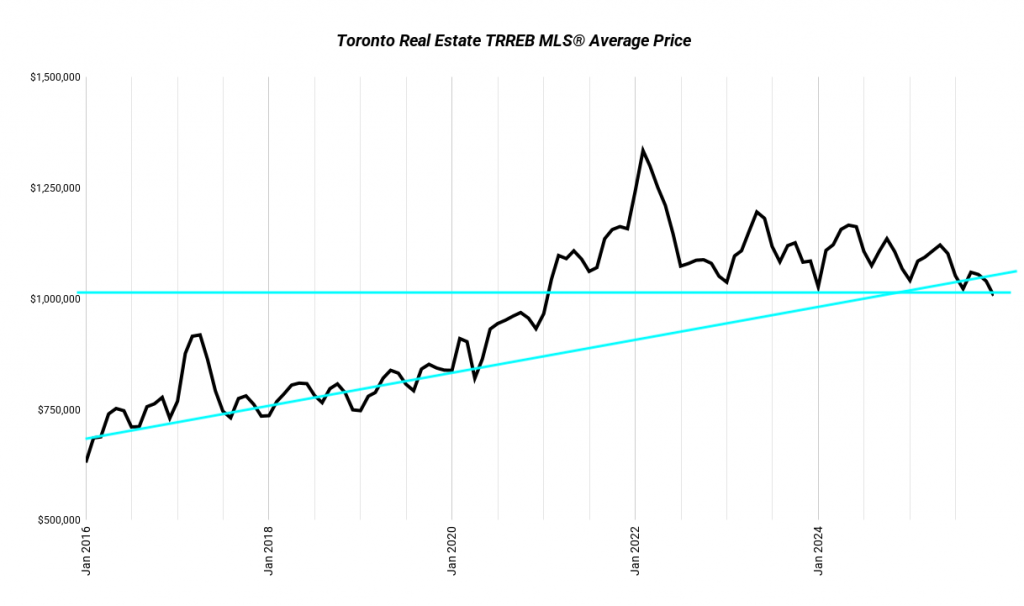

After a sharp correction from the 2022 peak, the Toronto market has shifted into a far more predictable phase. Prices have reset, rents have stabilised, and interest rates are no longer swinging wildly. From an income and risk perspective, this is one of the cleanest setups we’ve seen in years, especially for investors focused on cash flow and value-add, not speculation.

Why Toronto Real Estate Risk Is Lower in 2026

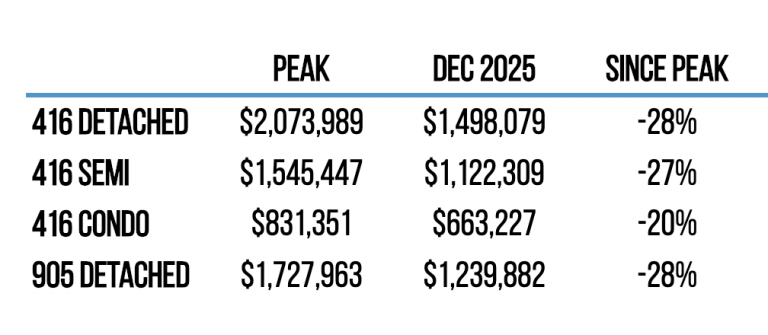

Prices across much of Toronto are sitting close to 30% below peak levels. That adjustment did the hard work already. Most of the downside risk that scared investors in 2023 and 2024 has been flushed out.

More importantly, prices have been hovering around similar levels for a while now. That matters. When values stop falling, underwriting gets easier. You can actually trust your numbers instead of building in extreme buffers just to feel safe.

Lower volatility reduces the chance that a deal unravels mid-hold or mid-renovation. That alone changes the risk profile of Toronto real estate in a meaningful way compared to the last few years.

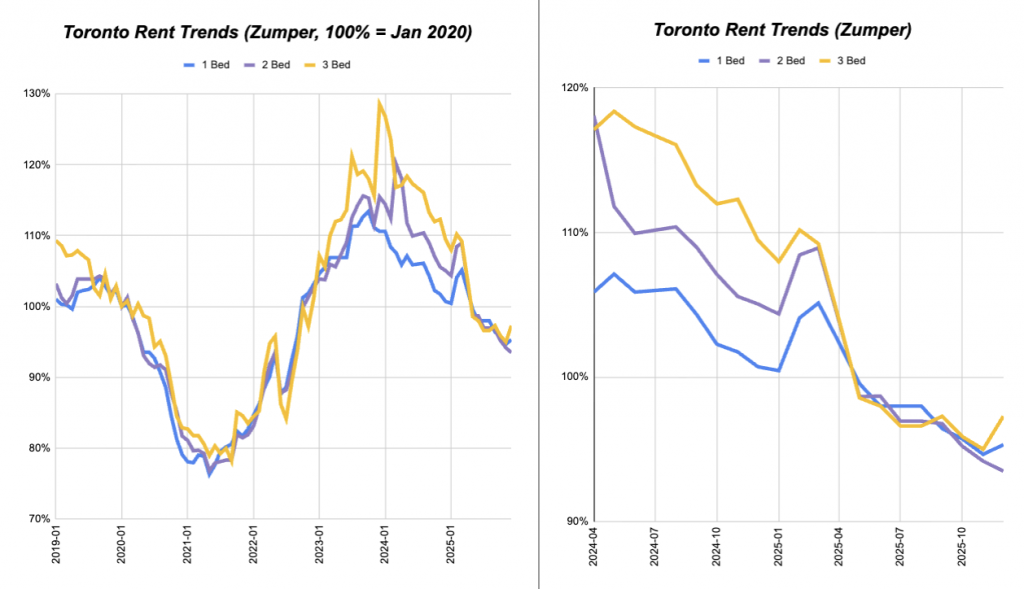

Rent Stability Is Back and That Changes Everything

Rents dropped quickly in early 2025 and spooked a lot of people. But by late spring, the declines slowed and rents levelled off. Over the past several months, rental rates have been relatively steady.

Stable rents are critical for investors. They make cash flow predictable and underwriting realistic. You can plan around income instead of guessing where rents might land in six months.

There is also a strong relationship between interest rates and rents. When rates spike, rents tend to overshoot on the downside. When rates stabilise, rents usually calm down too. With rates now much lower than their peak and expected to stay relatively flat, rental income is easier to forecast again.

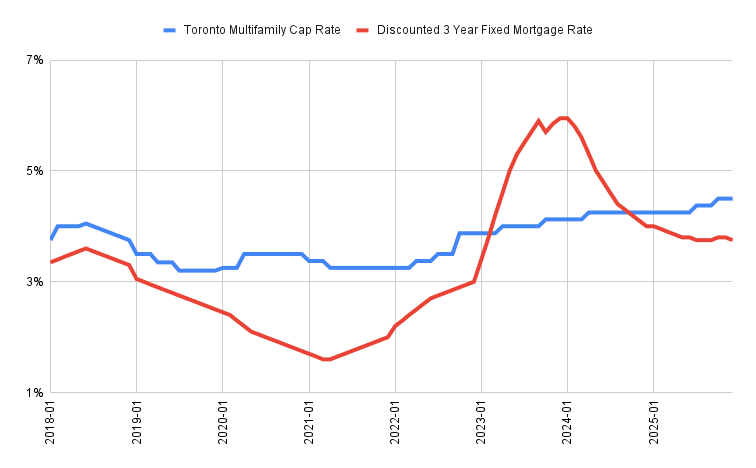

The Yield Gap Toronto Investors Have Been Waiting For

Normally, rent yields and interest rates move together. When borrowing costs rise, prices fall and yields adjust. When rates fall, prices rise and yields compress.

Right now, that relationship is out of sync.

Prices are still depressed from the correction, but borrowing costs have already come down. That has created a wider-than-normal gap between rent yields and interest rates. In plain terms, income looks unusually strong relative to financing costs.

This setup does not happen often and it never lasts forever. For income-focused Toronto investors, this is one of the most attractive yield environments since the COVID era.

Negotiation Power Is Still on the Buyer’s Side

Even though pricing has stabilised, activity remains muted. Many sellers are realistic but not desperate. That creates quiet opportunities.

Well-positioned buyers are still negotiating favourable terms, price reductions, and cleaner conditions. These are not fire sales, but they are rational deals in a market that is no longer emotional.

That extra bit of negotiation room can push already solid rent yields even higher, especially on small multiplexes and value-add properties where sellers often underestimate upside.

Why Value-Add Works Better When Markets Are Boring

Value-add investing carries one major risk: price volatility. If values drop while you are renovating or converting units, your projected lift can disappear fast.

That risk is meaningfully lower today.

Prices have already corrected and have been moving sideways. At the same time, the gap between dated properties and finished homes has widened. Renovated and well-designed multiplexes still command strong values and rents.

Construction costs have also become more predictable. That combination leads to lower downside risk and more reliable value creation for investors who execute properly.

Real Examples We’re Seeing in Toronto Right Now

Turnkey multiplexes in midtown Toronto are trading under $1 million and generating over $1,000 per month in positive cash flow after expenses and financing. That level of clean cash flow was almost impossible to find during the peak years.

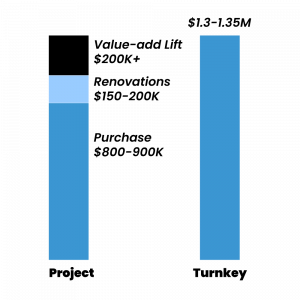

On the value-add side, we are seeing dated semis around $900,000 that can be converted into three legal units with roughly $200,000 in renovation costs. These projects can generate close to $2,000 per month in positive cash flow and support finished values around $1.3 million. That is roughly $200,000 in forced equity, plus ongoing income.

These are not outliers. They are realistic examples in today’s Toronto market.

Toronto Real Estate vs Other Asset Classes in 2026

Many alternative assets are still sitting near all-time highs with stretched valuations and thin margins for error. Toronto real estate, by contrast, has already reset.

Lower prices, stronger income, and more predictable value-add outcomes mean the asset class is far more de-risked than it has been in years. That is why more investors are quietly reallocating capital back into Toronto housing in 2026.

Key Takeaway for Toronto Investors

The Toronto real estate market in 2026 is not exciting. It is functional. That is exactly what reduces risk and creates opportunity. Stable prices, improving yields, and clearer value-add spreads favour investors who focus on fundamentals, not headlines.

How We Help Investors Navigate This Market

This is exactly the type of market we specialise in. We are not just a sales brokerage. We are Toronto multiplex investors who focus on cash flow, value-add, and long-term performance.

We help investors make clear decisions based on numbers, not noise, and support them from acquisition through execution so deals actually perform.

Our brokerage specializes in Toronto multiplexes. We’ll help you find deals, crunch the numbers, and guide you through renovations and management. If you want full support in Toronto multiplex investing, our team can help you:

- Find high-potential properties

- Crunch the numbers so you know exactly where you stand

- Coach you through renovations to maximize returns

- Lock in great tenants

- Provide full property management so your investment runs smoothly

Book a strategy session with us here and let’s map out the smartest move for your portfolio.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!