This is for educational purposes only; it does not guarantee future performance or serve as financial or tax advice.

Real estate feels boring again. And honestly, that might be the healthiest thing to happen to Toronto real estate in years.

For a long time, investing felt exciting because prices kept going up. Condos, pre-construction, negative cash flow, none of it seemed to matter because appreciation was doing the heavy lifting. Strategy was optional. Discipline was negotiable. Scrolling listings and sold prices became entertainment.

Then the last few years happened. Prices dropped, interest rates jumped, and the market went quiet. What really broke was not just pricing. It was the belief that real estate always goes up and everything else would take care of itself.

When Appreciation Stopped Doing the Heavy Lifting

Selling at a discount feels wrong. You worked hard for that down payment, and taking a loss feels like moving backward. But holding a negative cash-flow property and hoping appreciation bails you out can do far more long-term damage.

Your first investment sets the tone for everything that comes next. If that property cannot carry itself, it becomes an anchor. Banks do not lend based on effort or intent. They lend based on income. Deeply negative cash flow reduces your borrowing power and limits your ability to scale.

Income-producing properties do the opposite. They strengthen your balance sheet, improve debt coverage, and give lenders confidence. This is why portfolio growth stalls for many investors even when they “own real estate.”

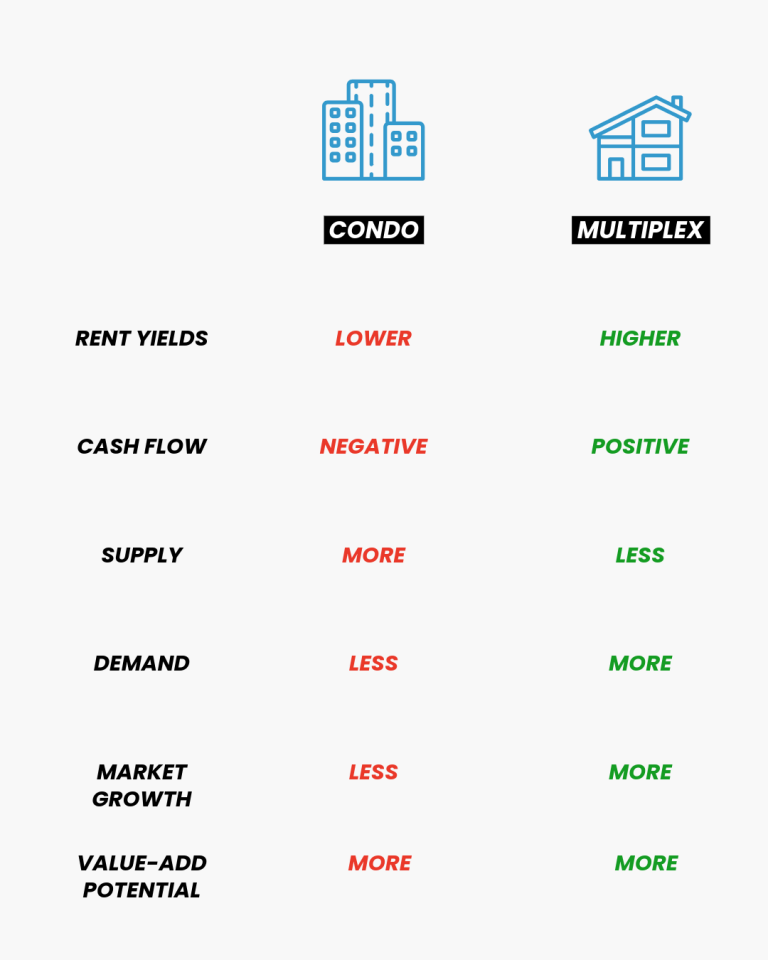

Why Toronto Multiplexes Behaved Differently

While most people were focused on falling prices, something else was quietly happening on the multiplex side of the market.

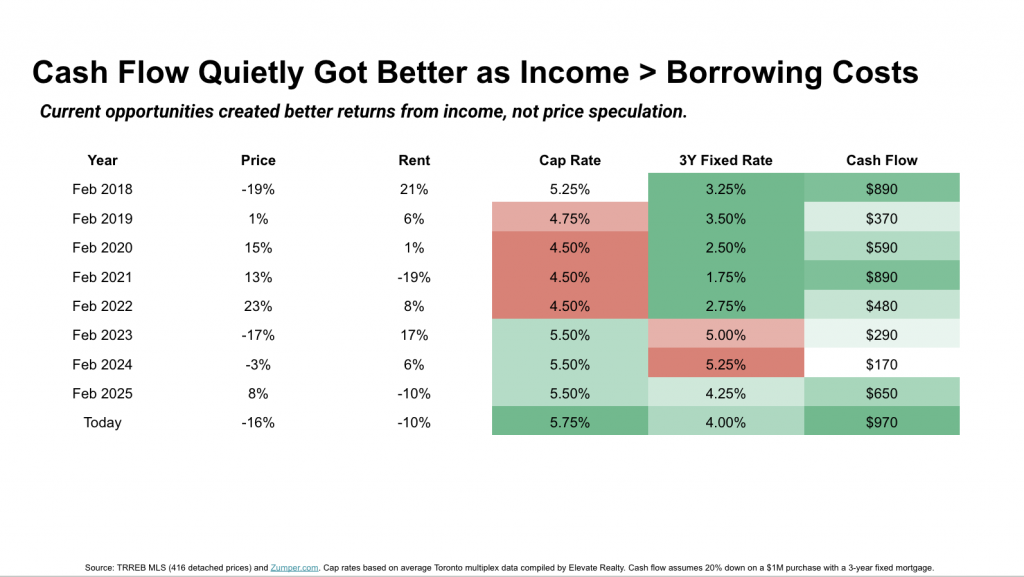

Toronto multiplexes are driven by income. Even near peak interest rates, many well-bought multiplexes continued to cash flow. The margins were tighter, but the deals held together. Now that interest rates have started to come down, cash flow is actually stronger than it has been in years.

Income-first assets behave differently in stress. They do not rely on optimism. They rely on rent, demand, and execution. That difference matters far more than most investors realize.

The Two Phases That Changed the Market

The last few years played out in two very different phases.

From mid-2022 to mid-2024, interest rates spiked, prices fell roughly twenty-five percent, and rents jumped. Multiplex investors who bought during this period were generally fine. Cash flow was not spectacular, but it stayed intact and often remained positive.

From mid-2024 to today, rents softened slightly, prices drifted lower, and interest rates began to ease. The result was better cash flow, not worse. Today, cash flow on Toronto multiplexes looks stronger than it has in almost a decade.

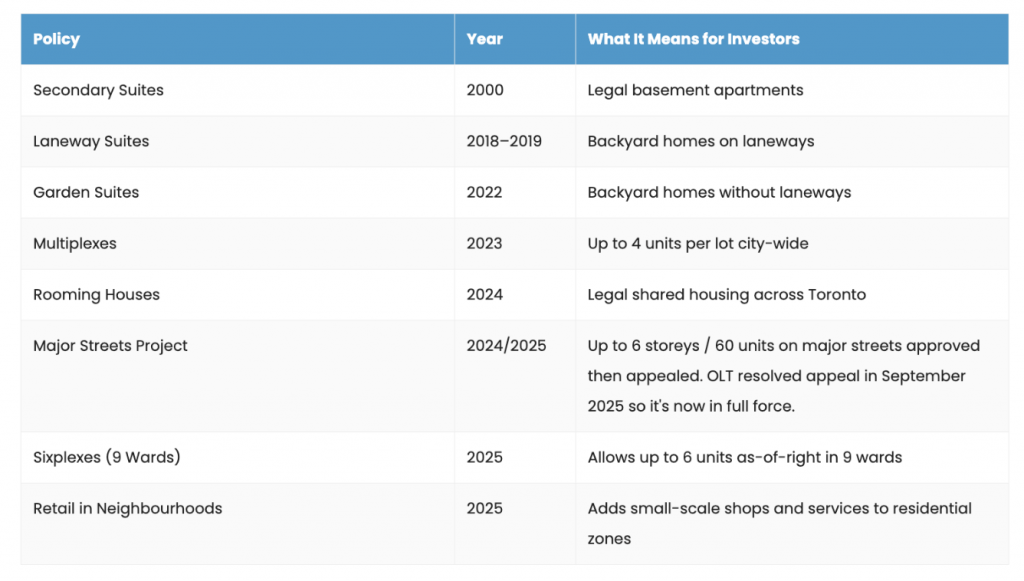

How Zoning and Density Quietly Reduced Risk

At the same time, housing policy in Toronto changed in a meaningful way. For decades, adding density was nearly impossible. Then suddenly, the rules opened up.

Laneway houses. Garden suites. Fourplexes city-wide. Sixplexes in select areas. Major streets allowing higher density. Even retail in neighbourhood properties. These changes matter because they allow investors to add more units on the same piece of land.

More units mean more income. More income means more stability. And more stability means less reliance on prices going up to make the deal work.

Why Risk Looks Different Today

So how has risk actually changed?

- A large part of the downside already happened. Prices corrected by roughly thirty percent. Compare that to other asset classes sitting near all-time highs, and it becomes clear why many investors are reallocating capital back into real estate.

- Investors are no longer buying under pressure. Conditional offers are back. Due diligence matters again. Financing and renovation assumptions can be checked before committing. That alone removes a lot of unnecessary risk.

- Stronger cash flow makes everything easier. It helps weather volatility, supports value, and creates options to refinance and scale.

- Value-add projects make sense again. With prices moving sideways since 2022, renovation math has become far more predictable. That is what better risk-adjusted returns actually look like.

There Is No One-Size-Fits-All Multiplex Strategy

There is no single best multiplex deal in Toronto. The right strategy depends on your capital, your experience, and your comfort with risk.

Some investors are better suited to turnkey three-unit properties that cash flow from day one. Others do better buying lower, renovating, and creating value through execution. The biggest mistake we see is investors copying someone else’s deal without context.

Same city does not mean same numbers. Different capital and experience require different strategies. Ignoring that is how people get burned.

A Simple Toronto Multiplex Example

In today’s market, there are turnkey three-unit properties around $1.2 million in Midtown Toronto that can cash flow over $1,000 per month. Typically, that requires roughly $300,000 in cash and the ability to qualify for a mortgage close to $1 million.

Another option is buying a property that needs work. Because the purchase price is lower, renovation-driven projects can often produce stronger cash flow and more upside once stabilized.

Again, the key is fit. What works for one investor may not work for another.

Key Takeaway for Toronto Investors

Boring markets force better decisions. When income matters more than appreciation, risk becomes clearer, cash flow improves, and strategy starts to matter again.

This is where our team comes in. We are not just a sales brokerage. We are Toronto multiplex investors ourselves, and we help clients match strategy to numbers, not hype.

Our brokerage specializes in Toronto multiplexes. We’ll help you find deals, crunch the numbers, and guide you through renovations and management. If you want full support in Toronto multiplex investing, our team can help you:

- Find high-potential properties

- Crunch the numbers so you know exactly where you stand

- Coach you through renovations to maximize returns

- Lock in great tenants

- Provide full property management so your investment runs smoothly

Book a strategy session with us here and let’s map out the smartest move for your portfolio.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!