This is for educational purposes only; it does not guarantee future performance or serve as financial or tax advice.

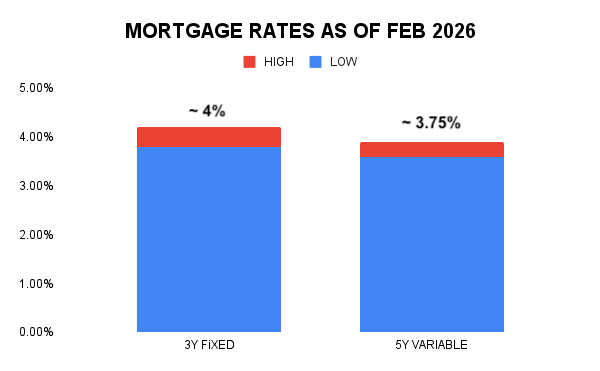

If you’re investing in Toronto real estate right now, chances are you’re asking the same question we hear every week: should I go fixed or variable? On the surface, the answer seems simple. Variable rates are roughly 25 basis points cheaper than fixed today, sitting around the mid-3% range versus about 4% for fixed.

But framing the decision that way misses the point entirely. The small gap between fixed and variable isn’t what will make or break your investment. If a quarter point difference determines whether your deal works, the deal is already too tight. The real decision comes down to structure, flexibility, risk, and how the mortgage fits your overall investment plan in Toronto.

The Rate Gap Matters Less Than Most People Think

Yes, variable rates are slightly cheaper today. That usually means marginally better cash flow, and in some cases, it can help with mortgage qualification if income is tight. That’s real, but it’s also limited. We’re not talking about a dramatic difference in monthly payments.

Too many investors fixate on today’s rate instead of asking the more important question: what happens if your plan changes? Interest rates move, but your exit strategy, refinancing timeline, or renovation plan matters far more than a small rate discount. The focus should be on whether your mortgage structure supports what you’re actually trying to do with the property.

Why Fixed Rates Appeal to Long-Term Hold Investors

Fixed rates offer one clear benefit: stability. If you’re planning to hold long term, don’t expect to refinance, and don’t want to think about interest rates at all, fixed does its job. You lock in, your payments are predictable, and you eliminate uncertainty.

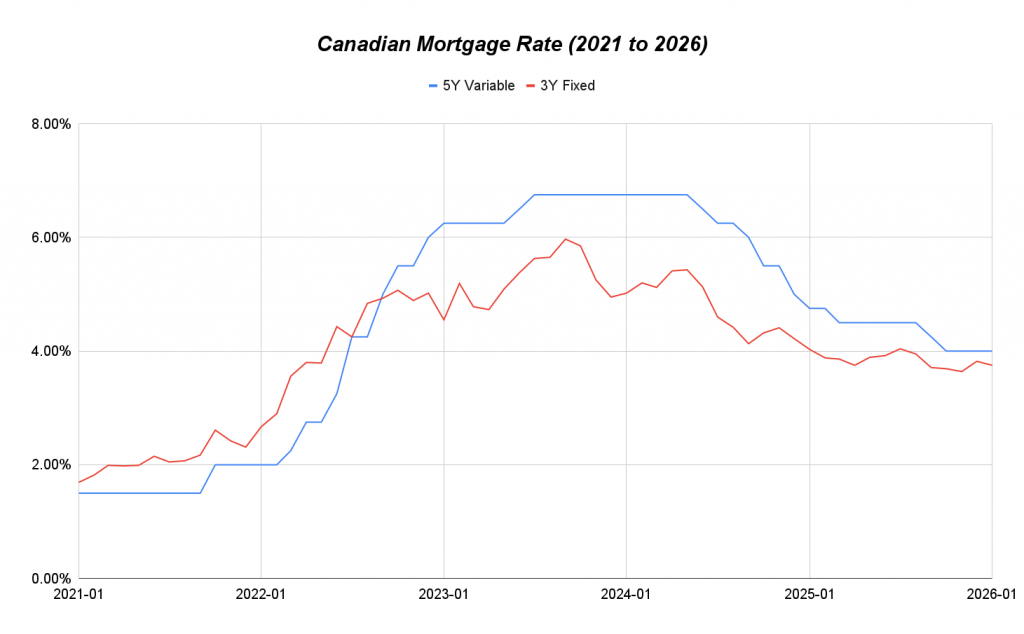

After the last rate cycle, that peace of mind has real value for many investors. Rates rose quickly, and anyone on variable felt it almost immediately. Paying a premium for certainty isn’t wrong, as long as you understand what you’re giving up in return. That trade-off is flexibility.

Where Variable Mortgages Usually Win: Flexibility

Variable mortgages tend to shine when flexibility matters. If there’s any chance you’ll need to break the mortgage early, variable is almost always safer. The penalty is typically three months’ interest, which is manageable and predictable.

Fixed mortgages are different. Penalties can be substantial if rates move against you, and we’ve seen investors get stuck paying large break fees at the worst possible time. This risk often outweighs the benefit of a slightly lower fixed payment or the comfort of stability.

Why Variable Often Makes Sense for BRRRR and Value-Add Strategies

For BRRRR strategies, variable mortgages are usually the better fit. If you’re buying, renovating, stabilizing, and planning to refinance within a year, flexibility matters more than locking in a rate.

Yes, you can go fixed and later blend and extend, but that often leaves you with two mortgages on one property with different maturity dates. That structure can become a real problem when it’s time to refinance again or sell. In many cases, investors end up paying a larger penalty later, exactly when they can least afford it.

How Investors Got Burned in the Last Rate Cycle

A lot of investors made mistakes in the last cycle because they misunderstood how rates move. Variable started lower than fixed. Fixed rates rose first, but they were still higher than variable, so many investors ignored them.

By the time variable rates overtook fixed, fixed rates were already much higher. People waited for the wrong signal. They thought they would switch once variable became more expensive, but by then the opportunity was gone. The lesson is clear: if you plan to switch from variable to fixed, you need to move early, not react late.

Where Interest Rates Are Likely Headed Next

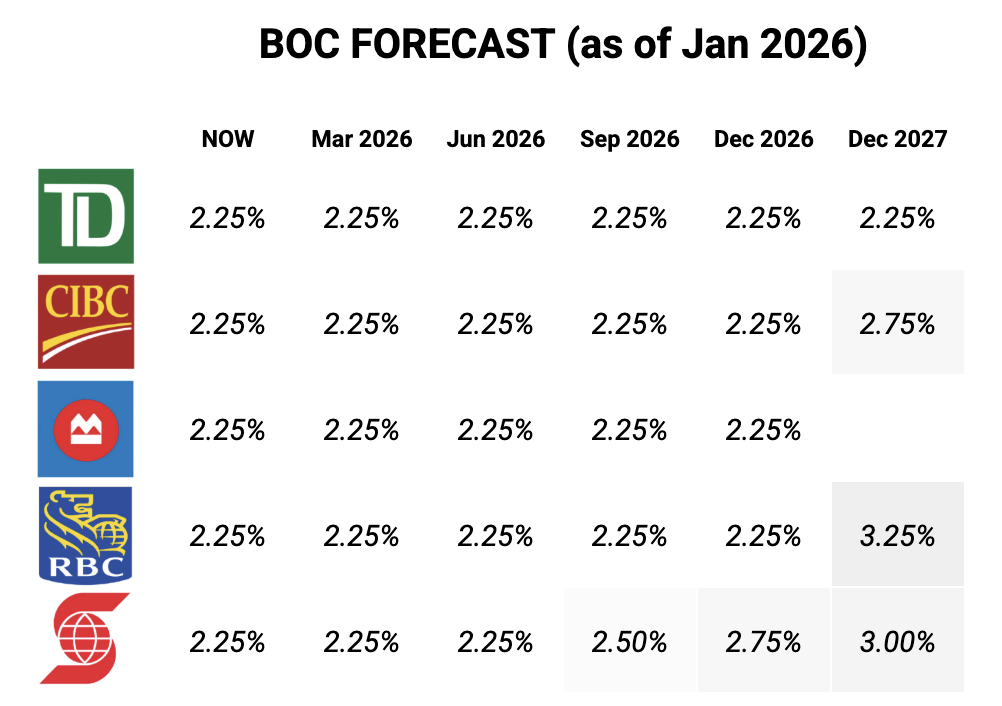

Looking ahead, most major banks aren’t expecting significant rate changes in the near term. Variable rates are likely to remain relatively stable this year, with some potential for modest cuts if inflation continues to cool and the economy weakens.

Fixed rates are tied to bond yields, not the overnight rate. Bond yields rose toward the end of 2025 as risk increased, then eased again. On top of that, mortgage pricing depends heavily on lender appetite. Discounts rotate. Some lenders pull back, others get aggressive. That’s why shopping your mortgage still matters, regardless of whether you choose fixed or variable.

Rates Aren’t the Main Driver of Toronto Real Estate Right Now

Zooming out, interest rates aren’t the primary driver of Toronto real estate in 2026. They’re not moving enough to dramatically change prices in either direction. What matters now are fundamentals.

Strong positive cash flow is back. Value-add opportunities are real. Prices in many areas remain close to 30% off peak. The market has already been de-risked.

In today’s market, you can find turnkey three-unit properties around $1.2 million in midtown Toronto that cash flow over $1,000 per month. To do that, you’ll typically need around $300,000 in cash and the ability to qualify for close to a $1 million mortgage.

Another option is buying something that needs work. You purchase at a lower price, renovate, and convert it into three units. Entry prices are lower, cash flow can be stronger, and upside is higher once stabilized. The trade-off is more upfront capital, often closer to $400,000, since renovations are usually paid in cash.

What This Means for Investors

The takeaway is simple. Fixed versus variable isn’t about chasing the cheapest rate today. It’s about matching your mortgage to your strategy, managing risk properly, and keeping flexibility where it matters.

If you’re not sure which approach fits your situation, that’s normal. This market rewards investors who think through structure, cash flow, and execution, not just headlines.

Our brokerage specializes in Toronto multiplexes. We’ll help you find deals, crunch the numbers, and guide you through renovations and management. If you want full support in Toronto multiplex investing, our team can help you:

- Find high-potential properties

- Crunch the numbers so you know exactly where you stand

- Coach you through renovations to maximize returns

- Lock in great tenants

- Provide full property management so your investment runs smoothly

Book a strategy session with us here and let’s map out the smartest move for your portfolio.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!