When Should You Invest In Toronto Real Estate? (Think About Risk, Returns, AND TIME!)

Video Transcript

The ultimate goal of investing is to maximize your returns while minimizing risk. So if something has similar returns and lower risk, then it’s usually a no brainer to go with that option. Something that you might forget to take no to account are transaction costs.

The reason is because most online stock trading platforms these days have minimal transaction fees, and that’s what you probably trade the most of. On the other hand, real estate investing does come with high transaction costs so this definitely needs to be taken into account.

If you have enough capital, ideally you would have some money in stocks and some money in real estate to diversify your portfolio with different investment timeframe objectives. In this video, I’ll explain what situations real estate investments are great for and when it might make more sense to go with something else.

Here’s a chart from Thomson Reuters that illustrates the risk and return of different type of investments. As you can see, government bonds have lower risk but also lower returns, and stocks have higher risk and higher returns.

What’s interesting here is that real estate has higher returns compared to stocks and also lower risk. So if you had to make an investment decision based on this chart alone, real estate should be the best choice for all situations.

20 Year Risk / Return Profile

This chart doesn’t take into account transaction fees and like I mentioned earlier, it’s significant for real estate. This is a fixed fee whereas your returns keep growing year over year, so if you hold real estate for a longer period of time, the transaction fees will become smaller in comparison to your bigger pool of total returns, so the impact is less significant.

At the same time, even if your rate of return for real estate is good, your absolute gain isn’t that much when you’re only holding it for a short period of time, so in this case it’s possible that transaction fees might wipe out your returns.

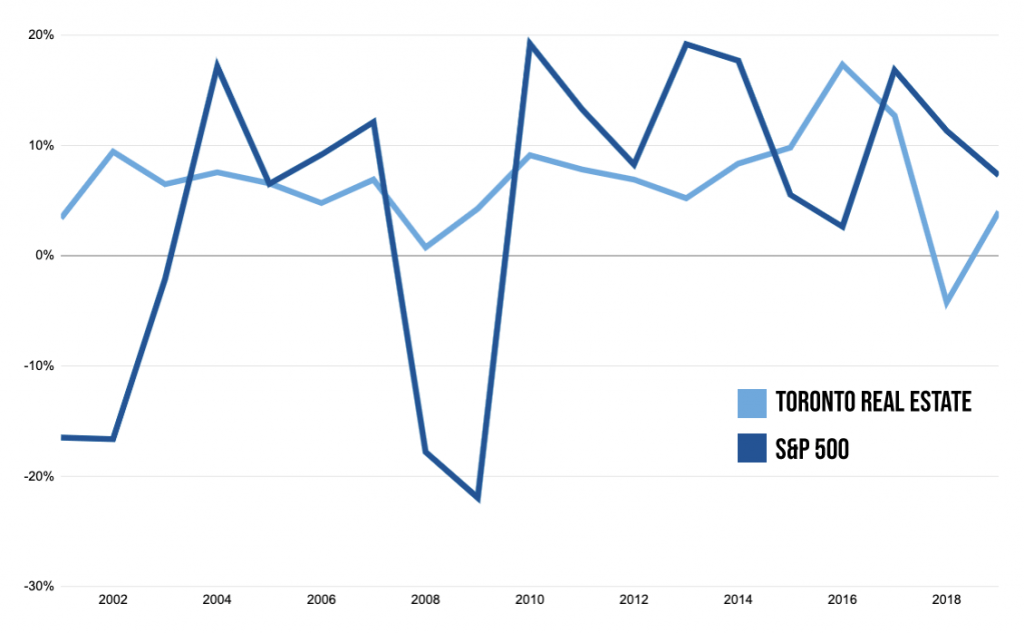

Now, let’s dig a bit deeper to see how Toronto real estate specifically stacks up against the S&P 500 index. From what we’ve seen this year already, It’s pretty obvious that stocks are a lot more volatile compared to Toronto real estate but here’s more proof.

This is a chart that compares the annual growth of Toronto real estate vs. the S&P 500 index over the past twenty years. Toronto estate has much softer swings compared to stocks and the standard deviation of Toronto real estate is 0.04 and S&P 500 is 0.13. If you’re not familiar with this statistical term, a higher number basically represents higher volatility.

Annual Growth: Toronto Real Estate vs. S&P 500

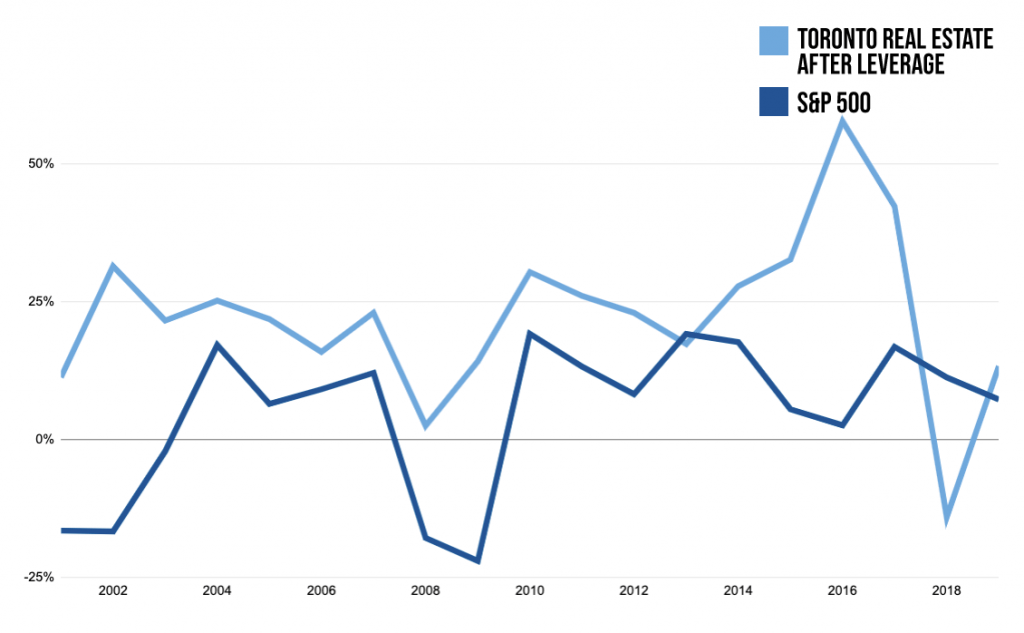

When we invest in real estate, we’re most likely buying with a mortgage. If we’re are only paying 20 percent down but getting the impact from all of the property’s appreciation and deprecation, our gains and risk are increased five fold.

On top of this 20 percent, we’ll need additional capital for land transfer taxes and legal fees which total around 4 percent of the property price. We’ll also add in some renovations that cost around 6 percent of the property price. So in this example, let’s say we put in 30 percent of the property’s price as capital which means we’re levered a bit more than 3 times.

This next chart shows how real estate after leverage from our example compares to stocks. As you can see, the risk is more similar now with a standard deviation of 0.15 for real estate after leverage and again 0.13 for stocks. You can also see that even at a similar risk level, the average returns on real estate after leverage are a lot better than stocks.

Annual Growth: Toronto Real Estate After Leverage vs. S&P 500

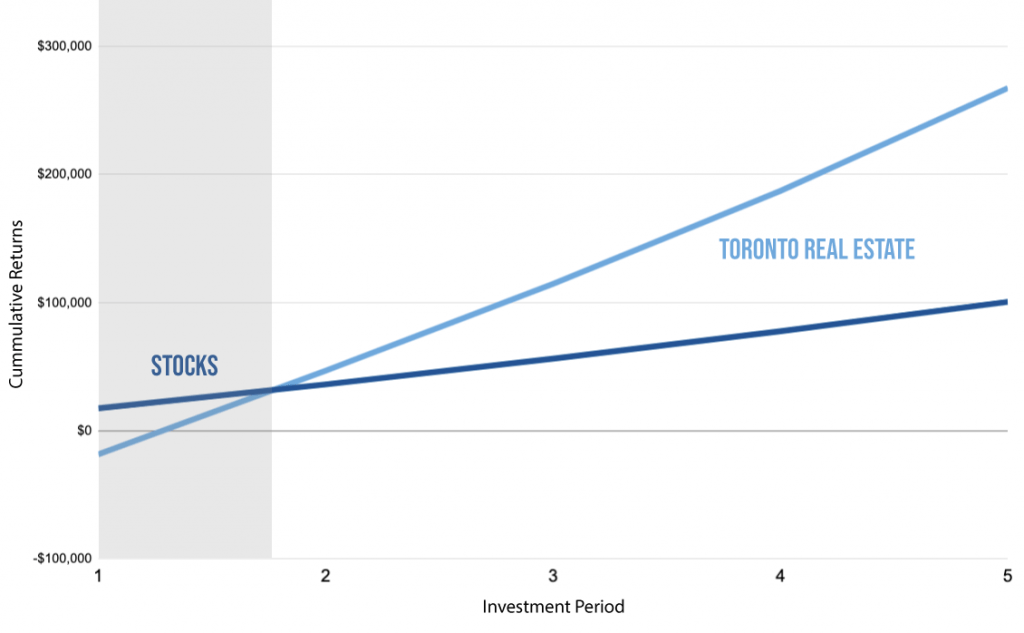

But like I mentioned before, real estate has high selling costs. So how would this risk / reward curve change once we take that into account? Here’s another example to illustrate my point. Let’s assume you have $250,000 to invest. With this amount, you can buy a property that costs $850,000 with a 20 percent down. If you add in $50,000 of renovations and closing costs, this totals $250,000.

In year 1, you get rental income which builds equity of $17,000 and you generate $6,000 in extra cash flows. On top of this, let’s use 5 percent appreciation which totals $47,500. Because real estate is more work for you than stocks, you value the time you put into managing your property at $5,000 a year which brings your total returns to $65,500. Selling costs are $54,000, closing costs were $30,000 so you actually lose money if you sell in year 1. With similar amount of risk, you can invest in stocks. Because there are higher price fluctuations in stocks, you’re able to get 7 percent returns on $250,000 will give you $17,500. So at a similar risk level, investing in stocks wins if your investment time frame is one year.

In year 2, you make more money with real estate. The total cumulative returns now is doubled with quick math at $131,000. If you sell this year, you deduct selling and costs costs again, leaving you with a total of $47,000. Stocks give you another 7 percent or a cumulative gain of $35,000. In this case, real estate starts getting better but you also have to deal with reviewing more legal and accounting work so I’d say this is kind of the break even point.

You can repeat the same process for the next few years which I did and here’s a summary that compares total returns after you take into account real estate transaction fees. Just FYI, I also take into account inflation and rent increases for more accurate calculations in this chart. Starting year 3, it starts getting obviously better, with total real estate returns being $115,000 compared to stocks at $56,000.

Cummulative Returns For Varying Investment Periods

So basically, instead of looking at just risk / reward, you should also look at your investment period. In this example, at the same level of risk, stocks perform better under 2 years whereas real estate investment with leverage start becoming a star performer from 2 years onward.

Now not everyone’s investment goals are the same. If you’re retiring, you might be more interested in preserving your wealth instead of growing it and liquidity is important to you. In this case, real estate might not be right for you and it’s better to go with even more low risk investments, combined with higher liquidity and lower transaction costs.

If you are considering of flipping a house or trying to take profit from real estate over a short period of time, remember to take into account fixed fees and also keep in mind that short term real estate gains might even be charged as income tax instead of capital gains tax which is double the amount.

If you’re still in the process of growing your money and you don’t need access to it for at least three years, then that’s when you should really consider a long term real estate investment which can significantly improve the performance of your overall portfolio in the long run.

Want To Start Investing In Toronto Real Estate?

Our team at Elevate specializes in real estate investments in Toronto and we can help you find the best opportunities on the market.