Midtown Toronto Cash Cow!

This detached multiplex is in midtown Toronto, steps from Cedarvale Station and minutes from the future Eglinton LRT. Strong transit access means reliable tenant demand in every market. This area also has real long-term upside. Gentrification, infrastructure investment, and rent growth are already happening, not just promised.

Despite being in Toronto, the property cash flows over $1,400 per month after expenses and mortgage! The property includes three self-contained units with separate entrances:

- Renovated 2-bedroom top floor

- 1-bedroom main floor

- Large 1-bedroom basement

A detached garage with storage adds flexibility and future garden suite options to further boost rents and value. Vacant possession gives you options. Live in one unit, rent all three, or spend about $80K on cosmetic upgrades to push rents and value. Renovated comparables support a post-reno value near $1.2M.

Deals like this are rare in midtown. Strong cash flow, transit-driven demand, and upside from day one. This one works now and still makes sense long term.

Why This Toronto Income Property Works So Well

Transit-Driven Midtown Location

Steps to Cedarvale Station and the future Eglinton LRT. Fast access downtown and consistent tenant demand.

Above-Average Cash Flow

Over $1,400 per month in positive cash flow after expenses and mortgage. Rare for midtown, especially on a detached property.

Built-In Flexibility

Vacant possession allows you to live in one unit, rent all at market, or reposition the property without tenant headaches.

Value-Add Upside Without a Full Reno

Cosmetic upgrades can increase rents and support a $1.2M valuation, on your timeline, not day one. Plus, future garden suite upside!

🧠 See The Numbers For Yourself

Use our interactive calculator to adjust rent, mortgage rate, and capital to see how this fits your plan.

Actual returns may vary depending on assumptions. Read our definitions and assumptions.

Ready to see if this deal actually fits your investment plan?

We’ll help you assess whether it aligns with your goals, capital, and financing capacity, walk you through strategy options, and arrange an in-person tour if it makes sense. If it looks like the right move, we’ll help you act quickly and structure the offer to your advantage.

Fill out the form and we’ll connect to discuss next steps.

💵 How Do You Actually Make Money With a Toronto Investment Property?

Traditional investments like GICs, bonds, and dividend stocks might feel safe, but they typically deliver 3–5% returns — and that’s before inflation takes a bite.

This property delivers 9.5% cash-on-cash return and over 15% income return, driven by strong rents and positive cash flow using leverage. That’s the power real estate has over passive investing.

Instead of waiting for the market to hand you returns, you use rental income and financing to create them. Real estate doesn’t just protect capital — it builds it.

Equity Gains

Every month your tenants pay rent, a portion of that pays down your mortgage. That means your loan shrinks, your ownership grows, and your equity builds—automatically.

It’s like a built-in savings plan, growing quietly in the background while your property works for you.

Monthly Cash Flow

Cash flow is the income left over after all bills and mortgage payments.

Some investors are OK with breakeven returns. But if you’re in it for financial freedom, we aim for strong positive cash flow that puts money in your pocket month after month.

This is your path to replacing your 9-to-5—with rental income instead of a paycheque.

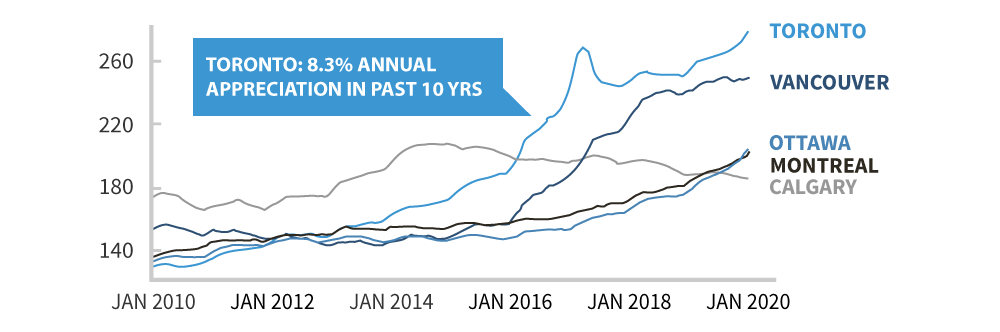

Long-Term Market Appreciation

Toronto real estate values don’t move in a straight line, but they’ve trended up over time—averaging 7% annually over the past 20 years.

That’s why investors with capital choose Toronto over riskier markets:

- ✔️ Stronger appreciation potential

- ✔️ Better mortgage terms

- ✔️ Lower long-term risk

Even better, you can tap that appreciation without selling—just refinance, pull out equity, and reinvest with zero capital gains tax.

This consistent growth makes Toronto’s real estate means better returns and lower risk when you want to cash out and take profit.

What's Happening In Toronto's Real Estate Market?

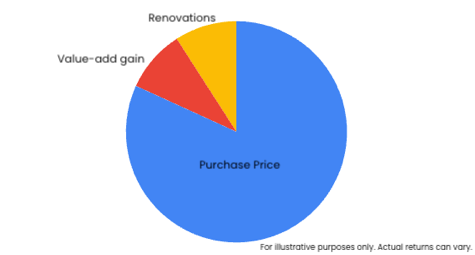

Value-Add Gain

Want to take it up a notch? Renovations can force up your property’s value fast.

But let’s be real—value-add isn’t passive.

You’ll need:

- Smart reno strategy (focus on what boosts rents)

- A good contractor

- Project management skills

Done right, it can mean tens or even hundreds of thousands in added value.

What Toronto Real Estate Investment Is Right For You?

Whether you want turnkey cash flow or a hands-on value-add project, we’ll show you what fits your goals and budget.