January 28, 2026 Bank of Canada Update

On January 28, 2026, the Bank of Canada held its policy rate at 2.25% for the second straight meeting.

This decision was widely expected. The real signal was not the hold itself, but how clearly the Bank acknowledged weaker economic growth and easing inflation pressures, while keeping policy flexible.

The message was simple:

Rates are on hold for now, but cuts are back on the table if inflation undershoots and growth weakens further.

Bank of Canada Meeting Schedule

Wondering when the Bank of Canada will make its next move? The BoC announces rate decisions eight times a year. These dates are key for anyone watching interest rates or planning a real estate move.

📌 Next meeting: March 18, 2026.

| Announcement Date | Target Rate | Change |

|---|---|---|

| January 24, 2024 | 5.00% | --- |

| March 6, 2024 | 5.00% | --- |

| April 10, 2024 | 5.00% | --- |

| June 5, 2024 | 4.75% | -0.25% |

| July 24, 2024 | 4.50% | -0.25% |

| September 4, 2024 | 4.25% | -0.25% |

| October 23, 2024 | 3.75% | -0.50% |

| December 11, 2024 | 3.25% | -0.50% |

| January 29, 2025 | 3.00% | -0.25% |

| March 12, 2025 | 2.75% | -0.25% |

| April 16, 2025 | 2.75% | --- |

| June 4, 2025 | 2.75% | --- |

| July 30, 2025 | 2.75% | --- |

| September 17, 2025 | 2.50% | -0.25% |

| October 29, 2025 | 2.25% | -0.25% |

| December 10, 2025 | 2.25% | --- |

| January 28, 2026 | 2.25% | --- |

| March 18, 2026 | TBC | TBC |

| April 29, 2026 | TBC | TBC |

| June 10, 2026 | TBC | TBC |

| July 15, 2026 | TBC | TBC |

| September 2, 2026 | TBC | TBC |

| October 28, 2026 | TBC | TBC |

| December 9, 2026 | TBC | TBC |

Source: Bank of Canada.

Historical Bank of Canada Interest Rates (2015–2025)

Rates don’t move in a straight line. Here’s how Canada’s overnight target rate has shifted over the past decade:

| Year | Start Rate | End Rate |

|---|---|---|

| 2015 | 1.00% | 0.50% |

| 2016 | 0.50% | 0.50% |

| 2017 | 0.50% | 1.00% |

| 2018 | 1.00% | 1.75% |

| 2019 | 1.75% | 1.75% |

| 2020 | 1.75% | 0.25% |

| 2021 | 0.25% | 0.25% |

| 2022 | 0.25% | 4.25% |

| 2023 | 4.25% | 5.00% |

| 2024 | 5.00% | 3.00% |

| 2025 | 3.00% | 2.25% |

Source: Bank of Canada.

What the BoC is Actually Seeing Right Now

Inflation:

Headline CPI is expected to dip below 2% in early 2026, with temporary softness before stabilizing near target.

Growth:

GDP growth is weak and slowing. Canada is underperforming the U.S. and global peers, reflecting softer consumption, lower business investment, and weaker exports.

Policy stance:

The Bank is focused on maintaining price stability while supporting the economy through a structural adjustment period. In plain English, they know growth is fragile.

This is not an overheating economy. It is a cautious one.

Where Are Interest Rates Going in Canada?

Do not expect a rate boom.

Do not expect aggressive cuts either.

The most likely path is flat rates with occasional adjustments, driven by inflation data, not housing prices.

If inflation continues to undershoot and growth weakens further, cuts become more likely.

If inflation re-accelerates, the Bank will pause or delay.

This is a narrow policy range environment.

| Bank | Now | Mar 2026 | Jun 2026 | Sep 2026 | Dec 2026 |

|---|---|---|---|---|---|

|

2.25% | 2.25% | 2.25% | 2.25% | 2.25% |

|

2.25% | 2.25% | 2.25% | 2.25% | 2.25% |

|

2.25% | 2.25% | 2.25% | 2.25% | 2.25% |

|

2.25% | 2.25% | 2.25% | 2.25% | 2.25% |

|

2.25% | 2.25% | 2.25% | 2.50% | 2.75% |

Last Updated: January 16, 2026.

Most banks are aligned in expecting the Bank of Canada’s policy rate to remain at 2.25% through 2026, reflecting the view that inflation continues to cool toward target and that economic growth remains modest, reducing the need for further rate moves in either direction.

Scotia differs from this consensus, forecasting the policy rate to remain at 2.25% through mid-2026 before rising to 2.50% in September and 2.75% by year-end, based on concerns that underlying inflation may prove more persistent and require renewed tightening later in the cycle.

How Different Toronto Properties Are Performing Right Now

Supply and demand vary sharply by property type. Condos continue to face oversupply from new completions and investor selling, which is weighing on prices and rents. Houses and multiplexes remain supply-constrained, with few motivated sellers and limited forced sales.

With policy changes supporting multi-unit housing, strong cash flows, and construction costs keeping a floor for houses, multiplexes continue to stand out as the most resilient investment segment in Toronto.

From a risk perspective, much of the downside has already occurred. Pricing has adjusted, expectations have reset, and returns are now driven more by actual income rather than future price appreciation. In this environment, performance depends less on market momentum and more on disciplined underwriting and execution.

Value-Add Opportunities: Better Returns, Lower Risk

Value-add opportunities are more attractive today for two key reasons.

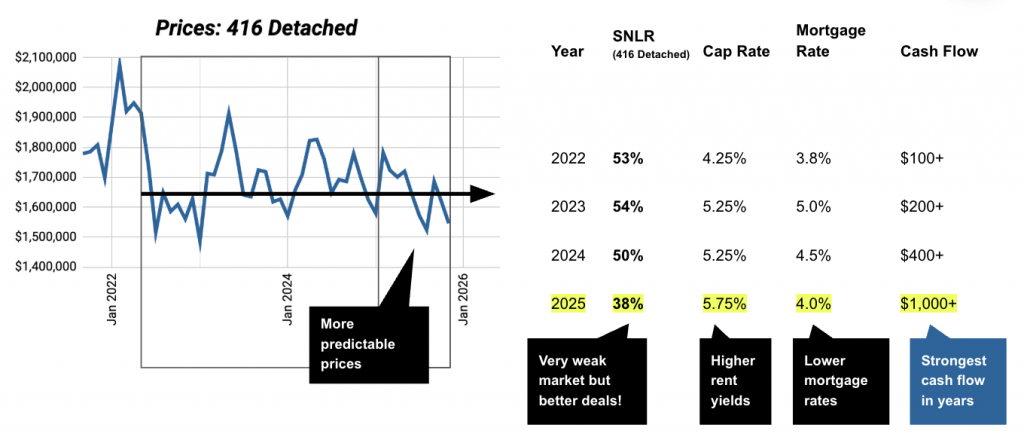

First, prices are more stable after adjusting downward from their peaks. Large price swings increase the chance that gains from a value-add project can be wiped out, so lower volatility reduces this risk.

Second, the gap between project properties and finished values has widened compared to the peak, creating stronger and more reliable upside for investors.

With construction costs more predictable, returns now depend more on execution and income growth than on market timing. For houses and multiplexes, this leads to better value-add returns with lower and more predictable risk.

Toronto Rents, Cap Rates, Cash Flow: Why Income Improved in 2025

2025 was not a strong market by traditional measures. Sales volumes were down and sentiment remained cautious. However, this softer environment created opportunity for income-focused investors.

During the year, both prices and rents adjusted lower, but purchase prices declined more than rents. When this happens, rent yields improve and cap rates expand, even in a weaker market. At the same time, mortgage rates began to ease from their peak, reducing borrowing costs.

The combination of lower entry prices, higher cap rates, and declining interest rates led to materially stronger cash flow on well-bought income properties. In many cases, monthly cash flow reached levels not seen in several years.

Mortgage Rate Estimates (January 2026)

If you’re planning to buy or refinance, here’s a quick cheat sheet:

| Product | Estimate |

|---|---|

| 3-Year Fixed Rate | 3-Year Bond yield + 1.5% |

| Prime Rate | Bank of Canada rate + 2.2% = 4.45% |

| Variable Mortgage Rate | Prime – 0.85% |

| HELOC Rate | Prime + 0% to 2% |

Cuts for fixed rates are already priced in, so the impact of new moves won’t be dramatic. Fixed rates usually drop first in a falling rate environment because they’re tied to bond yields, which anticipate cuts. Variable rates adjust only after the Bank of Canada makes its decision.

Example — January 2026:

- 3-year bond yield: 2.6% → Fixed mortgage rates: ~4.1%

- Prime rate: 4.45% → Variable mortgage rates: ~3.60%

Free Mortgage Calculator

Want to see how a rate change affects your monthly payment? Helpful if you’re house hunting, refinancing, or planning a top-up.

Expert Tip: Fixed vs. Variable in 2026

For the first time in years, variable rates are now dipping below fixed — and that’s actually the normal state of things. The unusual stretch we just went through, where fixed was cheaper, was never how the market typically works.

Think of fixed rates as insurance: you pay a premium for stability and peace of mind. Variable rates come with more risk, but they usually cost less — and with cuts underway, they now offer the bigger savings potential.

Bottom line: if you want certainty, go fixed. If you want lower costs and can handle some bumps along the way, go variable.

What Should Real Estate Investors Focus On Right Now?

This isn’t the time to bet on price appreciation. Instead, smart investors are focused on:

- ✅ Strong cash flow from day one

- ✅ Legal multi-units in stable, working-class areas

- ✅ Properties with laneway/garden suite potential

- ✅ Smart use of leverage while rates are easing

- ✅ Flexibility to refinance or exit

Canada’s 2026 Interest Rate Outlook and What It Means for Real Estate Investors

Interest rates have likely moved past their peak and are now settling into a more stable range heading into 2026. While further cuts are possible, the Bank of Canada has made it clear that any easing will be gradual and data-driven.

For investors, this environment rewards disciplined underwriting. Softer pricing, higher cap rates, and lower borrowing costs have improved cash flow on income properties, making fundamentals more important than short-term price movements.

Want to see what’s possible for you? Book a strategy session with us here.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!