This is for educational purposes only; it does not guarantee future performance or serve as financial or tax advice.

In a high-rate environment, most investors assume today’s market is worse than pre-COVID. But when you run the numbers properly, the reality is very different. Toronto investment properties in 2025 offer stronger cash flow, greater rental upside, and more capacity to scale than they did back in 2019.

Prices look similar to pre-COVID levels in nominal terms. But after adjusting for inflation and factoring in expanded density rules, today’s buying power is actually stronger. Add in better financing options and more motivated sellers, and 2025 is proving to be one of the best windows we’ve seen for strategic Toronto multiplex investing.

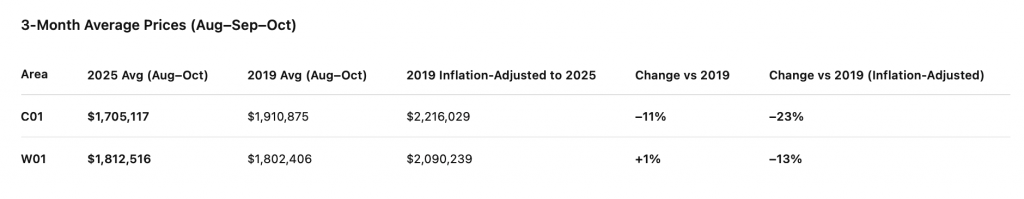

2025 Pricing vs 2019: Cheaper in Real Terms

Average Toronto pricing has returned to roughly 2019 levels. But when adjusted for inflation, today’s values are 13 to 23 percent cheaper in real buying power. On top of that, buyers are getting additional discounts due to longer days on market and limited buyer activity.

We’re not seeing the speculative bidding wars that dominated previous cycles. Instead, investors can negotiate stronger deals with more favourable terms. This market is quieter, but that’s exactly what makes it more profitable.

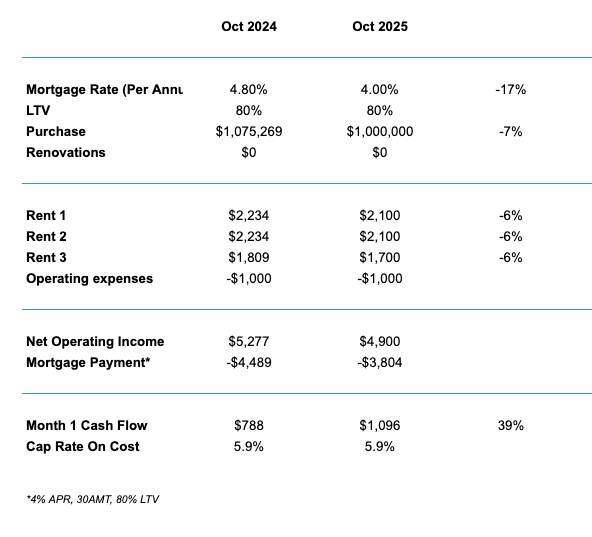

Cash Flow and Financing Are Stronger Than Last Year

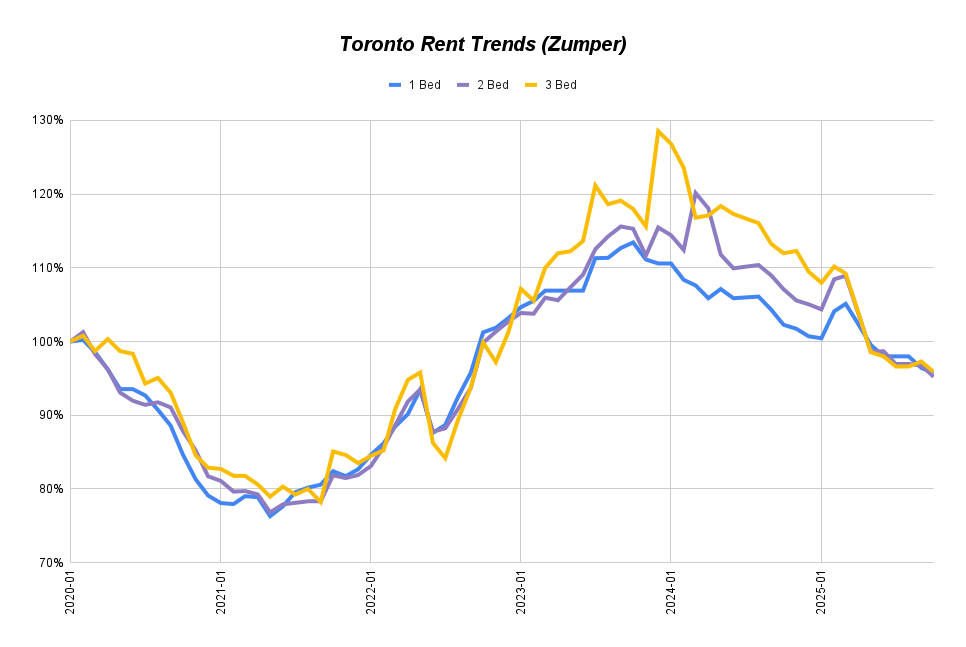

Compared to last year, cash flow on multiplexes is up around 40 percent. Rents for individual units are slightly lower than in 2024, but financing has improved. An average three-year fixed sits around four percent, down from last year’s levels.

Turnkey properties that would barely break even in previous markets are now returning close to $500 per month in positive cash flow from day one. For value-add projects, cash flow can exceed $2,000 monthly once stabilized and refinanced.

Density Is the Real Competitive Advantage

Back in 2019, most homes in Toronto could only be legally converted to two units. Today, zoning changes allow up to four legal units inside a house plus a garden or laneway suite across all lots. That means even if rents per unit are slightly lower than 2019 levels, total rental income capacity is significantly higher.

This shift is critical. Investors are now scaling through more units per property rather than depending solely on price appreciation. It’s a market that rewards smart planning, not speculation.

Who This Strategy Works For

This approach isn’t for everyone. In today’s environment, investors typically need around $300,000 in capital for a turnkey multiplex and a household income of about $200,000 to qualify for financing. But for those positioned to act, the numbers are stronger than they’ve been in years.

Successful investors are shifting away from betting on future price increases and focusing on cash flow, density potential, and real returns that can be optimized through proper planning.

Why Today’s Market Favours Value-Add Projects

For investors willing to take on light or moderate renovation projects, the opportunity is even stronger. A typical example: purchase a semi-detached property for around $900,000, invest approximately $200,000 in a conversion to three units, and exit with a property valued around $1.3 million. That’s a potential $200,000 lift, plus over $2,000 monthly in cash flow.

From there, refinancing allows many investors to recycle most of their capital into the next project — a key strategy for scaling in today’s density-focused market.

Your Next Step Starts With the Right Strategy

Toronto is no longer a market where you gamble on where prices will go. It’s now a market driven by solid returns, strong rental income, and value-add potential through density. When numbers take priority over speculation, the opportunity becomes much clearer — and 2025 is showing that.

At Elevate, we don’t just sell multiplexes. We invest in them ourselves. We use the same strategies with our clients that we apply in our own projects, ensuring every purchase is planned with cash flow, scalability, and long-term value in mind.

If you want full support in Toronto multiplex investing, our team can help you:

- Find high-potential properties

- Crunch the numbers so you know exactly where you stand

- Coach you through renovations to maximize returns

- Lock in great tenants

- Provide full property management so your investment runs smoothly

Book a strategy session with us here and let’s map out the smartest move for your portfolio.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!