This is for educational purposes only; it does not guarantee future performance or serve as financial or tax advice.

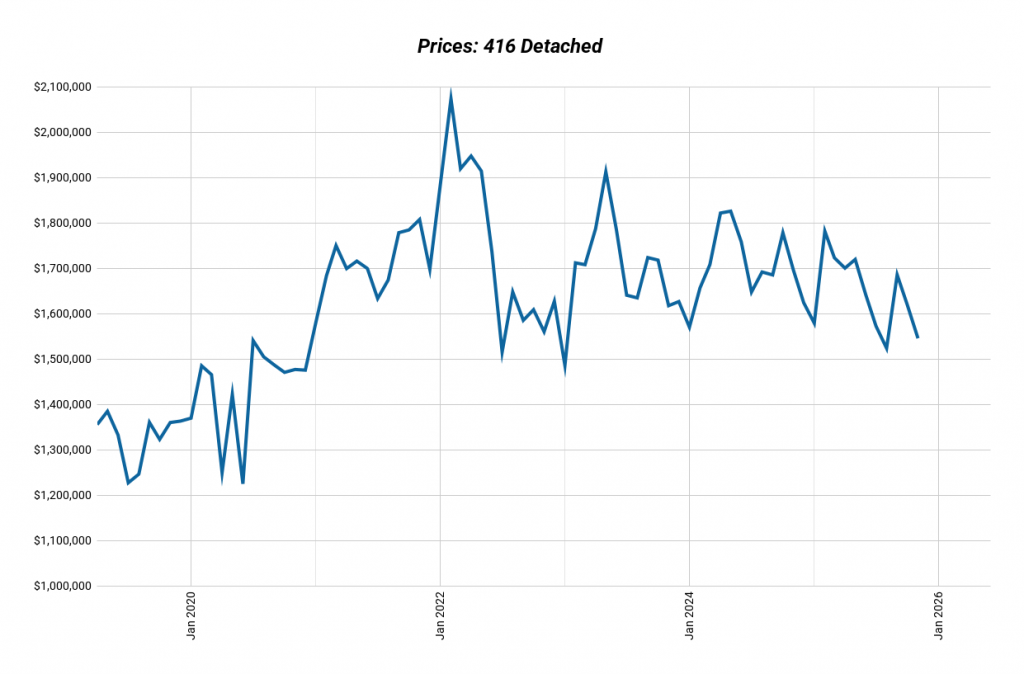

2025 didn’t look like a great year for Toronto real estate on the surface. Sales slowed, investor activity dropped, and confidence faded across the market. Many buyers chose to wait, assuming better opportunities would come later.

But history shows that the most interesting real estate cycles rarely look exciting while they’re happening. When fewer investors are active and competition thins out, the math behind deals often improves in ways that don’t show up in headlines.

Why a “Cold” Market Created Better Negotiating Power

What defined 2025 wasn’t a crash, it was a reset. Prices moved throughout the year, but overall the market was sideways. What changed dramatically was the balance between buyers and sellers.

There were more listings than serious buyers for much of the year. That imbalance created negotiating leverage that simply didn’t exist in previous cycles. Investors who stayed active had room to negotiate price, terms, and conditions instead of competing in bidding wars.

In Toronto real estate, negotiating power matters more than market optimism. Better entry prices are often the difference between a deal that barely works and one that produces meaningful long-term returns.

How Prices Fell Faster Than Rents (And Why That Matters)

Both prices and rents softened in 2025, but deal prices fell more than rents. That gap is critical. When purchase prices adjust faster than rental income, rent yields improve even in a slower rental market.

At the same time, mortgage rates began coming down from their highs. Lower borrowing costs combined with improved yields meant the cash flow math finally started to work again on well-bought properties.

For Toronto multiplex investors, this was a meaningful shift. Deals that were once break-even or slightly negative could now generate real monthly income.

Why Toronto Multiplex Cash Flow Improved in 2025

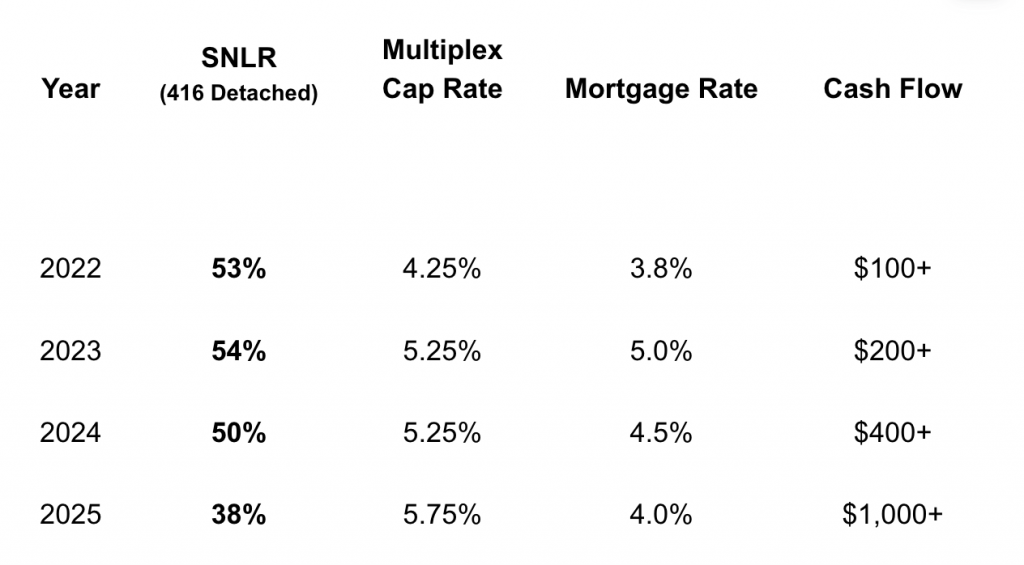

To understand how meaningful this change was, it helps to look back. In 2022, before interest rates rose sharply, many Toronto multiplexes were still only breaking even. As rates climbed, cash flow improved slowly, but financing costs capped returns.

By the end of 2025, conditions were different. Investors had more bargaining power on price, while mortgage rates fell well below 4% in many cases. As a result, turnkey multiplexes near downtown Toronto selling for under $1 million could generate well over $1,000 per month in cash flow after expenses.

That level of income hadn’t been common in years, and it didn’t come from speculation. It came from better deal fundamentals.

Why Risk Looks Different After the Reset

Another important change in 2025 was risk. Much of the downside in Toronto real estate has already played out. Prices adjusted, expectations reset, and sellers became more realistic.

Deals stopped relying on future appreciation to work. Instead, they had to make sense based on today’s rents and today’s costs. That shift reduced reliance on market timing and increased predictability for investors focused on income.

Markets driven by fundamentals tend to be healthier for long-term investors than markets driven by optimism alone.

How Toronto’s Multiplex Rules Changed the Game

At the same time, Toronto quietly became a much more flexible city for small multi-unit investing. During COVID, most houses were limited to two units. Today, every house in Toronto can have four units, and in Old Toronto, many properties can support six units, plus a garden suite or laneway suite.

These zoning and policy changes give investors more control over outcomes. Increasing rental income is no longer limited to buying perfect assets; it can be created through smart conversions and renovations.

That’s a major reason why deals are working today that didn’t exist just a few years ago.

Why Real Estate Plays a Different Role Than Stocks Right Now

With stocks sitting near all-time highs, many investors are reassessing portfolio risk. Toronto real estate today isn’t about chasing fast appreciation. It’s about steady income, downside protection, and assets where much of the risk has already been priced in.

This doesn’t mean real estate replaces other investments. It means it can once again serve as a stabilizing part of a balanced investment strategy, especially for investors who value cash flow and control.

A Simple Example of Forced Value in 2025

Consider a dated semi purchased for around $900,000. With roughly $200,000 invested into a three-unit conversion, that property can generate approximately $2,000 per month in positive cash flow.

Once completed, similar properties are often valued around $1.3 million based on current market comparables. That represents roughly $200,000 in forced value, on top of the ongoing monthly income.

This type of outcome is driven by execution, not market timing.

Need Help Finding the Right Toronto Multiplex Investment?

2025 wasn’t loud, but it quietly reset Toronto real estate in favour of income-focused investors. Better pricing, improved yields, lower financing costs, and policy changes combined to create opportunities that reward fundamentals over speculation.

At Elevate Realty, we don’t just talk about investing — we do it. We own, manage, and scale our own portfolios right here in Toronto, so every strategy we share comes from real-world experience.

If you want to grow efficiently and maximize your after-tax returns, you need a team that knows how to put these strategies into action. We help Toronto investors buy smarter, scale faster, and build portfolios that last. Our team can help you:

- Find high-potential properties

- Crunch the numbers so you know exactly where you stand

- Coach you through renovations to maximize returns

- Lock in great tenants

- Provide full property management so your investment runs smoothly

Want to see what’s possible for you? Book a strategy session with us here.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!