This is for educational purposes only; it does not guarantee future performance or serve as financial or tax advice.

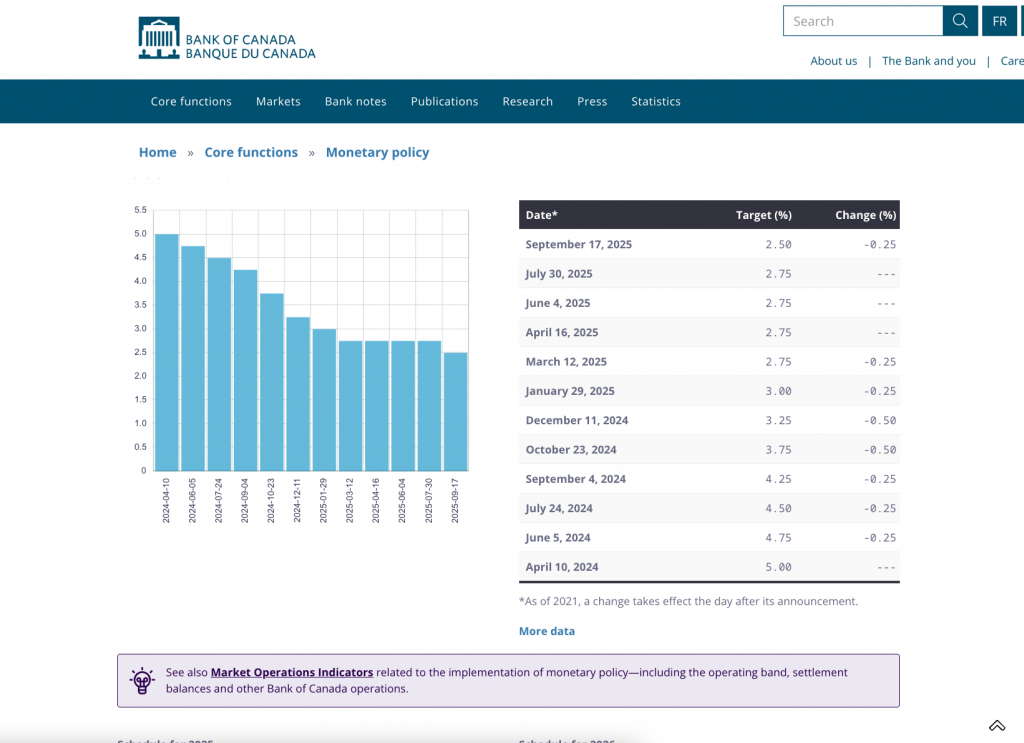

The Bank of Canada just trimmed its policy rate again, dropping another 25 basis points to 2.5%. That’s half the 5% peak we saw not long ago, and on the surface, it sounds like good news for buyers, sellers, and investors. Cheaper borrowing should mean more affordability, right?

Not so fast. The reality is more complicated. Rates don’t move in a straight line, and affordability isn’t magically fixed because the central bank pulled a lever. The underlying economy, inflation pressures, and housing inventory all shape how Toronto real estate reacts. Let’s break down what this rate cut really means for investors right now.

Why Lower Rates Don’t Guarantee a Boom

Yes, rates have been cut, but the Bank of Canada acted because the economy is showing cracks. Job growth is weak, economic momentum is slowing, and inflation has dipped below 2%. At the same time, food and services inflation remain stubbornly high. That’s why rates aren’t heading back to zero anytime soon.

History also tells us rate cuts rarely happen in isolation. Most banks are already betting another cut is coming this fall, either in October or December. But the path in between matters most for investors. It’s the uncertainty, not the headline cut, that shapes market behaviour in Toronto.

Toronto Housing Inventory: A Market of Two Stories

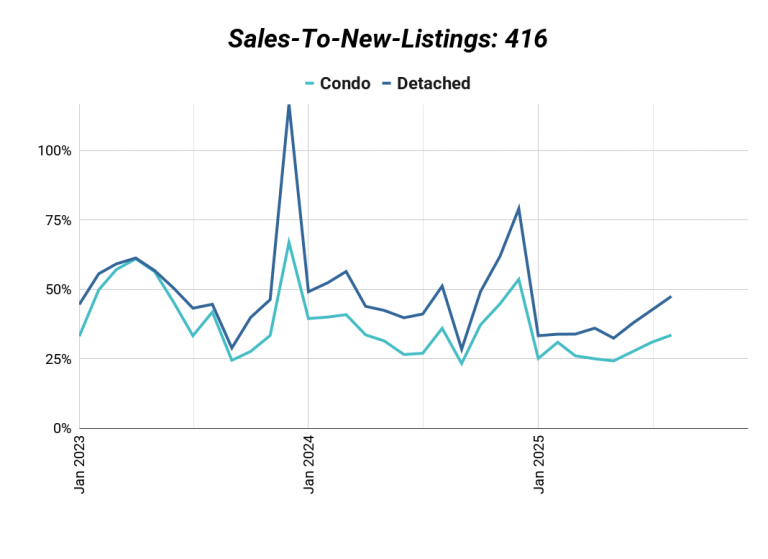

BMO called it an “inventory clearance sale.” Condos are flooding the Toronto market — from new builds and investor-owned units to relistings. This oversupply is putting pressure on condo pricing and investor confidence.

On the other hand, detached homes and multiplexes are holding up better. Sales-to-new-listings ratios show more stability, suggesting buyers still see value in properties that offer space and rental income potential. For investors, that gap between oversupplied condos and stronger multiplex demand is where opportunities emerge.

Is Affordability Really Back?

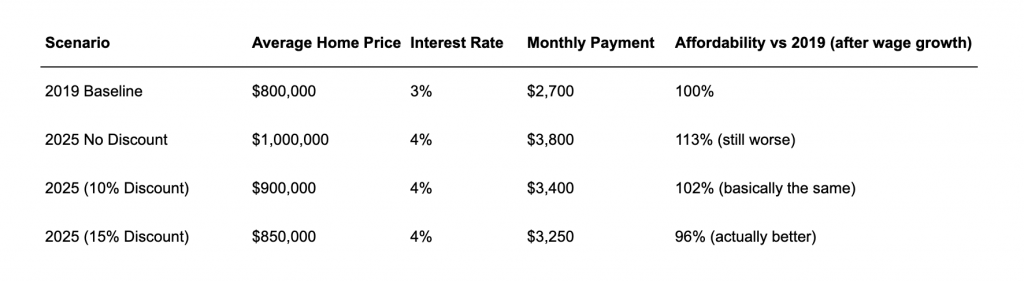

At first glance, affordability should be improving — after all, prices are down roughly 10% from last year. But factor in the bigger picture: wages and home prices are both about 25% higher than before the pandemic, while mortgage rates are still above 2019 levels.

Here’s the math that matters: a 10% discount from a motivated seller brings you back to roughly 2019 affordability conditions. Push that to 15%, and you’re actually ahead of where you would have been back then. That’s why long-term investors are creeping back into the market, while speculators remain on the sidelines.

Finding Today’s Cash Flow Deals

This isn’t about chasing speculative growth. It’s about spotting deals that make sense today and set you up for tomorrow. For example, you can pick up a turnkey triplex in Toronto right now for around $950K. With 20% down (about $200K), that’s roughly $1,200 in positive monthly cash flow without lifting a hammer.

And if you want to expand later? Add a garden suite over the garage to unlock even more rental income and long-term appreciation. Deals like these prove that investors don’t need a booming market to grow wealth — they just need to buy the right assets in the right locations.

Key Takeaway for Investors

This rate cut isn’t a magic fix, but it does mark a turning point. Toronto real estate remains a buyers’ market, with motivated sellers creating opportunities for investors who know how to run the numbers.

At Elevate, we’ve done this in our own portfolio and helped hundreds of clients do the same. We’ll show you exactly how to find properties that cash flow today while setting up long-term growth.

Our brokerage specializes in Toronto multiplexes. We’ll help you find deals, crunch the numbers, and guide you through renovations and management.

If you want full support in Toronto multiplex investing, our team can help you:

- Find high-potential properties

- Crunch the numbers so you know exactly where you stand

- Coach you through renovations to maximize returns

- Lock in great tenants

- Provide full property management so your investment runs smoothly

Want to see what’s possible for you? Book a strategy session with us here.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!