It’s time to make well-informed decisions that transform economic challenges into lucrative Toronto real estate investing opportunities. Ready to strategically position yourself in Toronto real estate investing? Let’s begin.

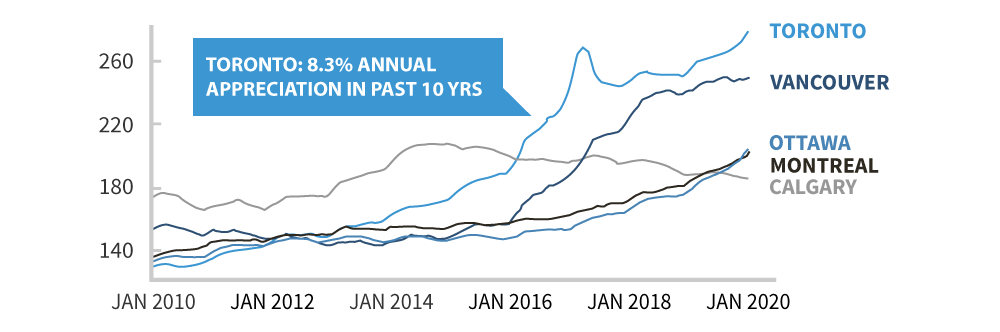

Toronto vs. Other Canadian Markets: Why Investing in Toronto Takes the Lead

Let’s uncover the unique advantages that make Toronto the prime destination for your real estate investments.

-

Thriving Economic Hub: Toronto is more than just a city; it’s a lively economic and cultural hub with a diverse and strong economy. The job market, business prospects, and overall economic well-being play a big role in making Toronto’s real estate market robust.

-

High Population Growth, Limited Toronto Supply: More people are moving to Toronto, and that’s creating a higher demand for homes. Even with the challenges from the housing crisis, the city is working hard to deal with them.

-

Big Government Investment In Toronto: Toronto is at the forefront of making things easier for investors in housing. They’re encouraging things like backyard houses and multiplexing, and they’re also continuously improving its public infrastructure. This not only makes living there better but also makes Toronto a top pick for real estate investment.

-

Toronto’s Resilience in Economic Downturns: Toronto’s real estate market strength comes from a diverse economy, making Toronto more resistant to ups and downs. Compared to other Canadian markets, Toronto’s unique strength and adaptability put it in a favourable position.

What's Happening In Toronto's Real Estate Market?

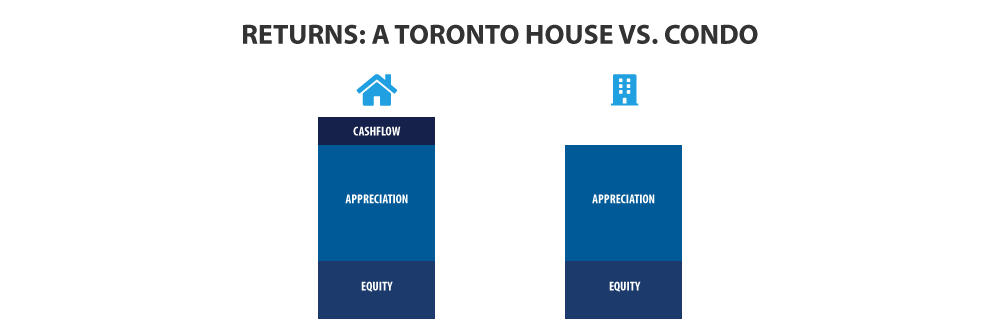

The Best Investment Type: Toronto Condos, Houses, or Multiplexes?

Follow Government Investments: Put your money where the government is investing – houses are a better choice than condos given the “missing middle” focus from all levels of government.

Explore Up-and-Coming Neighbourhoods: Keep an eye on affordable, up-and-coming neighbourhoods in Toronto; higher growth means better return potential.

Stable Income with Toronto Multiplexes: Opt for multiple units instead of a single unit in a house for more stable rental income. These rentals are not only more affordable, making them recession-friendly, but they also tend to provide safer rental income by diversifying streams through multiplexes rather than relying on a single unit for rental income.

Toronto Semis Over Detached Homes: Learn from the last recession – Toronto semi-detached houses recovered faster than detached homes, making them a resilient choice for investors.

Watch this video for a full breakdown of what we think will be the best types of Toronto real estate investments for 2024!

Get Ahead by Investing in Toronto's Buyer's Market

Right now is a fantastic time for Toronto real estate investment because buyers have the upper hand. There are more houses available than people looking to buy, giving you an advantage.

The best part? You can negotiate prices down instead of getting caught up in bidding wars and stressing about raising bids.

You can make offers with financing or inspection conditions, making it less stressful and more predictable for you. Plus, there are very few fixed offer dates, giving you more control over your real estate decisions.

Take a look at this video that delves into why it’s an excellent idea to make a purchase in today’s buyer-friendly Toronto real estate conditions.

Toronto's Economic Strength: Why It Matters for Rents

Let’s uncover the unique advantages that make Toronto the prime destination for your real estate investments.

Diverse Toronto Economy Keeps Rents Stable: Toronto’s mix of jobs in different industries helps keep unemployment low and rental prices steady. This variety makes the city more resilient when economic changes happen.

More Influx Of Renters In Toronto During Tough Times: When jobs disappear in places focused on just one type of work, Toronto becomes a go-to spot for people looking for new opportunities.

Limited Housing in Toronto Makes a Big Impact: Toronto stands out because there aren’t as many houses available compared to other places nearby. This scarcity makes Toronto special in the real estate world, especially when there’s high demand and not enough places to live.

Check out this explainer video where we conduct a comprehensive analysis to predict the direction of rents during a recession.

Bigger Renovations For Bigger Returns

In the current buyer’s market with high interest rates, you can score great deals in Toronto by choosing houses that require a lot of renovations. It’s not for everyone, but if you’re up for the challenge, taking on these projects can lead to even better returns on your investment.

Cosmetic Renovations for Value Boost: Consider engaging in cosmetic renovations to enhance a property’s visual appeal and overall value. Even simple changes can lead to a noticeable bump in property values.

Toronto Multiplex Conversion for Better Rent Yields: Explore the option of converting a property into a Toronto multiplex. This strategic move can significantly improve rent yields, making it a lucrative approach in a buyer’s market with high-interest rates.

Bigger Projects for Maximum Rental Potential: Take on more extensive projects, such as building a Toronto laneway suite or Toronto garden suite. While these endeavours may involve a higher initial investment and effort, they offer the potential for maximum rental returns.

Watch this video to see how we turned a Toronto single family home into a 3 units and a laneway suite!

Succeed In Investing In Toronto Real Estate In 2024

By following these tips, you can navigate Toronto’s real estate market with confidence for 2024:

- Toronto Outshines Other Cities: Recognize Toronto as the out-performer for real estate among Canadian cities.

- Pick Houses Over Condos: Choose houses for a stronger, better performing investment

- Smart Investing in the Buyer’s Market: Take advantage of the current market for great buying conditions.

- Stable Rentals, Even in Tough Times: Toronto’s rental market is more resilient during economic challenges.

- Better Deals with Renovations: Consider significant renovations for potentially better deals and more returns on investments.