If you’re investing in real estate in Canada — especially in a hot market like Toronto — capital gains tax is something you can’t afford to ignore. Whether you’re flipping properties, holding long-term rentals, or even selling your former home, understanding how capital gains work will help you plan smarter and keep more money in your pocket.

Let’s break it down.

This post is for general information only and does not constitute tax or legal advice. For advice specific to your situation, consult a qualified accountant or tax professional.

What Is Capital Gains Tax in Canada?

In Canada, when you sell an investment for more than what you paid for it (after expenses), the profit is considered a capital gain. You don’t pay tax on the full amount — only 50% of your gain gets added to your income and taxed at your marginal tax rate.

How It Works:

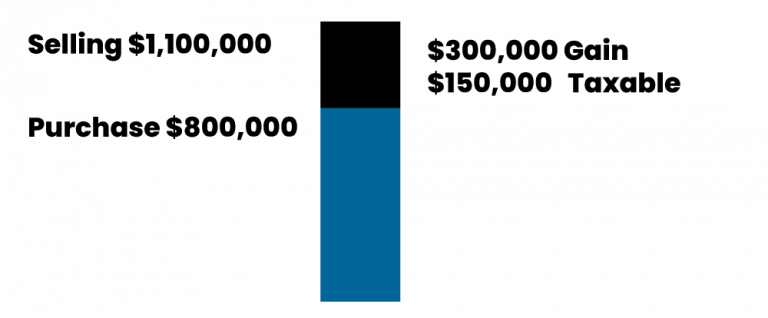

- You bought an investment property for $800,000.

- You sold it for $1,100,000, so your gain is $300,000.

- Taxable capital gain = $150,000 (50% of the $300K). That $150,000 gets added to your income in the year you sell.

Capital Gains Tax Example for a Toronto Investor

Let’s say you’re a salaried Toronto resident making $150,000 a year. You sell a rental property and make a $300,000 capital gain. Here’s what happens:

- $150,000 (50% of gain) gets added to your income

- Your new total income becomes $300,000 ($150K salary + $150K taxable gain)

How Much Tax Will You Pay?

You’ll be taxed at progressively higher marginal tax rates. The first chunk of your income is taxed at lower rates, but the more you earn, the higher the tax rate on each additional dollar. By the time you’re into the $300,000 range, you’re paying over 50% on the top slice of your income.

When we run the numbers using 2025 federal and Ontario tax brackets, your total tax bill comes to about $108,000. That means you’ll keep around $192,000 after tax.

Of that, roughly $60,000 in extra tax comes from the capital gain alone. So while your capital gain was $300K, after tax, you’re walking away with closer to $240K net.

| Taxable Income Range (2025) | Combined Marginal Tax Rate (Ontario + Federal) |

|---|---|

| $0 – $15,705 | 0% |

| $15,706 – $53,359 | 20.05% |

| $53,360 – $62,782 | 24.15% |

| $62,783 – $106,717 | 29.65% |

| $106,718 – $118,285 | 31.48% |

| $118,286 – $165,430 | 33.89% |

| $165,431 – $172,602 | 37.91% |

| $172,603 – $235,675 | 43.41% |

| $235,676 – $246,752 | 46.33% |

| $246,753+ | 53.53% |

How the Principal Residence Capital Gains Tax Exemption Works in Canada

The Principal Residence Exemption is one of the most powerful ways to reduce—or even eliminate—capital gains tax on your home. But it gets complicated when you rent part of the property or change its usage.

1. Full Primary Use — No Rental, No Tax

If you lived in the property every year you owned it, and never used it to earn any income, it qualifies as your principal residence for all those years. That means: You pay no capital gains tax when you sell.

2. Rental Is Minor — Full Exemption Still Applies

Yes, you may still qualify for full exemption if you rented out a small portion, but only under very specific conditions. CRA generally treats part as a “rental use” unless all three of these are true:

- Your rental use is relatively small compared to your personal use.

- You did not make structural changes to support rental or business use.

- You did not claim CCA (see below for explanation) on that portion.

If you meet all three conditions, CRA may still allow the entire property to qualify as your principal residence—even if you did rent out part, like a basement or in-law suite. This is outcome-specific and sometimes grey area — keeping clear records is essential.

3. Four-Year Rule: You Moved Out, But Exemption Still Applies

The Four-Year Rule lets you maintain full exemption even if you move out and rent out the entire property, as long as certain criteria are met:

- You submit the Section 45(2) election with your tax return when the use changes .

- You don’t designate any other home as your principal residence during that four-year window.

- You don’t claim CCA on the property.

That means you could live in a Toronto semi for five years, move out and rent it for three years, and still claim the exemption—if you haven’t bought a new home in that time and filed the election correctly.

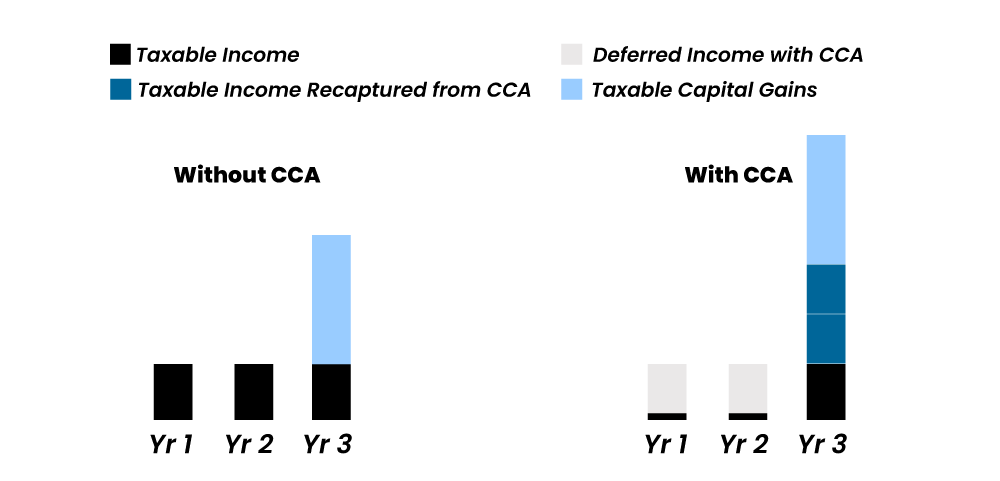

What Is Capital Cost Allowance (CCA)?

Capital Cost Allowance (CCA) is a tax deduction in Canada that lets property owners write off the cost of depreciable assets—like buildings or equipment—over time. For rental properties, you can claim CCA annually to reduce your taxable income.

But here’s the catch: If you claim CCA on your rental property, you may face recapture when you sell. That means the government can tax you on the CCA you previously deducted, increasing your tax bill.

Also, claiming CCA can affect your eligibility for the principal residence exemption, so it’s important to weigh the benefits with a tax professional.

Are There Other Ways To Avoid Capital Gains Tax In Canada?

Short answer: not entirely — but you can reduce or defer it in some cases.

- Capital Improvements: Keep good records of renovations — you can add major improvements (like adding a unit, roof, furnace) to your adjusted cost base, which lowers your capital gains.

- Joint Ownership With a Spouse: Splitting ownership might help spread the tax burden across lower tax brackets if one partner earns less.

- Timing the Sale: Selling in a lower-income year can reduce the amount of tax you pay if it brings your income into a lower marginal tax bracket.

FAQ: Capital Gains Tax on Real Estate in Canada

Q: Is capital gains tax based on the full gain or just half?

A: Only 50% of the gain is taxable. So if you make $200K in capital gains, $100K gets added to your income.

Q: What is the capital gains tax rate in Canada?

A: There’s no flat rate. The taxable portion gets added to your income and taxed at your marginal tax rate, which varies by province and income level.

Q: What if I live in the house and rent out part of it?

A: You may be eligible for a partial principal residence exemption. But if you make significant structural changes to convert it into a rental, that part may be taxable.

Q: Do I pay capital gains if I gift the property to a family member?

A: Yes. The CRA treats gifts as dispositions at fair market value, so if the property appreciated, you’ll owe capital gains tax — even if no money changed hands.

Q: What about pre-construction assignments?

A: CRA typically considers profits from assignments as business income, not capital gains. That means 100% of the profit is taxable.

Q: Are garden suites and laneway homes taxed differently?

A: Not directly. If they increase your property value and you sell, the increased value contributes to your capital gain. But the income you make while holding it is taxed as regular rental income.

Final Thoughts: Don’t Sleep on Capital Gains Planning

Capital gains tax is one of the biggest hidden costs in real estate investing. And it hits hardest when you don’t plan ahead.

If you’re holding a property and considering a sale, run the numbers before you list. If you’re buying, think about your exit strategy from day one — because how you enter the deal affects what you’ll pay when you exit.

Want Help Planning Your Next Move?

Real estate investors have a lot to think about – including things like tax implications. When you partner with our real estate sales brokerage, we can plug you into the right network to aid in making informed decisions.

We’re not your run-of-the-mill real estate sales brokerage. Our focus is on leveraging data to enhance real estate investing decisions in Toronto.

This involves seeking out robust investments with positive cash flow, strategizing for risk management, and identifying opportunities to increase returns through value-add renovations and in burgeoning areas.

Want to see what’s possible for you? Book a strategy session with us here.