If you’re a builder or investor in Toronto, it’s time to shift your focus from risky quick flips to smart multiplex builds backed by solid financing.

With new city policies and CMHC MLI Select financing, multiplex projects are more accessible and rewarding than ever.

Enjoy perks like waived or deferred development charges, no parking requirements, fast approvals, and full HST rebates on rentals with 4+ units.

This guide will show you how to maximise your returns by building a balanced portfolio that delivers steady rental income, value-add opportunities, and long-term growth. Get the facts, know the numbers, and play it smart.

Why Investors Are Switching to Multiplexes in Toronto

Toronto zoning now allows multiplex builds in every neighbourhood. Backyard houses and fourplexes are “as-of-right,” meaning no zoning headaches or special permissions.

You get big savings with waived development charges on up to six units and deferred charges on bigger projects. No parking requirements make construction simpler and cheaper. Approvals are fast and smooth since you’re building what’s already allowed.

Build 4+ rental units purpose-built from scratch, and you qualify for a 100% HST rebate — a massive cut to your costs that many builders miss out on.

Refinancing after completion lets you pull your initial investment back out while keeping your property rented and cash flowing positive.

Residential Multiplex Strategies That Work

Duplex Conversion + ADU Build

In Toronto’s zoning rules, duplexes are still considered houses. That means simpler approvals and faster timelines, which makes them easier to build and sell.

They also attract a wide range of buyers. Many people want to live in one unit and rent out the other, so duplexes often sell for more because buyers form an emotional connection to the home and neighbourhood. This strategy offers steady cash flow from day one and appeals to both investors and owner-occupiers.

Triplex Conversion + ADU Build

Triplexes often hit the sweet spot. You get better cash flow and higher yields than duplexes, but the scale is still manageable.

They attract investors as well as multi-generational families or house hackers who want income from extra units. Costs and complexity are higher than a duplex, but still lower than a full fourplex build. This keeps the buyer pool broad while still improving returns.

Fourplex Build

This is where you can add the most value. New construction gives you full control over the design to maximize income and long-term appreciation.

The trade-off is higher complexity and capital requirements. Financing can be harder to secure, and the buyer pool is smaller — mainly investors and developers.

Construction takes longer, and managing the build requires more experience. But there’s a bonus: full HST rebates apply, which helps boost your margins.

Commercial Multiplex Options: Bigger Scale, Bigger Returns

Going commercial means bigger projects with more units, higher costs, but also bigger HST savings and stronger returns.

Fourplex Conversion + ADU

This is the smallest commercial project you can take on. It’s often less disruptive since the building’s exterior stays the same, which can make approvals smoother.

The downside? Your ability to add value is limited, so your returns won’t be as strong. You also need to watch for HST implications—depending on your ownership structure, you may end up paying more tax than you expect.

Fourplex Build + ADU

This is the sweet spot for many investors. It offers the best balance of ROI, cash flow, and timeline. Construction usually takes about a year, and because it’s a purpose-built rental, you can qualify for full HST rebates, which significantly improves your profitability.

It’s big enough to generate strong returns but not so large that it becomes unmanageable for a first-time commercial investor.

Sixplex Build

A sixplex can produce returns similar to a fourplex build, but it often requires less land since you don’t need an ADU. This can save on acquisition costs and make the project easier to fit onto smaller sites. If your team is efficient, it can even be faster to complete.

The main trade-off is that it’s a bigger jump in unit count, so financing and tenant management need to be dialled in.

Severing A Lot And Building TWO Fourplexes

This approach works best when you have access to wider lots and can get severance approvals. That said, not every municipality allows severances, and the process adds both cost and risk.

Financing can be trickier because you’re dealing with two separate properties.

Selling them individually down the line might be easier, but you’ll need more capital up front and you’ll be taking on higher risk while you build.

The Truth About Exit Strategies

Selling the Whole Multiplex: Sounds good, but expect taxes, fees, and a small buyer pool to eat your profits. Plus, you lose steady rental income and future appreciation.

Selling Units as Condos: Longer, complicated process with high upfront costs to meet condo finishes. You compete against established condos and then manage the condo corporation forever. You lose cash flow and equity growth once sold.

Holding and Refinancing: This is the smarter move. Especially for 5+ units, you qualify for commercial refinancing based on property income (not your personal finances). This lets you cash out your investment, keep positive cash flow, and keep growing equity over time.

Refinancing with CMHC MLI

Most builders pay for construction themselves or through alternative loans.

While you can use MLI for construction, it’s often not worth the long wait and restrictions. The real advantage comes when your multiplex is built and rented.

Then you refinance with MLI insurance, either Standard or Select.

The key is qualifying based on how well the rents cover debt payments (Debt Coverage Ratio), not your income. You can borrow up to a portion of property cost or value with longer amortizations, making payments manageable.

Expect to refinance around 65-75% loan-to-value in Toronto, as rents typically support that range.

The real win is lenders look at property income, not your personal finances — crucial when borrowing over $2 million, which is common for multiplex projects.

Understanding CMHC MLI Programs

MLI Standard: Finance up to 85% loan-to-value or 100% loan-to-cost (construction + soft costs). Requires a Debt Coverage Ratio of 1.2, amortization up to 50 years, and competitive premiums.

MLI Select: Better terms with up to 95% loan-to-cost, but stricter rules. DCR threshold drops to 1.1. Premiums start higher but you can earn discounts based on your project’s score.

What Gets You Discounts in MLI Select?

MLI Select scores your project on three areas: affordability, energy efficiency, and accessibility.

Affordability: Keep rents affordable (around 30% of median renter income) for 10 years. More affordable units mean more points.

Energy Efficiency: Reduce greenhouse gas emissions 20-40% below code.

Accessibility: At least 15% of units meet Canadian standards and common areas are barrier-free. Higher points for better universal design.

Why Scoring High Points in Toronto Is Tough

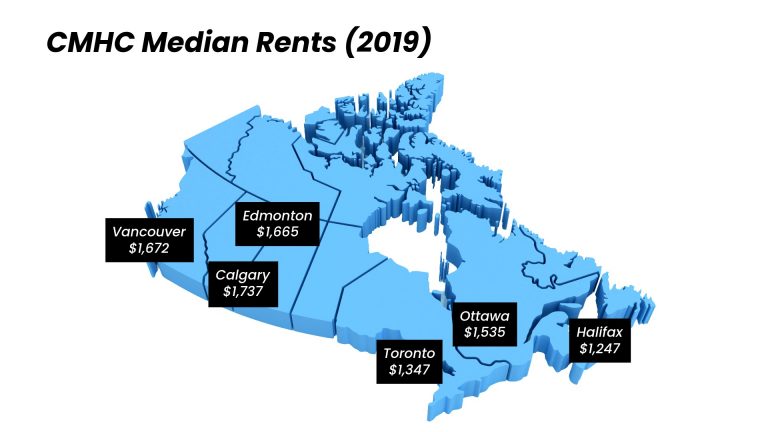

The gap between affordable rents (based on median rents, 2019) and Toronto’s market rents is massive. That’s the biggest challenge with chasing high CMHC MLI Select points through affordability.

Toronto rents are so high that lowering them enough to qualify for top affordability points can wipe out a big chunk of your returns.

Energy efficiency upgrades and accessibility features also add to your construction costs. Those costs hit your bottom line, especially if they don’t directly boost rents.

On top of that, lenders don’t just look at your loan-to-value. They put more weight on rental income and your Debt Coverage Ratio (DCR). So even if your property value could support a bigger mortgage, your borrowing power could still be capped if your rents are limited.

HST Savings: Why They Matter

Multiplexes with 4+ units built from the ground up qualify for the GST/HST Purpose-Built Rental Housing (PBRH) rebate. This can save you hundreds of thousands in construction costs.

Substantial renovations only qualify for the reduced GST/HST New Residential Rental Property Rebate. That means you’ll still owe a big chunk of HST, which can add huge costs to your project.

If you’re gutting and rebuilding multiplex units, a full new build is the most efficient way to keep HST costs down.

| Per Unit | Construction cost | Fair market value | Gross HST payable | HST rebate | Net HST payable |

|---|---|---|---|---|---|

| No self-assessment needed | $250,000 | $750,000 | $32,500 | $0 | $32,500 |

| Self-assessment for substantial renovations | $250,000 | $750,000 | $97,500 | -$24,000 | $73,500 |

| 4+ unit purpose-built rental housing | $250,000 | $750,000 | $97,500 | -$97,500 | $0 |

What Counts as a “Substantial Renovation”?

Under subsection 123(1) of the Excise Tax Act, a “substantial renovation” occurs when all—or essentially all—of a building is removed or replaced, excluding the foundation, exterior walls, interior supporting walls, floors, roof, and staircases that existed before the renovation began .

For practical purposes, most interpretations consider this to mean more than 90% of the existing interior must be removed or replaced—think of gutting a property down to the studs and rebuilding

Ready to Invest Multiplexes in Toronto?

Multiplexes give you better returns with balanced risk — but finding the right property isn’t simple. You need a solid strategy, expert knowledge, and tight project execution on construction and build timelines.

Not every house fits for multiplex conversion. You need the right layout, zoning, location, and a plan that supports refinancing and long-term cash flow.

Since Toronto’s market corrected in 2022, we’ve done hundreds of these deals and know exactly what works. If you want help finding good properties, crunching numbers, and smoothing the process, let’s chat.

Want to see what’s possible for you? Book a strategy session with us here.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!

This is for educational purposes only; it does not guarantee future performance or serve as financial, legal, or tax advice.