This is for educational purposes only; it does not guarantee future performance or serve as financial or tax advice.

CMHC’s MLI Select gets a lot of attention in Toronto real estate circles. Big loans, long amortizations, and the idea that you qualify based on rent instead of your personal income. On paper, it sounds like the ultimate investing strategy.

But here’s the reality most people don’t hear. CMHC MLI Select is not designed for the average Toronto real estate investor. It’s built for experienced builders with deep pockets, strong balance sheets, and the ability to manage complex construction risk. For most investors, especially those getting started or scaling carefully, there are better options.

Why CMHC MLI Select Sounds Better Than It Usually Is

The headline features of CMHC MLI Select are easy to get excited about. Lower rates, longer amortizations, and qualification based on rental income pull a lot of people in. It feels like a shortcut around traditional financing limits.

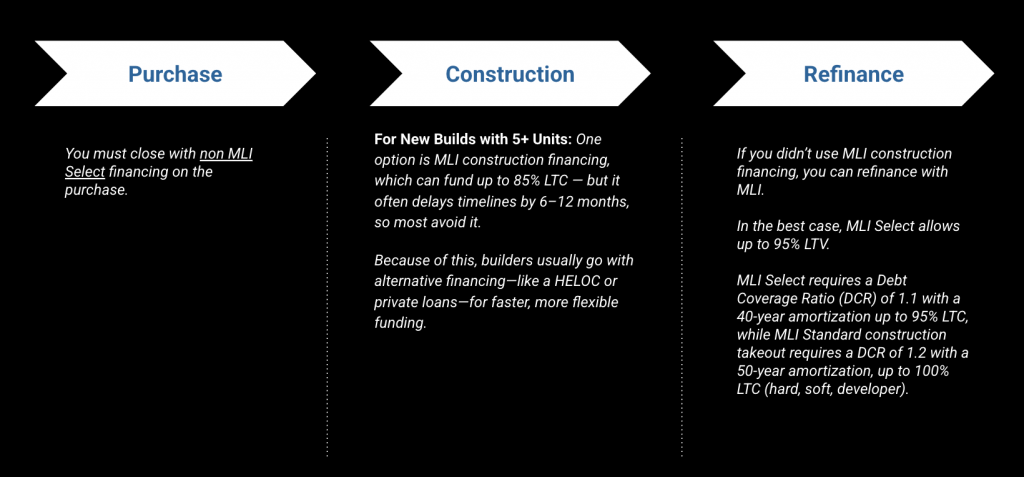

What’s often missed is that CMHC MLI Select is not available at purchase closing in Toronto. You still need to buy the property first using conventional or private financing. Only after you own the property, complete plans and permits, and start construction can you apply for CMHC MLI Select financing. Even then, approval is not guaranteed.

Experience, net worth, and borrower strength matter a lot. In practice, many experienced builders don’t even use CMHC MLI Select construction financing because it can be slow and restrictive. Instead, they build with private or alternative financing and refinance into MLI after the project is complete.

The Real Cash and Risk Behind Large MLI Projects

Once you accept that CMHC MLI Select usually comes at the end, you are really talking about private or alternative financing during construction. That changes the risk profile significantly.

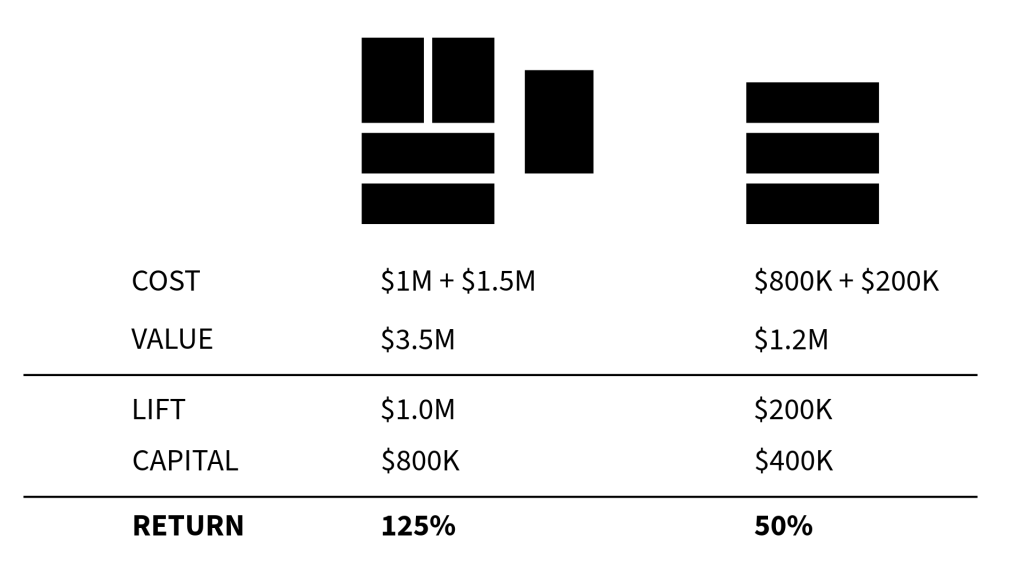

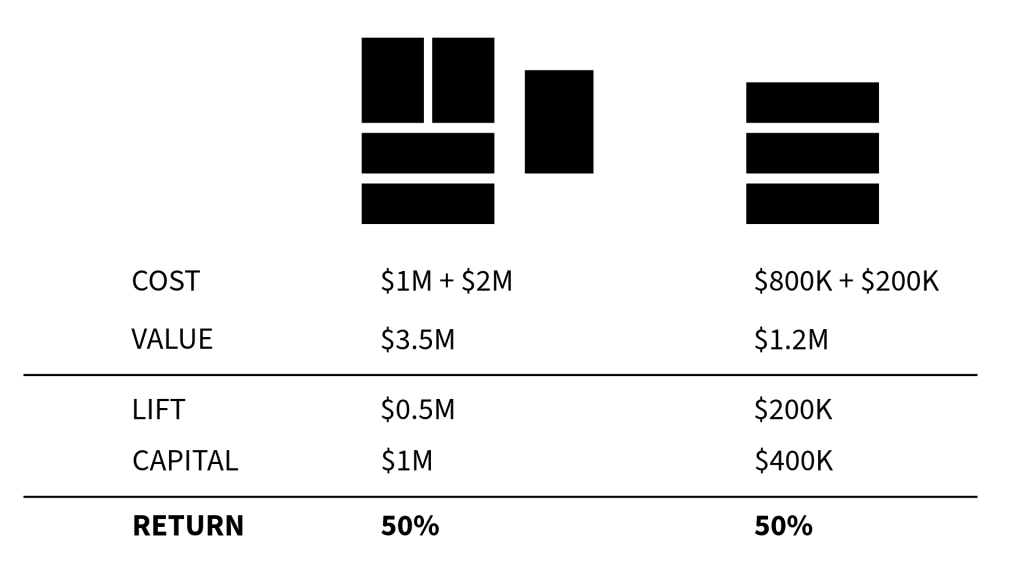

Construction loans are paid out in stages. Many projects require roughly one-third of the total project cost in cash before the first dollar is released. On a $2.5M project, that can mean $800,000 or more in upfront capital. Carrying a large private loan during construction also gets expensive very quickly.

This structure works for builders who have the capital, experience, and systems in place. For retail investors, the cash requirements, carrying costs, and execution risk can be overwhelming.

The Numbers Often Favour Smaller Multiplex Deals

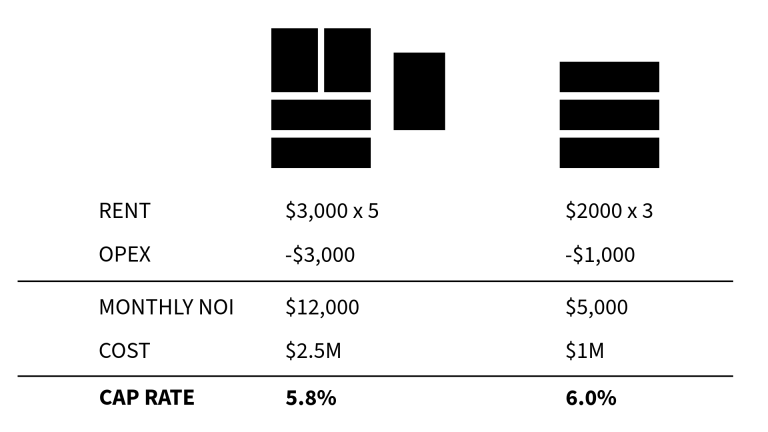

Large projects can look impressive on paper. Five units at $3,000 per month sounds great. But when you stack that against a $2.5M total project cost, the cap rate is often around 5.5 to 6 percent.

In today’s Toronto market, you can often achieve similar returns with far less complexity. A turnkey triplex around $1M generating $6,000 per month in rent is roughly a 6 percent cap rate. Similar income returns, far less capital, and much less execution risk.

The same logic applies to value creation. A large project might show a $1M value lift on paper, but that assumes perfect execution. Cost overruns quickly reduce that upside. Smaller residential projects can produce similar percentage returns with less time, fewer moving parts, and lower downside risk.

Why Smaller Projects Fit Most Toronto Investors Better

Most Toronto investors do not need CMHC MLI Select to build wealth. Smaller multiplex projects require less capital, take less time, and are easier to manage and hold long term.

A realistic starting point for many investors is around $300,000 in cash and the ability to qualify for a mortgage around $800,000. With that, you can buy a solid property, earn steady rental income, and grow without stretching yourself too thin.

Big projects often look exciting online. For experienced builders, they can work very well. But for most investors, smaller projects deliver similar returns with far better risk control.

How We Help Investors Navigate This Market

CMHC MLI Select is a tool, not a strategy. For most Toronto investors, smaller multiplex deals offer comparable returns with less capital, less stress, and lower risk.

If you want to invest in Toronto real estate the right way, the key is choosing a strategy that fits your capital, experience, and long-term goals. That’s where clear numbers and honest guidance matter.

Our brokerage specializes in Toronto multiplexes. We’ll help you find deals, crunch the numbers, and guide you through renovations and management. If you want full support in Toronto multiplex investing, our team can help you:

- Find high-potential properties

- Crunch the numbers so you know exactly where you stand

- Coach you through renovations to maximize returns

- Lock in great tenants

- Provide full property management so your investment runs smoothly

Book a strategy session with us here and let’s map out the smartest move for your portfolio.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!