Welcome to your complete guide to building a multiplex in Toronto!

Whether you’re new to real estate or a seasoned investor, learning about how to multiplex properties in Toronto can lead to big financial gains.

In this guide, we’ll break down everything you need to know about creating multiplexes in Toronto investment properties, including how to get started, what to watch out for, how much it costs, and how long it takes. Let’s begin!

What Is A Toronto Multiplex?

A Toronto multiplex is a building divided into two, three, or four separate self-contained residential units with separate kitchens and bathrooms.

You might also hear them called duplexes (two units), triplexes (three units), or fourplexes (four units). To be one of these, at least one home has to be either on top of another or partly above another.

Why Should You Create A Multiplex In Toronto?

Investing in multiplex properties in Toronto is a smart move for both real estate investors and the community.

Firstly, building more homes with smaller units helps tackle the city’s housing shortage and makes living spaces more affordable for people.

For Toronto real estate investors, owning multiple units in one property means earning more rental income and better rent yields. This can also make the property’s value go up faster upon completion of the project.

Plus, once you have five or more units, you’ll have more mortgage options available. This makes it easier to grow your investment portfolio and scale your real estate business.

How Do You Value A Toronto Multiplex?

Multiplexes offer a simpler valuation approach: you calculate the net rents and market cap rates to gauge their value. This makes it easier to forecast your investment’s growth and reduces overall risk.

How Do Total Returns On A Toronto Multiplex Build Look Like?

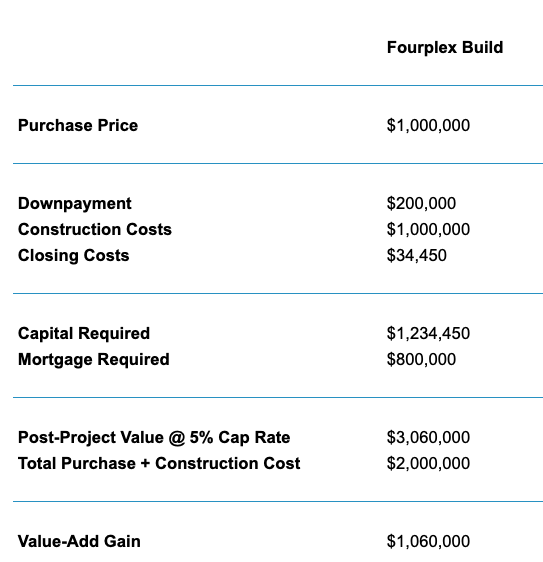

In Toronto, a common starting point is purchasing a bungalow for around $1 million. Then, we build a fourplex on it, which might cost another $1 million to construct.

Once everything’s set up, the total monthly rent for all four units is about $15,000. After subtracting operating expenses, we’re left with roughly $12,750 per month or $153,000 per year in net operating income.

Using a conservative estimate of a 5% cap rate for multi-family properties, the property’s value after construction rises to $3 million—giving us a $1 million gain from the four-unit build.

In addition to the value-added gain, you’ll keep benefiting from long-term appreciation and will generate impressive positive monthly cash flows, reaching over $8,000 per month before refinancing.

If you opt to refinance the construction project afterwards, you should be able to withdraw most of your initial capital while still maintaining a nearly break-even cash flow position on the building.

How Do You Finance A Multiplex Project In Toronto?

When it comes to financing, you can shoot for a down payment as low as 20% when you buy.

For construction, you’ve got options like construction financing, a line of credit, or other private funding. Some investors even use cash if they have it.

Once the project is complete, you could sell and take profit, but you could also rent out the multiplex and refinance.

For refinancing, you can still get residential refinancing for 4 and 5-unit properties from major banks.

Or, you could go for CMHC’s MLI Select financing if you have 5 or more units. This can mean lower rates, a higher loan-to-value ratio, and a longer time to pay off the loan.

How Many Units Can You Create In A Toronto Multiplex?

When it comes to building multiplex properties in Toronto, you might wonder how many units you can have.

Here’s a simple breakdown:

- In residential R, RD, RS, RM, or RT zones, you’re allowed to build up to four residential units within the main building as a standard.

- If your residential property falls within an R or RM zone, you might be allowed more than four units in the main house.

- And if your residential property is on a Major Street, there’s a chance you could be allowed up to 30 units in the future.

Head here to check the zoning for a specific address.

What Do Development Charges Look Like?

Since 2023, there have been some significant updates:

- There are no development charges for the first 4 residential units in Toronto.

- Development charges for backyard houses may be deferred in Toronto.

- If there are four or more existing residential units in a building, development charges may be waived when you add one more unit or up to 1% of the existing units (whichever is more) in Ontario.

These changes have made Toronto real estate investing much more feasible and financially attractive.

For educational purposes only. Please verify all information with the City of Toronto before proceeding.

Can You Build A Laneway Suite Or Garden Suite On A Lot With A Toronto Multiplex?

Yes, you’re allowed to have an accessory dwelling unit (ADU), such as a laneway suite or garden suite, on the same property as your Toronto multiplex.

Just make sure to review the regulations for Toronto laneway suites and Toronto garden suites.

What Are The Parking Requirements If You Build A Toronto Multiplex?

When it comes to parking requirements for building a multiplex, here’s a simplified breakdown:

- For buildings with up to four units (fourplex), minimum parking requirements are waived.

- For buildings with multiple dwelling units, minimum parking requirements are waived.

- Many apartment buildings have their minimum parking requirements waived, with exceptions in PZA & PBZ zones.

What Should You Keep In Mind When Creating A Toronto Multiplex?

If you’re converting an existing Toronto house into a Toronto multiplex, you typically maintain its original build form. While this option is cheaper, it may limit your ability to maximize rentable space and add value.

Building a Toronto multiplex from scratch allows for greater flexibility to optimize rentable space and get a better increase in the property’s value.

In this case, it’s important to aim for one unit on each floor and maximize the size of the building and any planned accessory dwelling unit (ADU) within setback and height regulations.

What Other Requirements Should I Keep In Mind For Toronto Multiplex Builds?

- Height: Floor requirements don’t apply to Toronto multiplexes, but there are height restrictions. Typically, they’re capped at 10m in height, but this could be higher based on height overlay (the taller height applies). If there’s no maximum height specified, then you would follow the height regulations based on zoning.

- Lot Coverage: This is the amount of your lot covered by buildings and continues to apply if it exists for Toronto multiplexes. For instance, if you have a 2,000 square foot lot with a 1,000 square foot building, your lot coverage is 50%.

- Floor Space Index (FSI): This measures how much floor space your building has compared to your lot. For example, a 3,000 square foot building covering all levels above ground on a 2,000 square foot lot will have an FSI of 1.5. Note that FSI doesn’t usually apply for Toronto multiplexes unless there’s a chapter 900 exception.

- Building Setback: This is the distance your building must be from the edge of your property. The rules depend on the zoning you’re in.

Head here to check on Toronto multiplex requirements for a specific address.

For educational purposes only. Please verify all information with the City of Toronto before proceeding.

How Do You Read Toronto Zoning Labels?

Check out this video below made by the Toronto Regional Real Estate Board to learn how to read zoning labels in Toronto.

How To Budget Costs & Timelines For Toronto Multiplex Projects

Below is a breakdown of the estimated timeframes and costs associated with various stages involved in creating a Toronto multiplex property.

For educational purposes only. Please verify all information with the City of Toronto before proceeding.

| Stage | Timeframe | Cost Estimate |

|---|---|---|

| Design & Drawings | 2 - 4 months+ | $10,000 - $30,000+ |

| Application For Zoning Review | 1 month+ | $600 - $2,000 |

| Committee of Adjustments (if needed) | 3 - 6 months+ | $5,000+ |

| City Building Permits and Fees | 1 - 2 months+ | $10,000 - 20,000+ |

| Multiplex Conversions | 3 - 12 months | $40,000+ per unit |

| Multiplex Builds | 12 - 24 months | $250 - $400 / square foot |

| Development Charges (if needed) and Other Soft Costs | N/A | Varies |

How We Can Help

Looking to take on a Toronto multiplex conversion or build investment project in Toronto? Our Toronto real estate sales brokerage is your best starting point!

With our wealth of experience in analyzing, searching, and acting as your buying agent, our Elevate team provides valuable insights to help you maximize returns while minimizing risks.

But we don’t stop there – we go above and beyond to assist you in planning your project, connect you with our trusted network of trades contacts, and provide ongoing guidance and support as you manage your construction project.

To discuss your unique Toronto real estate investing needs with us, to the link below to schedule a call to chat with our team!