Finding Investment Properties With Higher Returns in Toronto!

Video Transcription

In this video, I’m going to share three strategies that you can do to get better the market returns without doing any value-add work. Even if you think you can handle value add work, you can actually combine these strategies together so that you can get even better returns.

1. Location, Location, Location

I know what you’re thinking, you already know this! But when I refer to location I’m not just talking about how good a location is right now but to focus on properties not having higher growth potential because they’re in the early stages of gentrification.

I’m talking about neighbourhoods that might not be so nice right now but there are redevelopment plans in the work so that they’re more likely to improve in the future. Gentrification can begin with government initiatives, such as new transit lines that can make an area more accessible.

One example of this in Toronto is the Eglinton LRT that is underway. If you live in Toronto I’m sure you’re well aware of this. The good thing about the LRT construction is that once it’s done it’ll be a lot easier to get around midtown and properties close to the LRT will attract more buyers and renters.

Gentrification can also come from the private sector, such as major condo projects with master-planned communities. These developers aren’t just building condos, they’re also creating a new community complete with retail space, office space, trails and green spaces that will attract a new and better demographic.

As you can see, both public and private developments can contribute to the improvement of a neighbourhood. The key to the strategy is to choose properties in neighbourhoods that are in the early stages of gentrification. As the neighbourhood gentrifies, you’ll have to be patient and sit through years of construction.

Once these projects are done, these properties we’ll be able to attract a new crowd who’s willing to pay more for a more convenient location, better amenities, and better neighbours. In the end, you’ll see a big bump in the property’s market value and you’ll realize a much higher appreciation compared to the rest of the city.

2. Unique Properties

The second strategy is not to focus on commoditized properties. Yes, I probably made that term up but I’ll explain. When you look at condos in Toronto, there’s a lot more of them on the market and they’re pretty similar in terms of age, layout, and size.

And it’s not just condos, many newer residential communities, especially in the suburbs are pretty cookie-cutter. They’re nice and there’s nothing wrong about them, but they just all look very similar because of this they’re more like a commodity. It’s a lot easier to figure out how much a property like that costs, since you can compare them apple to apple.

On the other hand, Toronto’s houses tend to be older and there’s somewhat unique in terms of their size, layout, parking, design, condition and age. So when you zoom into a community, it’s very possible to see nothing sold in the past few weeks. When you’re comparing numbers from a few months back, they probably won’t be very good comparables now. On top of this, they might not be the same in terms of condition, size, and parking situation. So it’s a lot easier to misprice a house if you’re not experienced.

For the experienced investor, this is a great opportunity. On our end, we spend a lot of time looking at properties on the market for sale in Toronto on a daily basis. So after we shortlist properties that we think are good, we analyze them based on recent data and trends to see how their returns stack up now. Because of this, we can also say we’re one of the quickest at finding properties on the market that aren’t priced properly so that our clients can act on them.

Now if you want to do this yourself, it’s possible and here’s what you need to know. We recommend that you focus on unique properties and you really need to spend time to analyze and understand the sales and rental markets in different pockets of Toronto. This will help you find properties that are at a better discount which means they’ll be better returns for you in the long run.

3. More Expensive Types Of Properties

The final strategy I want to discuss is really more of the fact that not everyone knows about. Not all types of properties in Toronto have the same rates of return. As we move up to more expensive types of properties condos to single-family houses to duplexes and triplexes to commercial properties, you’ll see a better rate of return from rents.

I’ll use condos and houses to illustrate my point. Because condos are the cheapest, they have the lowest barrier of entry and as a result they have the most buyers. Unfortunately, that’s not to your advantage. This means that even if you find a good deal, it’ll be harder for you to get the deal and there’s also a lot more speculative buying which creates an environment where condos have a much higher purchase price per square foot compared to houses.

Even though buyers are willing to pay a higher price per square foot for condos, you don’t see this as much in the rental market. So what I mean is that the rent per square foot of a condo is really more or less the same as the rent per square foot of a house. Since a house has a lower purchase price per square foot and a similar rent per square foot, it is a much better investment compared to a condo.

Let’s look at some actual numbers in today’s environment. As a reference, we’re in the middle of 2020 right now and the entry one-bedroom condo in Toronto can cost around $500,000. After you buy it and rent it out, you can get $2,000 a month. Monthly operating expenses are around $600 a month, so this means that your annual operating income would be $16,800.

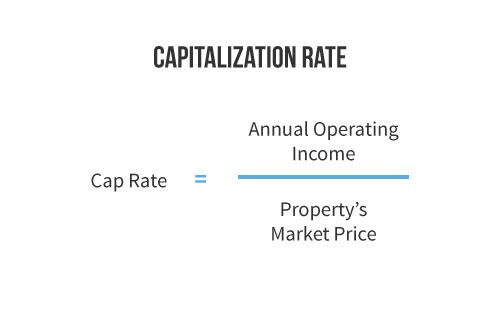

One way to compare returns on income properties is take the operating income and divide it by the property’s market value. We refer to this as cap rate. For this condo, the cap rate is 3.4%.

Let’s look at a house in Toronto that costs around $900,000. If you’ve rent it out for$4,800 a month combined with monthly operating expenses of around $850, your annual operating income will be $47,400 or a cap rate of 5.3%.

As you can see the cap rate on the house is much better than a condo, which means that you’ll get a much better return on your rent. The bottom line is if you can afford it, go bigger!

Final Words

Alright, I’ve just shared three practical strategies that can get you better than market returns even if you don’t do any value add work. You can pick and choose which ones work for you, or you can stack them up and your returns will look a lot better than the average real estate investor!