This is for educational purposes only; it does not guarantee future performance or serve as financial or tax advice.

Ever wonder why some people keep stacking wealth while others stay stuck? The difference usually comes down to this: smart real estate investing.

Toronto’s 2026 market is finally giving investors breathing room — prices have cooled, interest rates are trending down, and policies are opening the door for more density and opportunity.

Whether you’re new to investing or already own a few properties, this guide breaks down how to invest smarter, reduce risk, and build long-term wealth in today’s market.

Why Real Estate Builds Millionaire Wealth

Better Risk-Reward Balance Than Stocks

Toronto real estate continues to offer a balanced and consistent return profile. Even if we assume future price appreciation slows to 4% per year and add a modest 5% net rent yield, we’re still looking at returns that rival the S&P 500, with less volatility.

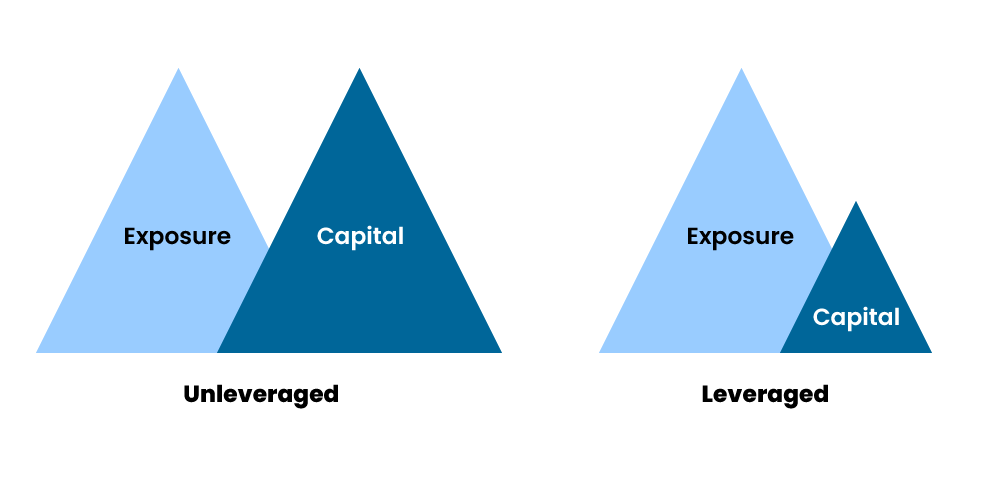

Leverage = Higher Returns

One of real estate’s biggest advantages is leverage. You can buy a $1M+ property with just 20% down — and grow your wealth using borrowed money. Lower fixed-rate mortgages (now around 4%) give you even more power to scale.

Multiple Ways to Win

With real estate, you’re not relying on just one stream of income:

- Cash Flow: Rents cover your expenses and give you extra income.

- Appreciation: Over time, your property gains value.

- Value-Add: Renovations can boost rents and property worth.

It’s a triple threat that makes your portfolio more stable and predictable.

Cash Flow = Stability

Positive cash flow means your property pays for itself and gives you breathing room — especially if the market shifts. It also gives you the freedom to hold long-term and refinance later.

Don’t Forget the Tax Breaks

- Rental Income Shelter: You can write off depreciation, reducing your taxes now and deferring them until you sell.

- Capital Gains Deferral: Instead of selling to access equity, you can refinance — keeping your investment intact while still cashing out.

The Case for Toronto Multiplexes

Better Cash Flow Than Condos

Multiplexes in Toronto generate significantly better rent yields than condos or single-family homes. More units = more income = more room for expenses, profits, and surprises.

Long-Term Market Growth

Toronto continues to lead Canada in real estate appreciation. Add that to stable rents and higher returns, and you’ve got a winning combo.

More Units = More Opportunity

Every extra unit gives you more revenue and flexibility. Whether you’re house-hacking, adding a backyard suite, or doing a full triplex conversion, the possibilities keep growing.

Pro Tips to Maximize ROI in 2026

Look for Value-Add Projects

Properties that need minor renos or layout changes can bring major upside. You can boost rents, increase property value, and build equity fast — often for less than the renovation cost.

Take Advantage of City Incentives

Toronto’s housing policies are pushing for more “missing middle” options. That means:

- Easier approvals for up to 4 unit conversions

- No development charages for up to 4 units plus deferred development charges on garden/laneway suites

- Enhanced HST rebates in some cases

These changes make it cheaper and faster to add units — and increase your ROI.

Need Help Finding the Right Toronto Multiplex Investment?

Leverage isn’t risky when used strategically. It’s what turns good real estate into a powerful wealth-building tool. The key is buying right — choosing properties that cash flow from day one so the rent covers your costs while the property grows in value.

At Elevate Realty, we don’t just talk about investing — we do it. We own, manage, and scale our own portfolios right here in Toronto, so every strategy we share comes from real-world experience.

If you want to grow efficiently and maximize your after-tax returns, you need a team that knows how to put these strategies into action. We help Toronto investors buy smarter, scale faster, and build portfolios that last. Our team can help you:

- Find high-potential properties

- Crunch the numbers so you know exactly where you stand

- Coach you through renovations to maximize returns

- Lock in great tenants

- Provide full property management so your investment runs smoothly

Want to see what’s possible for you? Book a strategy session with us here.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!