Investing in Toronto real estate opens up diverse opportunities, such as home ownership, capitalizing on property appreciation, earning rental income, and enhancing properties for profitable returns.

We, however, prioritize a method that balances these strategies strategically. Our focus is on minimizing risk while maximizing returns, and we achieve this by emphasizing long-term rentals with, at the very least, break-even cash flows in Toronto.

This guide is tailored to simplify our approach, offering you a clear and confident navigation through the dynamic Toronto real estate market in 2024.

1. Understand Why People Invest In Toronto Real Estate

Good Balance Of Risk and Returns in Toronto Real Estate

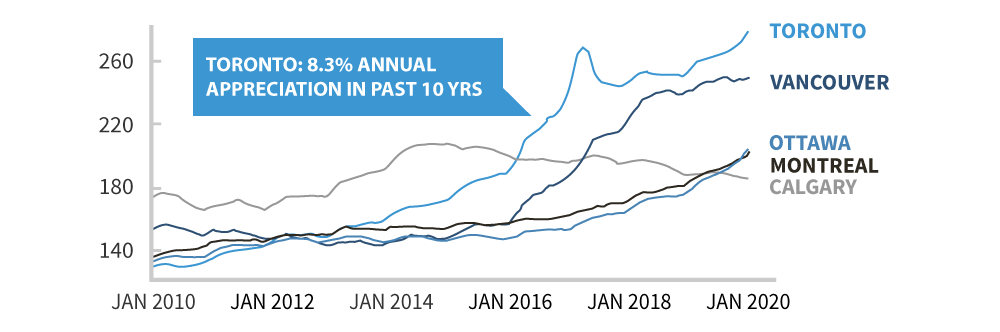

Investing in the S&P 500 index typically delivers about a 9% return each year.

Examining the past 10 years of Toronto real estate, it has shown a price growth of over 8% annually. Even with a more cautious estimate of 4% annual growth and an additional 5% for net rent yields, the returns still align with stock investments.

The attractiveness of Toronto real estate lies in its ability to provide well-balanced returns, not solely dependent on growth. This makes it a versatile and comprehensive investment option.

Leverage for Improved Returns

Real estate investing has a special perk: you can borrow money with a mortgage at a lower cost, which boosts your returns. Imagine your total returns, after accounting for borrowing costs, hitting 5% on the property price. That’s a significant 25% return on investment, with a 20% downpayment (5%/20%).

Now, why do we prefer Toronto multiplexes? They allow us to generate at least break-even cash flows with leverage. This gives us better holding power, essential for navigating the ups and downs of the Toronto real estate market successfully.

Remember, while higher returns in real estate are great, they come with more risk. To make it work, you need strong holding power and smart cash flow management. That’s the key to success in this game.

Tax Advantages in Real Estate Investments

Apart from the potential for high returns, real estate investments come with valuable tax benefits. For example, deferring rental income to a later date. This can make a big difference in total returns over time by providing you with more cash for reinvestment.

2. Set Investment Goals

Whether you’re aiming for long-term appreciation, stable rental income, or strategic property upgrades, having well-defined goals acts as your North Star. These goals will be your guide throughout the entire investment process.

We believe in a balanced approach to enhance total returns while spreading out our risk. This involves focusing on three key areas:

Rental Income:

- Cover operating expenses, monthly mortgage payments, build your emergency fund and equity over time.

- Aim for at least breaking even on cash flows to strengthen holding power.

Value-Add Gain:

- Boost returns through strategic projects and improvements.

- Take on projects that can enhance the property’s value and increase overall returns.

Market Appreciation:

- Benefit from long-term growth by holding onto the property.

- Hang onto the property for the long run and capitalize on its appreciation over time.

3. Understand Your Budget

In the face of higher interest rates, the Toronto real estate market has undergone significant shifts, resulting in noteworthy price drops.

This, however, has given rise to a unique opportunity for potential investors. Property values have experienced a dip of 15-20%, marking one of the most budget-friendly entry points we’ve seen in recent years.

Whether you’re eyeing rental income, value-add potential, or long-term appreciation, the Toronto investment property you take should depend on the goals you set for yourself.

Snapshot of Toronto Real Estate Prices (As of November 2023)

- Toronto Condos: Starting at $500,000 and above

- Toronto Houses: Starting at $800,000 and above

Navigating Mortgage Qualification: A Closer Look

When it comes to a rental property, you have the flexibility to borrow up to 80% of the property’s value. Eligibility criteria, set by the bank, are based on either your income or a high net worth approach. This approach requires a 1:1 ratio of cash to the borrowed amount.

Preparing for Purchase: Allocating Funds Wisely

Beyond the down payment, it’s crucial to set aside funds for closing costs and potential renovations. For rental properties in Canada, meeting the minimum 20% down payment requirement is essential. We recommend that you allocate an estimated 5% for miscellaneous closing costs in Toronto.

4. Think About Rental Income

Your investment choices should align with your goals for rental income.

For improved risk-adjusted returns, it’s advisable to select properties with at least break-even cash flows. This enhances your holding power, enabling you to weather short-term price volatilities and benefit from long-term appreciation.

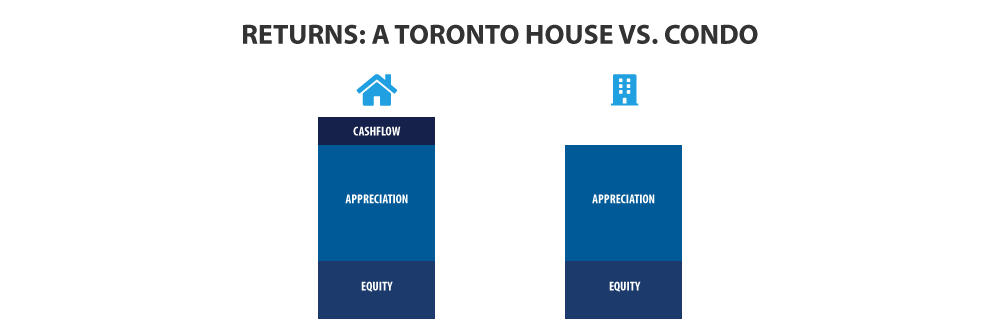

Toronto Houses vs. Toronto Condos

Toronto houses often outperform Toronto condos in terms of rental income. This is attributed to better gross rent yields and fewer expenses associated with condo fees, making Toronto houses a preferable choice if you’re looking for better cash flows.

Number of Units

The combination of higher rent potential and reduced purchase prices has significantly improved cash flow prospects for Toronto multiplexes, even in the face of elevated interest rates.

While single units may exhibit negative cash flows with a 20% down payment, multiple units have the potential to break even or even generate positive cash flows.

Number of Bedrooms

Increasing the number of bedrooms in a unit can lead to a further boost in rents. Simply put, if you can convert the interior configuration of a Toronto multiplex from three one-bedroom units to three two-bedroom units, you have the potential to substantially increase your rental yields and cash flows.

Unlocking Potential Through Renovations

Consider renovations as a strategic move to enhance cash flow potential. Purchasing properties at a discount and implementing renovations can not only improve the property’s value but also contribute to a more robust cash flow.

5. Balance Appreciation For Best Returns

Your decision might hinge on your preference for property appreciation. Generally, properties with high rent yields often experience lower appreciation.

However, Toronto multiplexes stand out as a smart choice, offering a good balance of both stability and appreciation.

It’s important to emphasize that we don’t endorse short-term speculation. We firmly believe that real estate investing should be seen as a long-term commitment, ideally for at least 5 years or more.

Toronto Growth Outperformance

Toronto has shown a commendable and more stable growth trend, averaging over 8% per year over the past decade. This outpaces the rest of Canada, which tends to experience more volatility and lower growth rates. Recognizing Toronto’s robust and consistent appreciation provides a foundation for strategic investment planning.

Toronto Houses vs. Toronto Condos

Distinguishing between Toronto condo and house appreciation trends is vital. Condos, often favoured by investors banking on appreciation in the past 10 years, will tend to be more volatile.

In more recent days, the government’s current focus on the “missing middle” housing approach has shifted favour towards houses. This emphasis may impact the future appreciation dynamics, urging investors to carefully assess the evolving landscape.

Toronto Neighbourhood Dynamics: Mature vs. Gentrifying Areas

Appreciation trends vary across Toronto neighbourhoods. Mature areas, characterized by stability, may see slower growth compared to gentrifying areas.

6. Analysis To Purchase

Before jumping into Toronto real estate investment, it’s crucial to carefully look at potential deals. This means thinking about different things to make smart choices.

If you’re not sure where to begin, no worries – our Toronto real estate investment team knows this well, and we’re here to help you through this important stage.

Estimated Property Value:

Research and assess what price the property might sell for. Understanding the market value provides a foundation for your investment calculations.

Space Configuration Optimization:

Consider how to configure the space to optimize its functionality. A well-designed layout can enhance rental potential and overall property value.

Renovation Cost Evaluation:

Calculate the expected cost of renovations. Knowing this upfront helps in budgeting and ensures you’re prepared for any necessary improvements.

Projected Rents:

Determine the projected rents. This involves understanding the rental market in the specific area and estimating how much income the property can generate.

Expense and Mortgage Payment Projections:

Project the expected expenses, including property taxes, maintenance, and insurance. Additionally, calculate mortgage payments to get a clear picture of ongoing financial commitments.

Expected Appreciation:

Factor in the expected appreciation of the property over time. Consider the historical trends in the area and potential future growth to gauge the long-term value of the investment.

Cash Flow Analysis:

Understand how cash flows will be impacted. This involves subtracting expenses and mortgage payments from the rental income to assess the net cash flow.

Comparative Analysis:

Stack up investment opportunities against each other. Compare the cash flows, potential appreciation, and overall returns to determine which property aligns best with your investment goals.

Inspect Thoroughly:

Before making any decisions, inspect potential properties. Look for any repairs or renovations needed. You want to know what you’re getting into.

Put in Offers:

Once you’ve identified a promising investment property, it’s time to put in an offers. Our team helps you strategically negotiate with the seller to ensure that the final deal aligns with your investment strategy and goals.

Secure Financing:

Once the offer is accepted, secure financing for the purchase. This might involve obtaining a mortgage or exploring other financing options.

Close the Deal:

Complete all necessary paperwork and finalize the purchase with your lawyer. This marks the official acquisition of your investment property!

7. Upgrade Your Property To Boost Returns

To enhance rent yields and returns, you might decide to take on value-add projects. Undertaking such projects involves budgeting extra funds and completing renovations before the property is ready for renting.

Investors typically finance renovations with cash or through their home equity line of credit (HELOC). After renovations are done, there is an option to refinance the property to free up the cash you put into the renovation project.

The key to successful renovations lies in both experience and the professionals you choose. This is where our team comes into play—we bring the expertise and a network of reliable and cost-efficient contractors to help you maximize real estate value-add success.

Cosmetic Renovations for a Gentle Boost

Starting with cosmetic renovations can provide a modest but tangible increase in the property’s value. Small budget-friendly improvements like fresh paint, updated fixtures, or enhanced curb appeal can make a noticeable difference.

Seizing Opportunities with Bigger Renovations

When considering more substantial renovations, be mindful of market dynamics. Demand for properties needing big renovations with bigger budgets has been dropping in the current market with high interest rates.

However, this situation can work to your advantage if you have the time and money for bigger projects. With less competition, you have the potential to secure better discounts, translating to a more significant value addition.

Adding units and bedrooms to your property is a strategic move that not only increases rental potential and improves rent yields but also substantially boosts the overall value of the property. This expansion can be a powerful driver for maximizing returns.

Exploring the Potential of a Laneway Suite Or Garden Suite In Toronto

Going one step further, consider building a laneway suite or garden suite in Toronto. This not only boosts the property’s rental potential but also adds extra value. It’s a creative strategy to maximize space and generate additional income streams. Generally, our suggestion is to focus on the main house initially. Once it’s rented out and your cash flows are more stable, you can then shift your attention to the backyard house.

8. Lease Out Your Toronto Rental Property

Leasing out your rental property goes beyond choosing a location with a higher likelihood of good tenants.

A crucial aspect is conducting thorough due diligence to ensure you find individuals who will care for the property and pay rents on time.

This proactive approach helps create a stable and mutually beneficial landlord-tenant relationship, contributing to the long-term success of your investment.

Want help with putting in good tenants for your Toronto investment property? Check out what we offer.

9. Manage Your Toronto Rental Property

After completing the property renovation and securing long-term tenants, effective management of your Toronto investment property becomes essential.

Taking care of condos is a bit easier. Condos are usually newer, so they need less fixing up. However, even when factoring in hiring property management for houses, the rental yields still tend to surpass those of condos.

In real estate, property management involves taking care of various tasks to keep the property in good shape and everyone happy. This includes dealing with tenants, making sure rent is paid, and handling regular maintenance checks and keeping up with repairs.

If you need help with property management in Toronto, we can help.

10. Refinancing Your Toronto Investment Property

Refinancing your property, whether it’s post-renovation or later on, is a clever strategy to access the extra equity in your Toronto investment property without the costs and hassle of selling. This approach empowers you to invest and expand your real estate portfolio more effectively.

When investors buy with our team, we assist in reviewing your Toronto real estate portfolio when circumstances shift, ensuring you can fine-tune and make the most out of your real estate investments.

How Can We Help

Navigating Toronto’s real estate landscape demands a strategic approach. Aligning these considerations with your specific goals and budget serves as the bedrock for informed decision-making. But with us, it doesn’t stop at the purchase; that’s just the beginning.

Our Toronto real estate investment team doesn’t just help you buy; we’re here for the long haul. We keep a watchful eye on the Toronto real estate market at all times. We also stay by your side, helping you review your portfolio, and assisting you in growth when you’re ready.

Whether your focus is on stable rental income, exploring higher growth locations in Toronto, or diving into value-add projects, our expert Toronto real estate investing team is here to lend a helping hand.

Want To Get Started With Real Estate Investing In Toronto?

We’re not your typical real estate sales brokerage. Instead, we focus on using data and numbers to help you make smarter real estate investing decisions in Toronto. If you want to learn more about real estate investing in Toronto, just reach out.