Introduction

Let’s tackle one of the biggest questions for real estate investors: should you focus on cash flow or appreciation?

This debate isn’t just among new investors; even within our team, there’s no one-size-fits-all answer. Why? Because everyone’s at a different stage in life with unique investment goals.

So, let’s break it down and explore when to prioritize each, and how returns may vary between the two.

What To Choose Depends On your Goals

Imagine you’re fresh in your career, eyeing your first real estate purchase. You’re willing to take risks and put in the effort, but your income too high yet.

This is where cash flow takes the spotlight. It’s not only crucial for qualifying for larger mortgages but also sets the foundation for your future success.

When you pick properties with higher cash flow and rental income, you might be able to borrow more money. That’s because the rent you receive adds to your total income, making you eligible for a larger mortgage.

As you progress and your income grows, your investment goals may evolve. Are you looking for steady income stream for retirement? If so, cash flow becomes your best friend.

Or, perhaps you’re aiming to scale up and build an empire. If this is you, you might want to consider taking on bigger projects instead. Think of buying run down properties at a discount, renovating, and adding more units to it.

This strategy can substantially boost property values more quickly so that you can go back to the bank to pull out your initial investment capital to do it again.

The caveat here is that you’ll want to have decent cash flows still so that your property on refinancing can still support itself with at least break even cash flows – the reason here is two fold:

- You won’t have to stress as much about keeping the investment property afloat.

- Having at least break even cash flows will help you continue to qualify for future mortgages moving forward.

Canadian Real Estate Investing Income Tax Implications

Next, let’s break down income taxes. When you aim to maximize your real estate investment returns, you’ll also want to minimize your tax bill.

Cash flow gets taxed at a high rate of 100%, whereas appreciation enjoys a lower rate of 50%. So if you end up making the same amount from both, gong with appreciation actually gives you better net returns after tax.

Another thing to keep in mind here is that in order to access your cash, you don’t have to sell and pay the capital gains tax.

You can actually go to the bank to refinance and pull a similar amount out, deferring tax obligations which is another big benefit with focusing on appreciation.

Toronto Real Estate Investing Returns Comparison

But finally, the most important part is to learn how to find the best returns and the key concept I want you to know is that doubling your cash flow isn’t the same as doubling your appreciation.

Take a look at this simple example. Imagine we have two properties, both worth $1 million. Property A sees a 3% increase in value annually, while Property B sees a 6% appreciation each year. That’s a $30,000 difference and after taxes (let’s say at a 30% rate), Property B brings in $25,500 more in appreciation.

However, Property A, with its double cash flows of $1,000 per month compared to $500 for Property B. That translates to $6,000 more annually before taxes, or $4,200 after taxes.

What you need to actually see is $3,500 in monthly cash flows in Property A just to break even with Property B – which is like a unicorn deal. So in short, while strong cash flows can help you get your foot in the door, experienced investors often shift their focus to appreciation.

And that’s where Toronto shines.

Why Invest In Toronto?

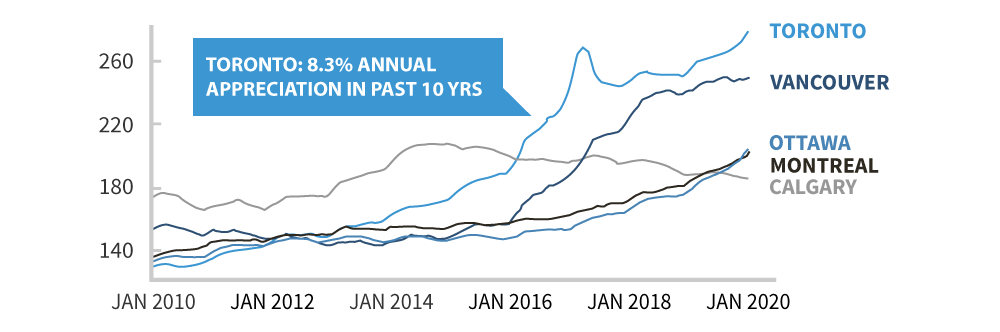

Toronto has a proven track record of outperforming other Canadian cities in terms of long-term appreciation, which means better total returns and better tax benefits.

Plus, the market in Toronto is pretty stable, so when it’s time to sell, you’ll be at lower risk of big losses during market downturns.

If you’re aiming for max real estate investing returns, like any savvy investor should, and want the best of both worlds in terms of appreciation and cash flow potential, then Toronto’s new housing policies, focusing on the missing middle, are definitely worth checking out.

These new policies in the past year or two now allow you to turn one house into 5 units and possibly up to 30 units sometime this year.

What you get here is stable appreciation, great cash flows with more units, and better value add potential when you take these projects on too because higher rents translate to higher values from an investment property standpoint.

How We Can Help

No matter if you’re focused on cash flow or appreciation, it’s essential to understand your investment and do the math.

If you’re diving into Toronto real estate and need expert advice, we’re here for you at Elevate Realty. We’re not your typical real estate sales brokerage.

Instead, we focus on using numbers to make better real estate investing decisions in Toronto. That can mean looking for stronger investments with positive cash flow, thinking about risk management, and looking for ways to boost returns like value-add renovations and gentrifying areas.

If you want to discuss your private real estate situation with us, just go to this link below to set up a time to chat!