This is for educational purposes only; it does not guarantee future performance or serve as financial or tax advice.

Most investors only learn about HST self-assessment after they’ve already gutted half their house — which is the worst possible time. CRA’s rules around “substantial renovation” can swing your numbers by six figures, and if you don’t understand where the line is, your budget can blow up fast.

Toronto investors converting homes into multiplexes are especially exposed. Whether it’s a 3-unit conversion, a 3+1 with an ADU, or a full fourplex build, the tax treatment changes dramatically based on how much of the original house you remove. And the scary part is that many investors think adding new kitchens, new bathrooms, or new fire separation triggers HST — but that’s not how CRA looks at it at all.

Understanding What Actually Triggers HST Self-Assessment

The first thing investors get wrong is assuming that adding new materials equals “substantial renovation.” It doesn’t. CRA doesn’t care about how much you add; they care about how much of the existing interior you remove or replace.

If you take out 90% or more of the original interior — meaning the old drywall, framing, finishes, floors, and non-structural elements — CRA considers the home “substantially renovated.” Once that line is crossed, they treat your project like a new build, and HST is applied on the full completed value, not just what you spent.

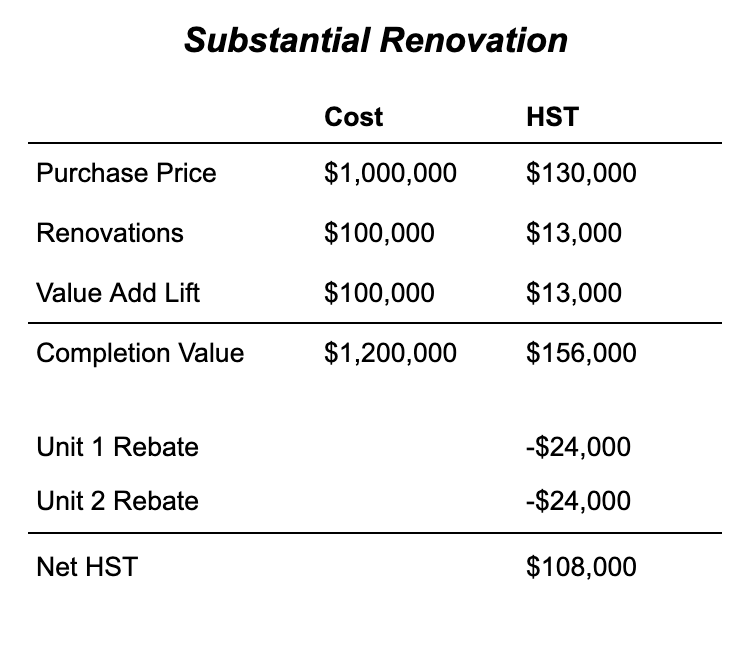

Where this hits hard is in typical gut-renovation scenarios. Say you buy for $1,000,000, spend $100,000, and the finished property is worth $1,200,000. Substantial reno means you owe 13% of $1,200,000 — a brutal $156,000. Even after partial rebates, most investors are still out over $100,000.

Why Most Multiplex Conversions Avoid Substantial Renovation

Here’s where smart investors stay ahead. A conversion isn’t automatically substantial. In fact, most 3-unit conversions avoid it completely when done properly.

If you keep the main floor layout intact, leave the basement floor and walls, add new kitchens and bathrooms, apply fire separation, or layer new drywall over old drywall — none of this counts as substantial. You didn’t remove 90% of what was already there, so you only pay HST on your actual renovation spend, not the whole property value.

This single distinction can be the difference between paying $13,000 and paying over $100,000. For Toronto investors working with tight capital and strong ROI targets, staying under the 90 percent rule is non-negotiable.

How ADUs Are Treated Differently — And Why They Actually Benefit You

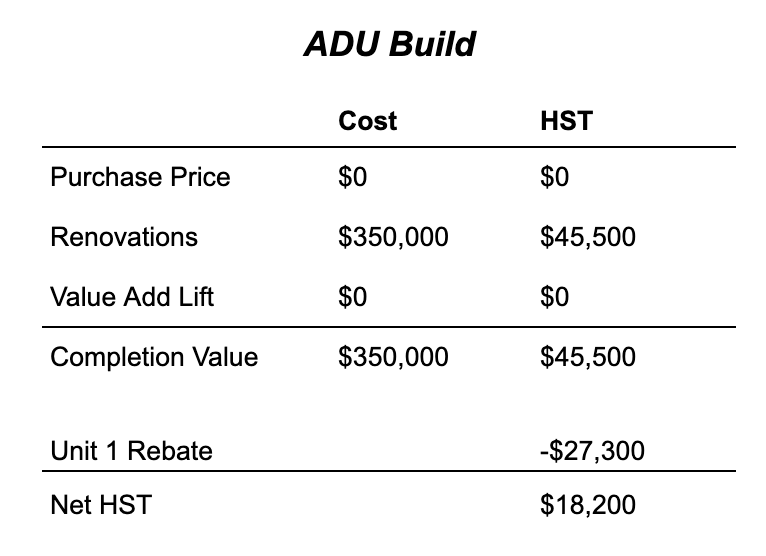

A 3+1 setup — triplex plus ADU — gets taxed as two totally different projects. And this is where ADUs shine.

Most garden suites and laneway suites in Toronto are currently appraising at close to their construction cost. If you build for $350,000, the finished appraisal often comes in around the same number. That means:

- HST is $45,500

- The rebate is ~$27,300

- Your real out-of-pocket is only $18,200

If you don’t self-assess, you miss the rebate and pay the full $45,500. So unlike triplex gut jobs, ADUs can actually save you money under the self-assessment rules.

Why Fourplexes Fit the Tax System — And Triplexes Don’t

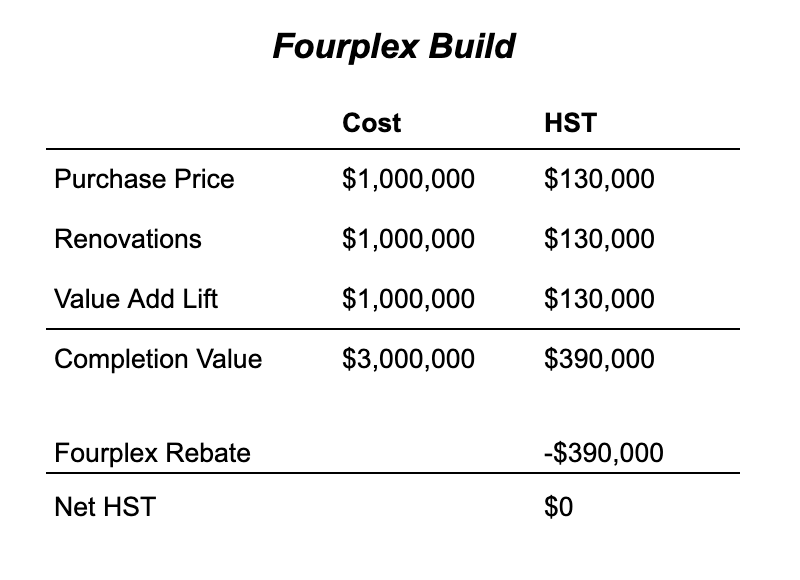

Another turning point happens when you hit 4+ units. New rental properties with four or more long-term units qualify for the full HST rebate. If you build a fourplex worth $3,000,000, CRA may charge $390,000 in HST — but the rebate returns the entire amount.

This is why purpose-built fourplexes often outperform triplex builds. Triplexes only get partial rebates, but fourplexes get everything back. The tax treatment alone can swing ROI by tens of thousands every year.

Bottom Line for Toronto Multiplex Investors

Multiplex conversions work extremely well when you keep the scope tight, avoid full gut renos, and structure units intelligently. You save on taxes, move faster, and get better ROI without taking on the financial pressure of a full new build.

If you’re ready to invest with a proven approach, we can help you apply these strategies to your situation. We use them in our own projects and with our clients.

Our brokerage specializes in Toronto multiplexes. We’ll help you find deals, crunch the numbers, and guide you through renovations and management. If you want full support in Toronto multiplex investing, our team can help you:

- Find high-potential properties

- Crunch the numbers so you know exactly where you stand

- Coach you through renovations to maximize returns

- Lock in great tenants

- Provide full property management so your investment runs smoothly

Book a strategy session with us here and let’s map out the smartest move for your portfolio.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!