Why Do Income Properties Make Great Investments?

Income properties are great long term investments. In fact, income properties can improve returns and reduce risk in your total investment portfolio. Here are our top five reasons why we love income properties.

5 Reasons You Should Invest In Income Properties

1. Income Properties Lower Overall Portfolio Risk

When the are higher swings in a market, means more uncertainty – therefore, higher risk. So how do income properties and the stock market compare? If you look at the historical data from 2000 to 2019, Toronto real estate has much lower price fluctuations compared to the S&P 500 index over the 20 year period.

Toronto Real Estate Prices vs. S&P 500 (2000 - 2019)

Source: TRREB Historic Statistics

Most people think real estate and stocks correlate to the economy, but the reality is that they don’t always move in the same direction. For example, during the stock market crash in the early 2000’s or during the subprime crisis in a 2008-2009 where the S&P 500 index had double-digit percentage drops, Toronto’s real estate stayed relatively stable year over year.

So if you had a combination of income properties and stocks in your portfolio during those years, you would feel a lesser impact from the negative swings in the stock market and reduce your overall investment risk.

2. Income Properties Improve Overall Portfolio Returns

We usually associate lower risk with lower returns. But the interesting thing about income properties is that this is not the case. Over the past 20 years, Toronto’s annual appreciation was 6.7%, whereas the S&P 500 index grew by 4.8%. So this means Toronto’s real estate actually outperformed the S&P 500 index, even though it is lower risk.

Now, let’s zoom in to the last 10 years. When we do this, you’ll actually see that the S&P 500 index did outperform at 12% per year, compared to Toronto’s real estate that grew at 8% per year. What this means is that stocks are in fact higher risk with more price fluctuations but they do have a potential for higher returns if you buy and sell at the right times. On the other hand, income properties provide more stable and better long-term returns.

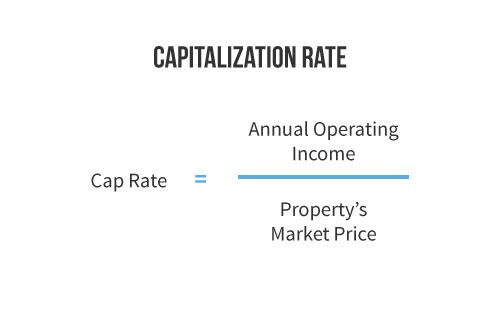

Note that this doesn’t take into account rental income or stock dividends. Toronto’s rental capitalization rate (cap rate) is around 4.5%. If you’re not familiar with cap rates, this is basically your rents yield. On the other hand, the average S&P 500 index dividend yield is 1.9%. So better yields make income properties looks even better.

3. Leveraging Income Properties Magnify Stable Returns

Banks consider income properties lower risk and therefore offer great borrowing terms. Typically, we’re looking at a 20% downpayment and the best borrowing rates on the market. On top fo this, a mortgage is guaranteed for a fixed period of time as long as you pay your monthly payments.

When you trade on margin with stocks, you’ll need a margin requirement of at least 30% and get higher borrowing rates because margin trading with stocks is very risky. If prices swing the wrong way, banks will ask you to top-up your margin requirements or you’ll have to sell your stock investment, which puts you in a very vulnerable position.

With lower interest rates, lower downpayment and better holding power, income properties is a better use of leverage which can positively magnify your investment potential.

4. Income Properties Give Way To Forced Appreciation

Stocks are passive which means you don’t have the ability to improve your investment’s performance. On the other hand, income properties can give you the option to do more if you want to. This means you can get higher forced appreciation even when there’s a downturn in the market.

Specifically, if you renovate older homes, you’ll be able to bump up your income property’s value. The appreciation you gain (when done right!) is more than the amount you put in, so you’re able to actively create forced appreciation on your income property.

The example below shows the forced appreciation that you can get from a $835,000 property. By putting in $100,000 in renovations, your property’s price increased to $1,150,000, which is a $315,000 bump in price. If you take out your cost of upgrades and closing costs, you gain $187,000 – this is your forced appreciation.

5. Income Properties Offer Better Principal Protection

Large cap stocks are pretty secure but they still have a chance of getting completely wiped out if it’s not handled properly by the company’s management.

On the other hand, land is valuable because they’re not making any more of it and demand for housing keeps growing in Toronto. This makes real estate hold its value and even increase in price over time because of simple supply and demand.

So if you’re concerned about principal protection, income properties will give you more security in your overall portfolio.

How We Can Help

Don’t put all your eggs in one basket! Diversification is key to successful investing and as you can see, investing in income properties can reduce your overall risk while improving your portfolio’s long term returns.

If you want help choosing the best income properties on the market in Toronto, we’re here to help. Let’s chat so that we can learn about your budget and requirements. Our goal is to help you find and invest in an income property that can help you generate the best long term investment returns.