Should You Go With A Fixed or Variable Mortgage?

This is of the most frequently asked questions when it come to mortgages. Rates, drivers, penalties, your personal views, and preferences all come into play when deciding whether to choose a fixed or variable mortgage rate. Follow along as we walk you through how to choose the right option for you.

The Definition

As the name implies, variable rates may change over your mortgage term. The bank will lend you money at the “prime” rate, plus a fixed premium or less a fixed discount. An example of a variable rate would be prime – 0.45%. If the current prime rate is 3.45%, this means your variable rate is 3%. If the prime rate drops to 2.95%, then your variable rate drops to 2.5% – this also means your remaining mortgage payments will be lowered as well.

A fixed rate, on the other hand, will not change over your mortgage term. An example of a fixed rate would be 3.75%. Even if rates change, you are locked in at 3.75% and your mortgage payments will stay the same for your entire mortgage term.

HOW DOES THE ECONOMY AFFECT THE RATES

Both variable rates and fixed rates are driven by economic factors, such as inflation and employment. However, they don’t always move at the same rate or the same time. Variable rates are based on the prime rate, driven by Bank of Canada’s overnight lending rate. On the other hand, fixed rates are based on bond yields and are driven by the market.

So, when the market predicts that the Bank of Canada will cut rates in the future, the market drives bond yields down. In this case, fixed rates would move sooner than variable rates. If there is a surprise rate cut by the Bank of Canada, fixed rates will move first and variable rates will follow.

If you have a strong view of where the economy is headed in the future, you may be more inclined to choose one over another. For example, if rates are already very high and the market is pricing in drops in bond yields, then it might be a good idea to stick with variable rates in anticipation for multiple interest rate drops.

On the other hand, if rates are already so low that it can’t drop much more, then you might want to lock in your rates.

Penalties If You Break Your Contract

The termination fee for breaking your contract (which is needed for refinancing!) is different for variable and fixed mortgages. For variable rates, the penalty is usually calculated as three month’s interest. Fixed rates are a bit more complicated – it is typically calculated based on the higher of three month’s interest or the interest rate differential. If rates have gone down from your fixed rate at the time you terminate your mortgage, the bank will lose out because they can’t get those same rates from new borrowers anymore. In this case, banks will look at your interest rate differential, which is basically the total interest lost by the bank over the rest of your term if you break the contract. Note that termination fees may vary by bank, so please check your individual contract for specifics relating to your mortgage.

If you have a long tenor left on your mortgage contract, penalties for breaking your contract can be high for fixed rate mortgages. So, if you are looking to refinance your mortgage after renovations, it might be a better idea to stick with variable rates to minimize the cost of penalties.

What else should you consider when deciding on a fixed or variable rate?

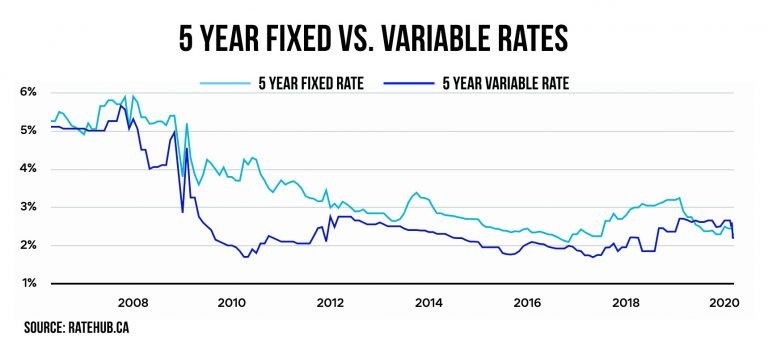

Based on historical data, you’ll see that variable mortgages have outperformed fixed mortgages over the past 30 years. So, there’s a high chance that you’ll be paying less over the mortgage term with a variable mortgage.

If you are not comfortable with taking on the risk of paying more in the future, then a fixed rate can be a good option so you won’t have to worry about payment fluctuations. Note that you are likely to be paying a premium for the added stability, just like an insurance policy. However, it might be worth weighing the cost of the premium with the risk you’re comfortable with. If variable rates are significantly lower than fixed rates, then the premium might not be worth the protection.