Should You Sell Your Toronto Condo?

Introduction

With condo rents dropping combined with higher vacancies, a lot of investors as coming to us asking whether they should hang onto their condo investments. In the past 10 years, the average appreciation in Toronto houses was 9 percent per year and Toronto condos didn’t do bad either at 7.5% per year. Of course, condos had a lot more volatility and the bulk of those returns were from a good run in appreciation over the past 5 years of 12% per year.

Condos require less cash upfront & less maintenance, so even though condos have higher price volatility, it’s can be a very decent investment with good long term appreciation.

Returns Breakdown For Toronto Houses

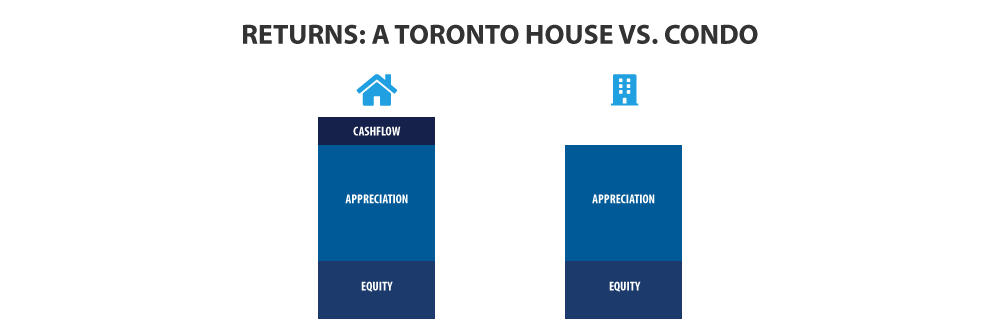

Here’s the difference between houses and condos and I’ll make my point with an example on $900,000 house. Houses at this price typically can get you $4,500 in monthly rent, so after expenses and your mortgage, you’re left with $800 at the end of each month or $9,600 each year. Part of the rent helps you build equity and this equals $16,700 in year one. If we go with a conservative appreciation at 5%, that still comes up to $45,000 a year. So, for a typical Toronto house, 37% of your returns come from rental income and 63% come from appreciation.

This means that even though freeholds still get the majority of returns from appreciation, they have a healthy balance of cash flows and appreciation. It’s kind of like investing in stocks – you don’t want to put all your eggs in one basket and diversifying between growth and dividends stocks, or even bonds if you are more conservative, will give you the best combination of higher returns and stability.

Returns Breakdown For Toronto Condos

Now let’s look at condos. For a $500,000 entry level condo, you can get $2,000 in rents pre-COVID, which leaves you with no cash flows at the end of each month. Your rental income still helps you build equity on your mortgage, which is $9,300 in year one. And at 5% appreciation, we’re looking at $25,000 of appreciation a year and the return split comes out to 27% from rental income & a heavier weight of 73% from appreciation for a condo vs. what we talked about before of 63% for houses.

Here’s the thing – if you invest in condos because that’s what you can afford plus you understand that no cash flows typically mean lower returns AND that you might have to pitch in to pay for carrying costs, then condos still give decent long term returns.

The issue happens when your expectations aren’t met and causes your investment to fall apart. So some condo investors might have expected double digit annual appreciation in condos because that was what was happening the past few years. This caused them to be less concerned about lower cash flows because the total returns would be similar to houses anyway. And they might not have fully understood the implications of not having cash flows. The thing is

If there’s a dip in rental income, basically what we are seeing now, condo investors are having a hard time hanging on and might be forced to sell.

Should You Sell Your Condo?

So if you’re asking whether you should sell your condo, it really comes down to your cash flow position. If you purchased your condo a few years back which means your mortgage is a lot less – you might not have a problem with cash flows, so you can choose not to sell and still hang onto your investment and benefit from appreciation in the long run.

But if you have enough capital to enter the freehold market, it’s might be an even better idea to move from condos to freeholds right now. This is because you’ve probably already gained from the amazing run in condos in the past few years. Right now, condos have lost their steam but they still have strong supports. So if you take profit from your condos now and redistribute your capital into a house instead, you’ll end up with better cash flows meaning a safer investment AND you’ll get higher, more stable long term appreciation compared to condos.

How We Can Help

Our team at Elevate specializes in freehold real estate investments and we can help you find the best opportunities on the market.

Just so you know, you’ll need at least $200,000 to get into the Toronto freehold market. And if you’re concerned about getting a higher mortgage approval, another heads up is that banks will add in expected rental income to your qualifying income, so you may qualify for more than you think.