This is for educational purposes only; it does not guarantee future performance or serve as financial or tax advice.

Toronto investors hear it all the time: “You can’t cash flow in Toronto anymore.” Rising prices, higher interest rates, and tighter lending have made many buyers assume positive cash flow is off the table unless major renovations are involved.

But that assumption isn’t always true. In early 2026, we reviewed a 3-unit property in Midtown Toronto that cash flows well without any renovations, offers strong house-hacking potential, and comes with a clear long-term value-add option. This is exactly the type of deal many investors overlook.

A Midtown Toronto 3-Unit Property That Cash Flows Day One

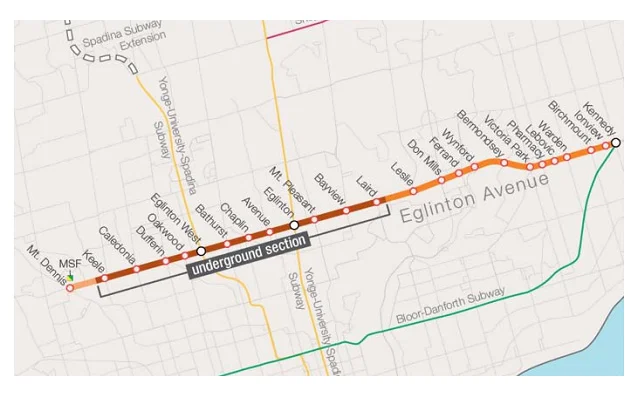

This 3-unit property sits near Eglinton and Dufferin, just minutes from the future Eglinton LRT. Location matters, especially for rental demand. Being within walking distance of rapid transit consistently attracts stronger tenants and supports long-term value.

The building includes three rentable units that can be leased as-is. There’s no forced renovation, no immediate capital outlay beyond the purchase, and no pressure to execute complex construction just to make the numbers work. For investors who value stability, that matters.

Why This Works for First-Time Investors and House Hackers

This deal is particularly well-suited for newer investors or owner-occupiers. The unit mix includes a renovated two-bedroom on the top floor, a one-bedroom on the main floor, and a larger one-bedroom basement unit.

An owner-occupant can live in the top unit and rent out the other two units immediately. With conservative rents of about $2,000 per unit, the rented units can generate close to $4,000 per month. At current interest rates in the high 3% range, that rental income offsets most of the mortgage.

In practical terms, this means living in a renovated two-bedroom unit for roughly $1,000 per month out of pocket, covering mainly expenses like insurance, utilities, and maintenance.

Strong Cash Flow Without Renovation Risk

What stands out about this property is that it works without needing renovations. Many investors underestimate how much risk renovations add, especially for first-time buyers.

If the entire property is rented out, cash flow increases meaningfully. With all three units leased, projected monthly cash flow can reach the $1,000 range, assuming a 20% down payment. That’s real rental income and cash flow without construction risk or delayed timelines.

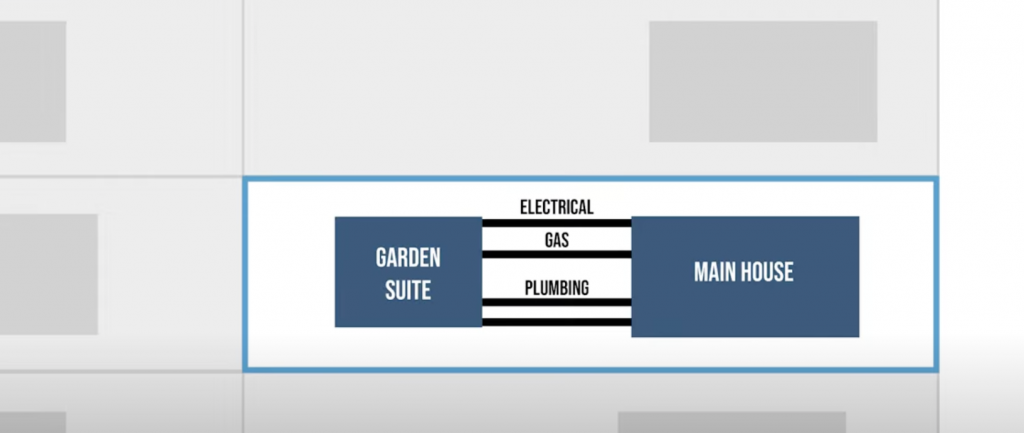

Built-In Upside: Garden Suite Potential

The real optionality comes from the backyard. The existing garage may be replaced in the future with a garden suite.

The key advantage is timing. Investors don’t need to build the garden suite immediately. They can stabilize the main property first, collect cash flow, and pursue the garden suite later when capital allows. This phased approach reduces risk and improves flexibility.

Transit, Infrastructure, and Long-Term Growth

Transit access is a major driver of long-term value in Toronto. Properties within roughly 800 metres of rapid transit historically outperform those without easy access.

This location benefits from multiple transit options, including the Eglinton LRT, nearby subway connections, GO Transit, and quick highway access. Similar infrastructure upgrades have historically supported long-term appreciation in comparable Toronto neighbourhoods.

Capital Requirements: Realistic and Achievable

For buyers using a 20% down payment, the capital requirements are relatively modest by Toronto standards. On a purchase price around $1,000,000, a buyer would need approximately $200,000 down plus land transfer tax and closing costs.

All-in, investors are looking at under $250,000 in upfront capital to acquire a turnkey, cash-flowing 3-unit property in Midtown Toronto. No renovation reserve is required to make the deal work, which lowers financial stress significantly.

How We Help Investors Navigate This Market

Toronto multi-unit properties can still cash flow if you focus on fundamentals. Location, unit mix, realistic rents, and manageable capital requirements matter more than chasing complexity.

If you’re buying or selling in Toronto and want help finding deals like this or evaluating whether your property fits a similar strategy, that’s where we come in.

Our brokerage specializes in Toronto multiplexes. We’ll help you find deals, crunch the numbers, and guide you through renovations and management. If you want full support in Toronto multiplex investing, our team can help you:

- Find high-potential properties

- Crunch the numbers so you know exactly where you stand

- Coach you through renovations to maximize returns

- Lock in great tenants

- Provide full property management so your investment runs smoothly

Book a strategy session with us here and let’s map out the smartest move for your portfolio.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!