This is for educational purposes only; it does not guarantee future performance or serve as financial or tax advice.

A lot of Toronto condo investors feel stuck right now. You bought with good intentions — maybe your first step into real estate, maybe a stepping stone to something bigger — but the math just doesn’t work anymore. Rents haven’t kept up, prices have softened, and your carrying costs keep creeping up.

Selling at a discount feels wrong. You worked hard for that down payment, and taking a loss feels like a step backward. But here’s the truth: holding out for the market to save you can hurt a lot more than biting the bullet now. Smart investors know when to cut, reposition, and scale up into stronger opportunities — and this market is one of those times.

When Holding On Starts Holding You Back

Your first property sets the tone for everything that comes next. If that first investment isn’t pulling its weight — bleeding cash each month — it can actually stall your portfolio’s growth.

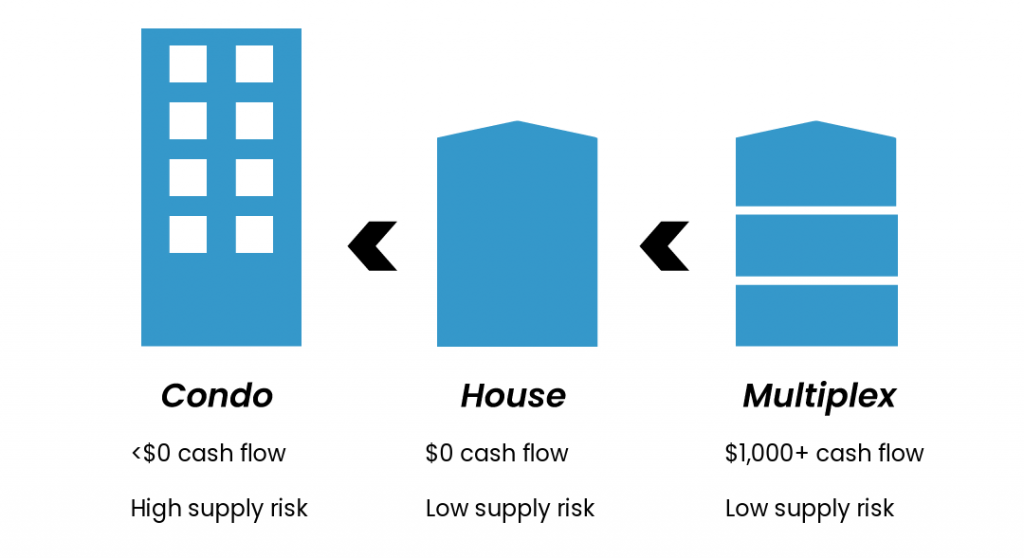

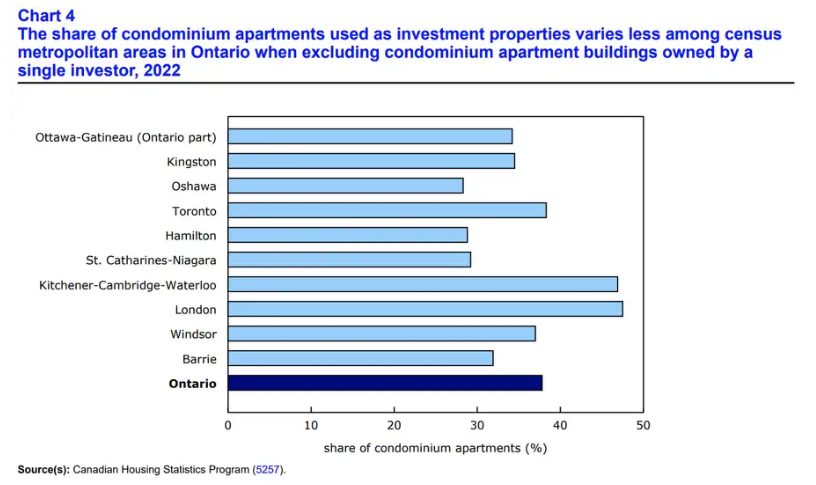

Condos, especially in Toronto, are mostly investor-driven. When investor confidence drops, that market softens first and recovers last. Negative cash flow eats away at your borrowing power because the banks view it as added risk. That means you qualify for less, even if you’re making good money personally. On the other hand, if your property generates income, that cash flow boosts your financing potential — making it easier to scale into your next deal.

Why Taking a Small Loss Can Pay Off Bigger

Selling at a loss isn’t failure — it’s strategy. The short-term pain of a lower sale price can set you up for a much stronger long-term position.

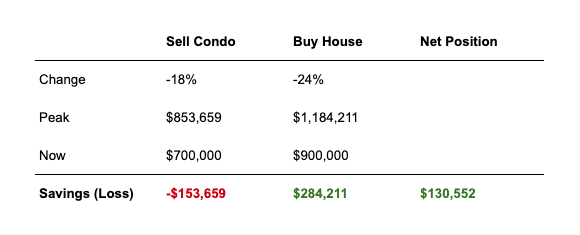

Let’s break it down. Say you sell your condo for $700,000 instead of the $750,000 you hoped for. After closing, you’ve got about $350,000 in cash to work with. You buy a $900,000 house and invest $150,000 to convert it into a multiplex. That property now cash flows around $2,000 a month instead of losing $350. On top of that, it’s worth roughly $1.2 million after renovations, giving you $150,000 in forced appreciation. And because the income is higher, you can refinance, pull out $240,000, and still cash flow.

Short-term hit? Sure. But long-term? You just turned a dead-end property into a cash-flowing machine that builds wealth every month.

Pricing Right and Selling Smart

Once you’ve decided to reposition, how you sell matters. Too many sellers overprice, adjust too late, and end up chasing the market down — never catching up. In today’s environment, that’s a recipe for frustration.

The right strategy means pricing competitively, prepping properly, and planning for vacant possession if the property’s tenanted. A well-presented unit with the right pricing gets traction faster — and every day it sits unsold costs you more. The goal isn’t just to sell — it’s to sell strategically so you can move on to a stronger asset that actually pays you back.

The Power of Repositioning

Repositioning isn’t giving up — it’s leveling up. Toronto’s multiplex market offers better cash flow, value-add potential, and long-term stability. While condos depend on market sentiment, multiplexes generate real income through multiple tenants and flexible unit options.

This isn’t about timing the market; it’s about making your money work harder. Every month you hold a negative cash-flow property is money you’re giving away — while those who reposition now are buying discounted multiplexes and locking in stronger returns.

Ready to Invest in Toronto Multiplexes?

Taking a small loss hurts, but staying stuck hurts more. The investors who move up now — even with a short-term hit — will come out stronger when the market rebounds. It’s not about being emotional, it’s about being strategic.

At Elevate Realty, we understand how tough these calls can be. That’s why we specialize in helping Toronto investors sell smarter and reinvest better. From analyzing the numbers to finding high-performing multiplexes, we help you make moves that actually grow your wealth.

Our brokerage specializes in Toronto multiplexes. We’ll help you find deals, crunch the numbers, and guide you through renovations and management. If you want full support in Toronto multiplex investing, our team can help you:

- Find high-potential properties

- Crunch the numbers so you know exactly where you stand

- Coach you through renovations to maximize returns

- Lock in great tenants

- Provide full property management so your investment runs smoothly

Book a strategy session with us here and let’s map out the smartest move for your portfolio.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!