This is for educational purposes only; it does not guarantee future performance or serve as financial or tax advice.

If you are still waiting for Toronto prices to “come back,” you are playing defence. The investors who are moving right now are increasing income instead of hoping for appreciation.

We recently walked through a two-storey garden suite under construction in the east end of Toronto. When finished, this one lot will generate over $9,000 per month in gross rent. No condo speculation. No guessing. Just better use of land.

Let’s break down how it works and what you need to know before you try this yourself.

Why Two-Storey Garden Suites Are a Game Changer in Toronto

This garden suite will be just under 1,200 square feet with three bedrooms and two full bathrooms. Two bedrooms upstairs, one on the main floor. Full kitchen. Full height second level.

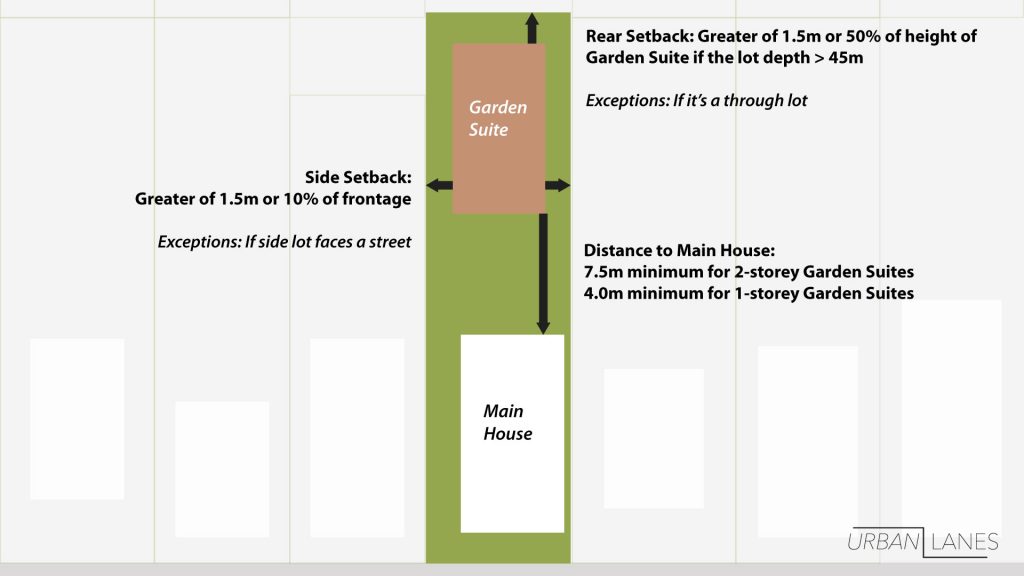

The key is separation distance. In this case, there are 7.5 metres between the main house and the garden suite. That spacing allows for a legal two-storey build. Previously, angular plane requirements reduced usable second-floor space. With flat roof allowances, you can now maximize vertical space more efficiently.

The takeaway is simple. You do not need the biggest lot on the street. You need enough depth, proper emergency access, and the right zoning. Vertical density is where the leverage is.

Avoiding underpinning by building in the backyard also keeps costs more predictable. For many investors, that risk control matters more than squeezing out every last square foot.

The Numbers: From $6,000 to $9,000+ Per Month on One Lot

The main bungalow on this property is already converted into two separate three-bedroom, two-bathroom units. That alone generates over $6,000 per month in rent.

The garden suite build cost is roughly $350,000. In starter Toronto neighbourhoods where houses still trade under $1 million, a unit like this can rent for around $3,000 per month depending on location and finish level.

That pushes total gross rent on one lot to over $9,000 per month.

Here is the important comparison. To buy a condo that rents for $3,000 per month, you might spend $600,000 or more. Here, you are creating similar rent for roughly $350,000 in build cost. That is how you improve yield without chasing appreciation.

Appraisals, Value-Add Lift, and Realistic Expectations

Let’s stay conservative. In many starter neighbourhoods, banks are cautious. There are not yet a lot of comparable sales with garden suites. Appraisals may come in around build cost, valuing the suite between $350,000 and $400,000.

In stronger downtown rental markets, some garden suites are being valued closer to $600,000. But those lots often cost closer to $1.5 million to acquire. That means more capital up front.

Assume you invest $350,000 using cash or a HELOC. Once built and stabilized, say it appraises at cost. You refinance at 80 percent loan to value.

You may be able to pull out about 80 percent of your capital. That leaves roughly $70,000 still invested in the project.

And you are generating roughly $36,000 per year in additional rent from the garden suite alone.

That is a serious return on remaining capital, even without big lift or speculative price growth. In a couple of years, that remaining $70,000 can effectively be recovered through cash flow.

Tree Protection, Services, and Other Real-World Constraints

Not every lot works. That is where many investors get burned.

Healthy trees are protected in Toronto. Even if there are no trees directly on your lot, neighbouring roots can affect foundation design. In this project, part of the structure had to be built on helical piles to avoid disturbing tree roots.

That adds complexity. If you do not underwrite it properly, your budget can blow up.

Another key rule. Garden suites must remain connected to the main house. All services, including plumbing, drains, hydro, and gas, are tied into the primary dwelling. You cannot sever the lot and sell the garden suite separately.

This is a long-term income strategy. Not a quick flip.

Due diligence on lot depth, access, tree protection zones, servicing capacity, and zoning is what separates real investors from gamblers.

Smart Density Beats Market Timing

In this market, hoping for appreciation is lazy strategy.

Increasing income through smart density is disciplined strategy.

Stacking a duplex in the main house plus a garden suite in the backyard turns one property into a small multiplex. That improves cash flow, stabilizes risk, and gives you optionality in any rate environment.

The opportunity in Toronto right now is not timing the bottom. It is maximizing land you already control or acquiring properties where that potential exists.

Your Next Toronto Real Estate Investment Move

The key takeaway is simple. A well-selected Toronto property with garden suite potential can generate condo-level rent at a fraction of condo pricing, while dramatically improving cash flow and long-term resilience.

If you want help identifying lots that actually qualify, running conservative numbers, and planning a realistic build strategy, we can guide you through it. Not every property works. Strategy and underwriting matter.

Our brokerage specializes in Toronto multiplexes. We’ll help you find deals, crunch the numbers, and guide you through renovations and management. If you want full support in Toronto multiplex investing, our team can help you:

- Find high-potential properties

- Crunch the numbers so you know exactly where you stand

- Coach you through renovations to maximize returns

- Lock in great tenants

- Provide full property management so your investment runs smoothly

Book a strategy session with us here and let’s map out the smartest move for your portfolio.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!