Do you have questions about Toronto income properties? You’ve come to the right spot! We’ve curated a set of statements from frequently asked questions (FAQs) from new real estate investors looking to invest in Toronto.

- Myth 1: Toronto’s income properties are way too expensive.

- Myth 2: Toronto strong appreciation days are over.

- Myth 3: Investing in old houses is a bad idea.

- Myth 4: Nicer Toronto neighbourhoods have better appreciation.

- Myth 5: Toronto income properties don’t cash flow.

Join us as we address common myths and steer you towards making informed decisions in the dynamic world of Toronto real estate investing.

Myth 1: Toronto’s income properties are way too expensive.

It’s true that Toronto real estate is pricier than in other parts of Canada, but the good news is it might not be as expensive as you imagine.

With recent rate hikes, real estate prices have actually dropped quite a bit.

Many of the rental houses our clients are eyeing can be bought for less than $1 million. These homes are often found in areas where renting is more common, which means they come with a lower end-user premium.

Despite the lower prices, rental rates remain pretty consistent across different neighbourhoods in Toronto. So, if you invest in these budget-friendly Toronto income properties, you could end up with better rent yields.

And here’s a smart move: Consider a Toronto income property in the early stages of gentrification. These areas might see a bigger increase in property value compared to places already well-established in Toronto.

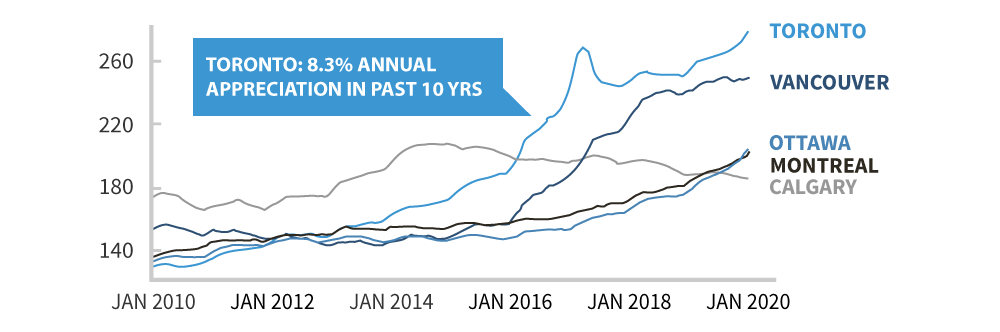

Myth 2: Toronto’s strong appreciation days are over.

Toronto’s real estate has been a standout performer, and we’re confident this trend will continue, despite worries about affordability shifting growth elsewhere in Canada.

With Canada aiming for more immigrants, the demand for homes is going up all over, but it’s hitting Toronto particularly hard. The city is always a hot spot because it’s close to a wide variety of jobs, entertainment, and has a buzzing lifestyle – and that won’t change anytime soon.

But here’s the thing – it’s not just about not building houses fast enough in Toronto. The real headache is that there’s no new land available for building more homes. Without more land, fixing the housing shortage becomes way trickier.

So, Toronto’s housing challenge boils down to high demand, a backlog of new homes that can’t be created as quickly as the demand grows, and a lack of land for new homes to be built.

It’s a tough spot, bu that’s precisely why Toronto’s home values will hold a lot better than other cities in Canada.

What's Happening In Toronto's Real Estate Market?

Want to know what’s been going on in Toronto’s real estate scene lately? Curious about where the market is heading? Our expert insights have you covered!

Myth 3: Investing in old houses is a bad idea.

Old houses can be a solid income property in Toronto because they’ve been around for a while, making them potentially more structurally sound than newer builds.

When you buy an older house, you’re paying more for the land and less for the building, reducing the depreciation loss and increasing the potential for growth. Plus, owning land gives you options for future development, like adding a backyard house or converting it into more units for extra income.

Sure, older homes might need more maintenance, but if you renovate and upgrade, they can stay in good shape for a long time.

On the flip side, it’s true that condos are less work since the condo management takes care of many things (for a hefty fee).

However, if you prefer a more hands-off approach with a house, you can hire property management services like ours. Even with the extra fees, Toronto income properties with multiple units can bring in better cash flows and rental income than Toronto condos.

Myth 4: Nicer Toronto neighbourhoods Have better appreciation.

Choosing a mature and highly desirable location is a strategic move for consistent Toronto income property value growth. However, it’s important to note that rent yields may not be as lucrative initially due to the higher end-user premium paid for such sought-after areas.

On the flip side, steering clear of underdeveloped areas is advisable as they typically experience slower increases in property value. The uncertainty about when these areas will develop and become desirable can be a drawback for Toronto income properties.

Our preferred sweet spot for Toronto income properties lies in areas undergoing gentrification. These locations offer a balance – they are still affordable, boast strong rent yields, and have a higher potential for property value growth during the transition. It’s worth considering that the gentrification stage may come with construction, uncertainty, and changes to the surroundings, but the trade-off is the potential for better returns.

Post-gentrification, these areas usually stabilize with property value increases comparable to more established neighbourhoods, making them a compelling Toronto income property choice.

Myth 5: Toronto income properties don’t cash flow.

While Toronto condos definitely cash flow very negative these days, investing in Toronto multi-unit income properties presents a compelling opportunity for substantial returns.

Having more than one unit in a house can make your rental income much higher, giving you a better chance at making more money.

Toronto stands out because of its housing crisis, making it easier to add extra units here than in other cities in Ontario. If you’re thinking about investing in a triplex or a backyard house, Toronto’s cash flows can look pretty amazing and outperform many other parts of Canada.

How We Can Help

Now that we’ve debunked these myths, it’s clear that Toronto’s real estate investing landscape offers more opportunities than some might believe.

Ready to learn more about Toronto’s best investment property opportunities on the market? We can share our best insights to help you make smarter Toronto real estate investing decisions.

Don’t let myths stop you – let’s connect and make your Toronto income property goals a reality!