This is for educational purposes only; it does not guarantee future performance or serve as financial or tax advice.

If you own a Toronto condo or townhouse that is losing money every month, waiting for the market to save you is one of the riskiest moves you can make right now.

A lot of investors are stuck here. You bought with good intentions. Maybe it was your first investment. Maybe it was meant to be a stepping stone. But today, the math no longer works, and holding on is quietly doing more damage than you realize.

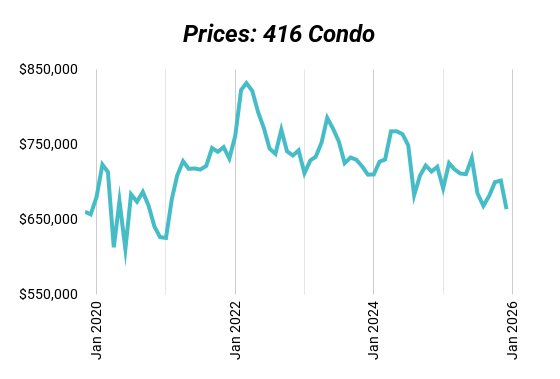

Toronto prices are still well off their peak, interest rates remain meaningfully higher than a few years ago, and what used to be “slightly negative” cash flow is now bleeding much harder. With no appreciation to justify the pain, hope has become the strategy. And hope is not a plan.

Why Negative Cash Flow Is a Bigger Problem Than Most Investors Admit

Selling at a discount feels wrong. You worked hard for that down payment, and taking a loss feels like moving backward. But holding a negative cash-flow property and hoping appreciation bails you out can do far more long-term damage.

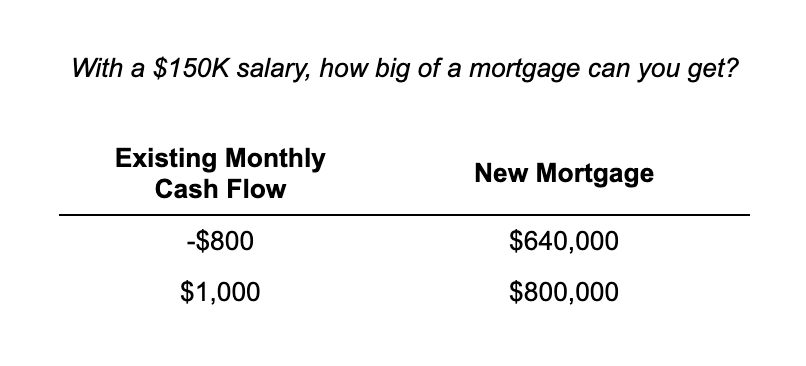

Your first investment sets the tone for everything that comes next. If that property cannot carry itself, it becomes an anchor. Banks do not lend based on effort or intent. They lend based on income. Deeply negative cash flow reduces your borrowing power and limits your ability to scale.

Income-producing properties do the opposite. They strengthen your balance sheet, improve debt coverage, and give lenders confidence. This is why portfolio growth stalls for many investors even when they “own real estate.”

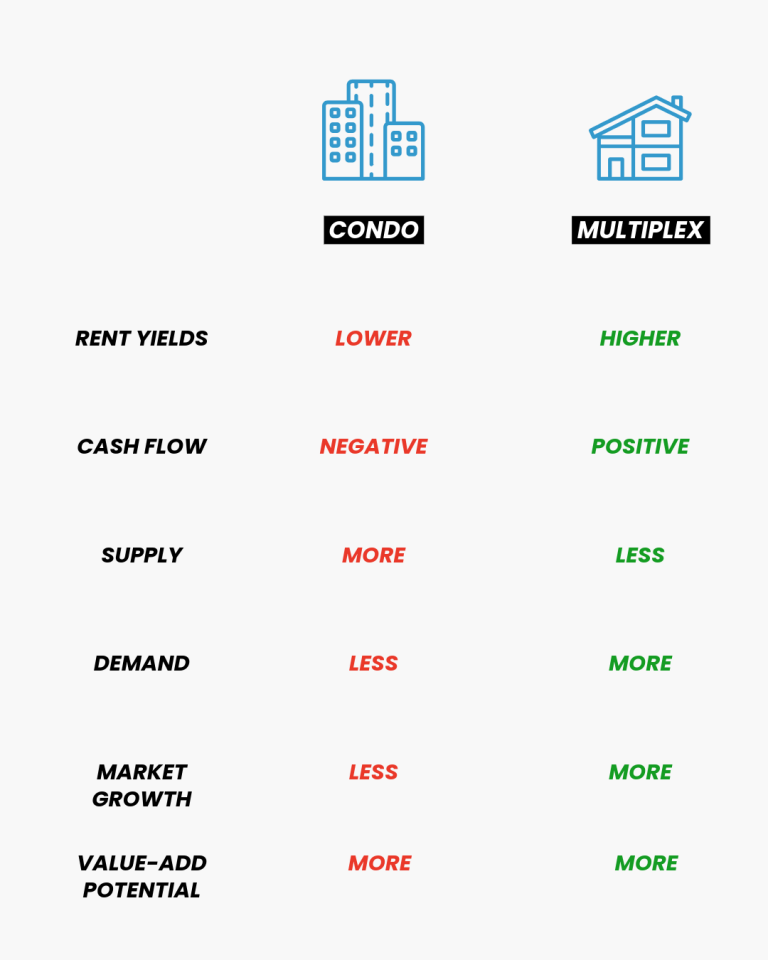

Why Toronto Multiplexes Behave Differently

Toronto multiplexes are driven by income, not speculation. That difference matters. Even near peak interest rates, many well-bought multiplexes continued to cash flow while condos struggled.

Now that rates have come down from their highs, these properties are cash flowing better than they have in years. Rents are resilient, demand remains strong, and income is doing the heavy lifting instead of appreciation.

This is why experienced investors focus on assets where returns are more controllable. When income drives value, you are less dependent on market timing and price swings.

Repositioning Today Is Lower Risk Than It Looks

Repositioning does not mean gambling on a rebound. In fact, it can be lower risk than holding on. Toronto prices are already down roughly thirty percent from peak levels, which limits downside risk compared to parking capital in assets sitting near all-time highs.

That is why many investors are shifting capital back into real estate this year for principal protection. The goal is not fast appreciation. The goal is stability, income, and optionality.

There are also practical cost and tax considerations. Selling an investment property at a loss can create a capital loss that may be used to offset other investment gains now or in the future. Buying at a lower price also reduces land transfer tax. This is not tax advice. Talk to your accountant before making decisions.

A Simple Toronto Repositioning Example

Let’s walk through a real-world scenario. Say you sell a condo and walk away with roughly $300,000 in usable equity.

In today’s market, that capital can buy a turnkey three-unit property for around $1 million in Midtown Toronto. With light renovations to improve rents, that property can cash flow around $1,700 per month.

If you prefer less upfront work, you could rent it as-is on day one at slightly lower rents and still generate roughly $1,000 per month in cash flow. Either way, the key difference is this: the property is no longer bleeding.

That breathing room matters. With time and savings, you could later add a garden suite by converting an existing garage, potentially adding another $2,100 per month in income. Strong cash flow today, even stronger with value-add work tomorrow.

Why Cash Flow Unlocks Long-Term Growth

Cash flow buys you options. It allows you to save, refinance, and reinvest. It strengthens borrowing power and creates more paths to scale.

This is the real advantage of repositioning. Not timing the market. Not betting on appreciation. Making your money work harder with assets that support you instead of draining you.

Repositioning is about upgrading your portfolio quality. Stronger income, more stability, and better long-term upside.

Key Takeaway for Toronto Investors

Holding a negative cash-flow property and hoping appreciation saves you is often riskier than making a tough move. Income-driven assets give you control, stability, and room to grow.

This is where our team comes in. We are not just a sales brokerage. We are Toronto multiplex investors ourselves, and we help investors reposition capital intelligently, based on numbers, not hype.

Our brokerage specializes in Toronto multiplexes. We’ll help you find deals, crunch the numbers, and guide you through renovations and management. If you want full support in Toronto multiplex investing, our team can help you:

- Find high-potential properties

- Crunch the numbers so you know exactly where you stand

- Coach you through renovations to maximize returns

- Lock in great tenants

- Provide full property management so your investment runs smoothly

Book a strategy session with us here and let’s map out the smartest move for your portfolio.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!