This is for educational purposes only; it does not guarantee future performance or serve as financial or tax advice.

Lately, there’s been a lot of hype around CMHC’s MLI program. On paper, it sounds like the ultimate financing tool for real estate investors: you can borrow more, stretch amortizations, and qualify based on rental income instead of your own. It gets pitched as the “golden ticket” for scaling.

But here’s what most people don’t realize: MLI isn’t always the smartest path. For many Toronto investors, chasing MLI can add unnecessary cost, complexity, and delays — especially when there’s a strategy that’s faster, safer, and gets you cash flowing much sooner. That strategy is multiplex conversions.

Why Smaller Multiplex Conversions Are Gaining Traction

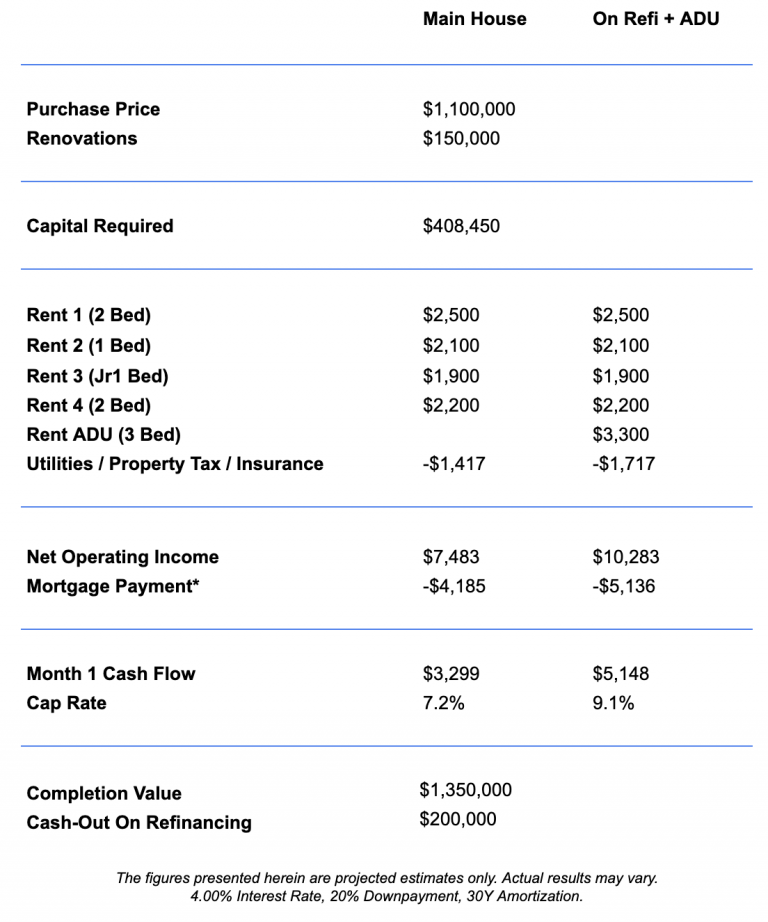

Instead of building brand new fiveplexes from scratch, smart investors are converting single-family homes into triplexes or duplexes into fourplexes. Add in an ADU like a laneway or garden suite, and the numbers get even stronger.

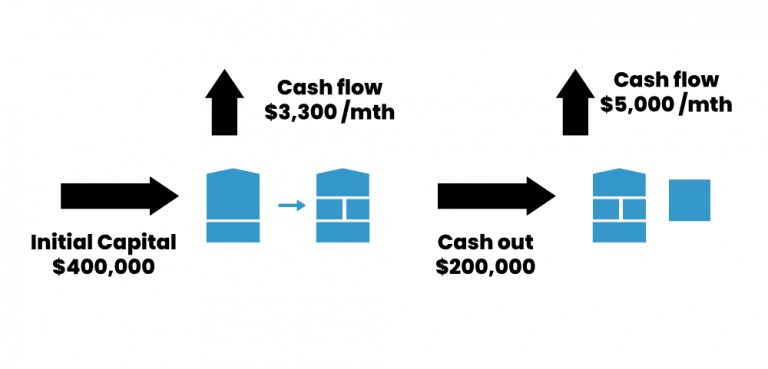

These conversions stand out because they’re far more accessible. A ground-up build can easily demand over $1M before you see a dollar of rent. A conversion, on the other hand, can be done with around $400K in total capital (downpayment plus renovation).

That’s enough to convert a duplex into four units, get tenants in place, and start generating positive cash flow — then roll that equity into building the ADU. And right now, the city isn’t charging development fees for multiplex conversions or ADUs, which keeps costs even lower.

Faster Approvals and Quicker Cash Flow

Speed is a huge advantage of conversions. Because you’re working with an existing structure, approvals are faster and construction is more straightforward. That means you can often get the main house rented in just a few months. Cash flow starts coming in while you’re still finishing the rest of the project.

By the end of the year, the ADU is done and occupied. Compare that with a new build: more moving parts, higher risk, and much more costly mistakes if something goes wrong. Conversions keep your money working for you instead of sitting idle.

Rental Income That Drives Refinancing

A duplex might cover your mortgage, but a fourplex plus a laneway suite can push stabilized rents to $12,000+ per month. That kind of rent gives you leverage for refinancing.

With MLI, lenders advertise that you can borrow up to 95% of the completed value. But the reality is that construction takeouts are capped at 100% of project costs. If your project costs $1.6M, that’s your ceiling — no matter if the market says it’s worth more. Add to that months of waiting for CMHC, consultant fees, and extra requirements, and your financing strategy starts to look a lot less appealing.

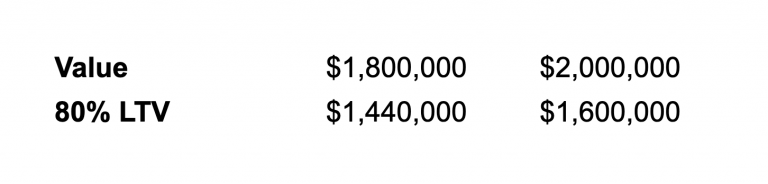

Residential refinancing is simpler and often just as effective. Conservative valuations on conversions in Toronto are around $1.8M, meaning you can refinance at 80% loan-to-value and pull out about $1.44M. If values are closer to $2M, you’re at $1.6M — the same as MLI, but without the red tape. The path is clean, predictable, and much faster.

The Bottom Line on Conversions vs. MLI

For investors looking to grow in Toronto right now, smaller multiplex conversions are one of the strongest plays. Lower capital requirements, quicker timelines, strong rental income, and simpler refinancing make them a strategy that delivers both stability and scalability.

The Smart Play in Toronto Multiplexes

Multiplex conversions give Toronto investors a faster, more reliable path to strong cash flow than chasing CMHC MLI. You don’t need to wait on approvals or gamble on consultants — just focus on smart conversions, solid rents, and strong market comps.

We’ve done this in our own portfolio and guided hundreds of clients through the same process. If you’re serious about investing in Toronto, our team can help you identify the right properties, crunch the numbers, plan renovations, and manage the entire process so you can focus on building wealth.

Our brokerage specializes in Toronto multiplexes. We’ll help you find deals, crunch the numbers, and guide you through renovations and management. If you want full support in Toronto multiplex investing, our team can help you:

- Find high-potential properties

- Crunch the numbers so you know exactly where you stand

- Coach you through renovations to maximize returns

- Lock in great tenants

- Provide full property management so your investment runs smoothly

Want to see what’s possible for you? Book a strategy session with us here.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!