This is for educational purposes only; it does not guarantee future performance or serve as financial or tax advice.

Toronto investors often assume the best real estate opportunities are in large apartment buildings or shiny new condo projects. But in today’s market, the smartest money is flowing into smaller multiplex properties — duplexes and triplexes.

These properties require less upfront capital, carry lower risk, and often deliver better risk-adjusted returns. The key decision many investors face is whether to go after a duplex or a triplex. Both offer strong upside, but they perform differently depending on your goals, tax strategy, and appetite for stability versus appreciation.

Toronto Duplex Conversions: The Capital Gains Strategy

Duplexes are typically the go-to option for investors chasing bigger after-tax profits. You’re buying a property that needs work, renovating strategically, and selling or refinancing for a significant lift in value.

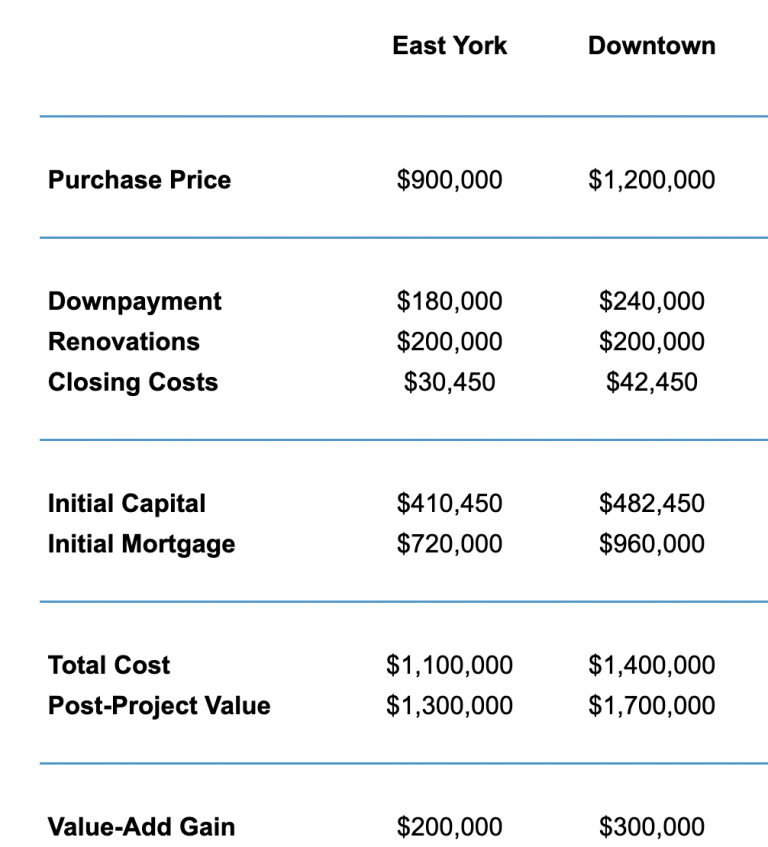

For example, a tired East York property bought for $900K and renovated with $200K can resell around $1.3M — that’s a $200K gain. In more established downtown neighbourhoods, you could buy around $1.2M, renovate, and see comparable properties trading closer to $1.7M. That kind of upside is hard to match with other property types.

Another advantage of duplexes is the tax treatment. Profits from a sale are treated as capital gains, and only half of that gain is taxable if it’s a long-term investment. Compare this to rental income, which gets fully taxed like your salary, and you see why duplexes are attractive for higher-income investors looking to keep more of their returns.

The trade-off is holding power. While duplexes often still cash flow positive, the margins are thinner. If interest rates rise or a big repair comes up, you’ll have less cushion than with a triplex.

Toronto Triplex Conversions: The Cash Flow and Stability Play

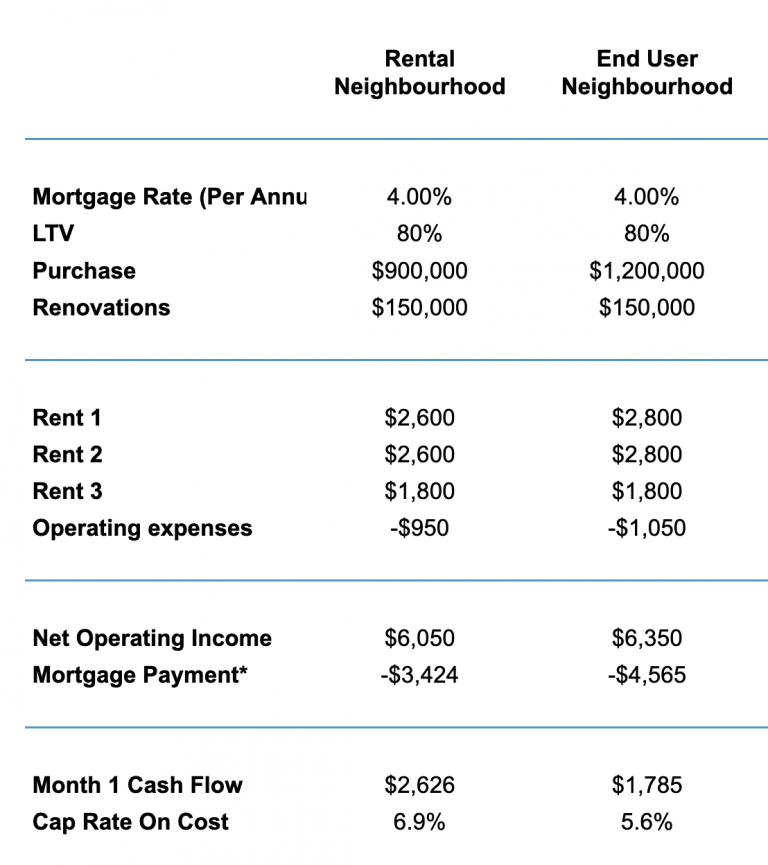

Triplexes are designed for investors who value steady income and stronger holding power. With three rental units instead of two, your property generates more rent, covering a higher share of your expenses. This makes it easier to ride out market fluctuations and financing changes without stress.

You may not see the same six-figure lift as a duplex, but triplexes provide reliable monthly rent cheques and long-term appreciation. For investors who want less risk and more predictability, the triplex is often the smarter choice. Rental-heavy neighbourhoods are the best fit here, where tenant demand is consistent and property values hold strong even in softer markets.

Which Strategy Fits You Best?

If your goal is maximizing upside and leveraging tax-efficient gains, duplexes in family-friendly or downtown neighbourhoods may be your best move. End-user buyers, especially families, are willing to pay more for homes with basement units — whether for in-laws, a nanny suite, or extra income to qualify for a larger mortgage. That demand can significantly boost your resale value.

If your goal is steady returns and less exposure to risk, triplexes are the safer option. These properties let you hold comfortably through market cycles, relying on consistent rent instead of betting on big appreciation.

Both approaches are strong — the right choice depends on your personal strategy and financial comfort level.

How We Can Help

Smaller multiplex conversions — duplexes, triplexes, even fourplexes — are some of the best opportunities in Toronto real estate today. They combine cash flow, value lift, and long-term appreciation, all with lower upfront capital than larger projects.

You don’t need to know how to find these opportunities or where to start. That’s where we come in. At Elevate Realty, we don’t just show listings — we act as your advisor, planner, and coach. We’ll walk you through the process from acquisition to management so you can invest with confidence.

Our brokerage specializes in Toronto multiplexes. We’ll help you find deals, crunch the numbers, and guide you through renovations and management.

If you want full support in Toronto multiplex investing, our team can help you:

- Find high-potential properties

- Crunch the numbers so you know exactly where you stand

- Coach you through renovations to maximize returns

- Lock in great tenants

- Provide full property management so your investment runs smoothly

Want to see what’s possible for you? Book a strategy session with us here.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!