This is for educational purposes only; it does not guarantee future performance or serve as financial or tax advice.

The problem with data is that it can tell two completely different stories at the same time. One headline screams “market crash,” another says “market boom.” Both numbers are technically real, but if you take them at face value, you’re setting yourself up for bad decisions.

Why Real Estate Data Often Misleads Investors

The Lag Problem: Why You’re Already Behind

Real estate data isn’t fake, but it’s rarely up to date. Toronto sales numbers lag by a month, inflation data by six weeks, and GDP by entire quarters. By the time you’re reacting to those numbers, the market has already moved on.

The Snapshot Problem: Base Effects and Headlines

Ever notice how a single month can create a dramatic story? Prices down 5% sounds like a crash — until you zoom out and see Toronto’s prices have bounced around the same average since 2022. One snapshot doesn’t tell you the trend. It just fuels headlines.

Why Sales-to-New-Listings Ratio Isn’t Foolproof

Analysts often point to the sales-to-new-listings ratio (SNLR) to determine buyer vs. seller markets. But this too can distort reality. For example, in December many sellers pull listings for the holidays, so only the most motivated remain. That pushes the ratio higher, making the market look hotter than it really is.

What Smart Toronto Investors Actually Focus On

Data should support your strategy — not drive it. The investors making money right now in Toronto are focused on what they can control:

- Strong rental income that covers costs and provides cash flow

- Value-add renovations that lift property value beyond reno costs

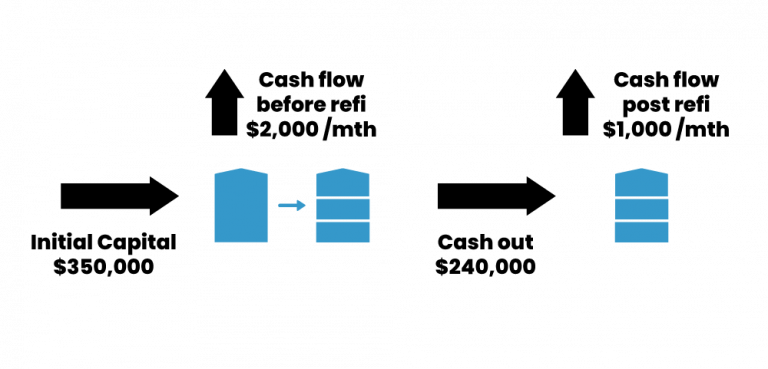

- Refinance strategies that recycle capital into the next project

Why Toronto’s Fundamentals Still Win

Here’s the part no data point can replace: Toronto’s fundamentals. There’s no new land for houses, demand is steady, and jobs are concentrated here.

That’s why the Ontario government is forcing density in Toronto more than anywhere else. The city’s long-term outlook is driven by real supply and demand, not monthly headlines.

The Multiplex Strategy That Works in Any Market

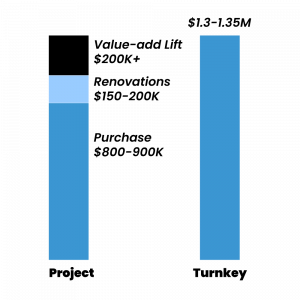

Our focus? Turning single-family homes into multiplexes. The math is compelling:

- A $150,000 renovation can turn a $400,000 fixer-upper discount into a triplex cash flowing $2,000/month.

- Add a garden suite after you refinance, and you’re looking at $4,000/month in cash flow.

- Even after refinancing again, you can stay cash flow positive $3,000/month.

This is how you create wealth in Toronto real estate — not by chasing every headline, but by creating value.

Investor Takeaway

Don’t hang your strategy on one data point. Smart investors buy at discounts, build cash flow, and take advantage of Toronto’s fundamentals. Multiplex investing turns the noise of misleading data into a clear path to long-term wealth.

Ready to invest smarter? Our brokerage specializes in Toronto multiplexes. We’ll help you find deals, crunch the numbers, and guide you through renovations and management.

Want to see what’s possible for you? Book a strategy session with us here.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!