This is for educational purposes only; it does not guarantee future performance or serve as financial or tax advice.

Toronto’s 2025 Market Recap for Investors: Why the Numbers Finally Make Sense Again

The Toronto real estate market has shifted — and this time, the shift actually helps long-term investors. After three tough years of high rates and slower sales, the numbers have finally swung back in favour of people who buy for income, stability, and control rather than speculation. Prices are more reasonable, borrowing costs are easing, and cash flow has made a real comeback.

If you’ve been waiting for the market to make sense again, this is it. The emotional bidding wars are gone. The froth from the COVID boom has washed out. And for the first time in years, investors who care about fundamentals finally have leverage again. This recap breaks down exactly what changed and why today’s environment is one of the best we’ve seen since before the pandemic.

Toronto Home Prices in 2025: What Actually Changed

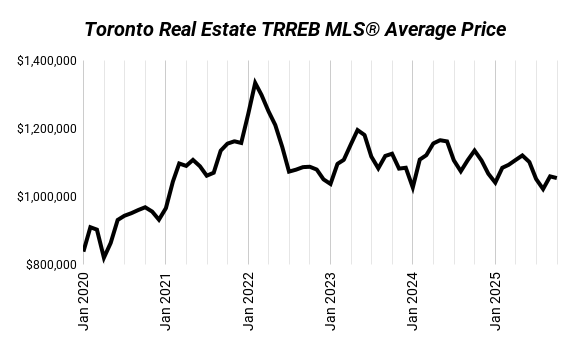

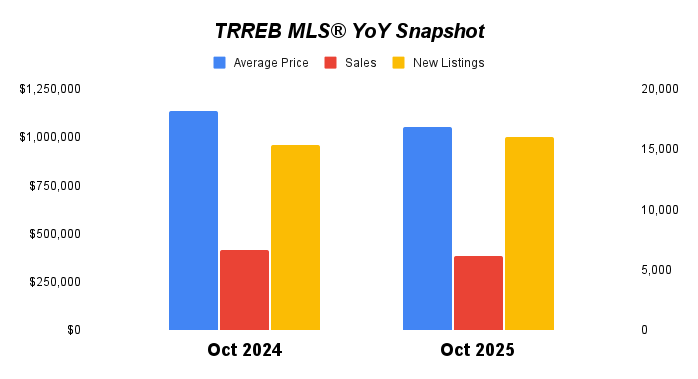

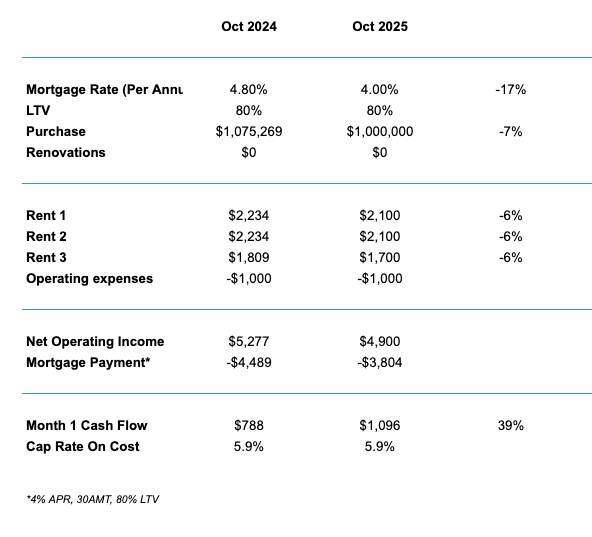

Toronto’s average home price sits just over $1 million as of October 2025 — about 7% lower than last year. That drop may not sound dramatic, but it’s exactly what the market needed. Overheated values have corrected, sellers are more flexible, and buyers have room to negotiate again.

This slowdown wiped out the speculative pricing that propped up the market through the pandemic. Homes that would have sparked bidding wars two years ago are now sitting long enough for investors to make rational, numbers-driven offers. You’re no longer competing with ten people throwing money at a listing — and that alone has brought sanity back to the market.

Even more important: today’s prices aren’t inflated by cheap 2020–2021 mortgage rates. These values are grounded in actual affordability. And that makes the long-term upside far more reliable.

Toronto Rent Trends: The Dip, the Flattening, and the Opportunity

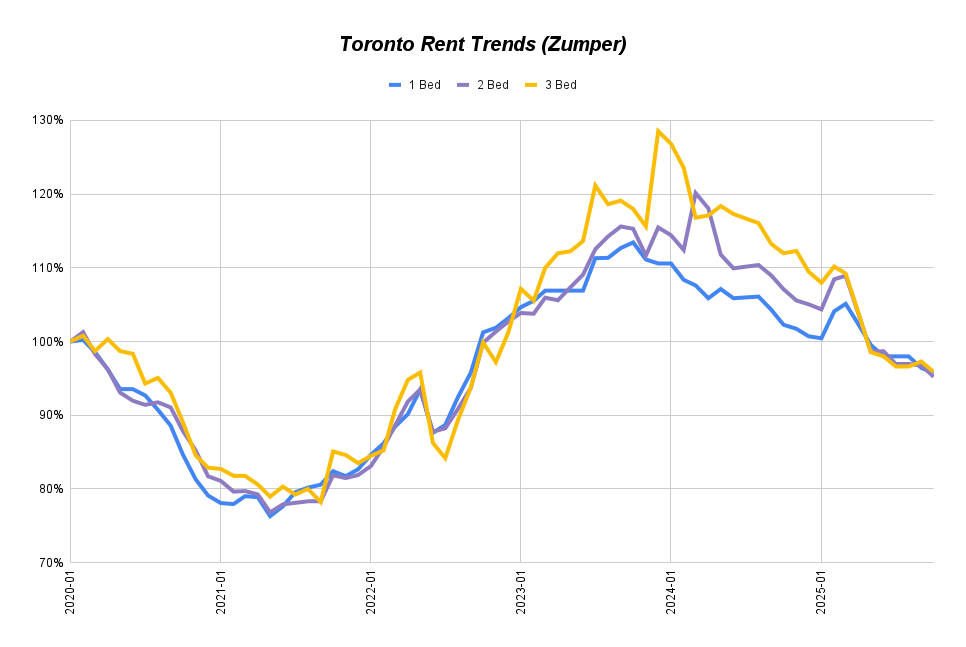

Rents dropped about 6% year-over-year, but the steep declines from early 2025 have levelled off. A typical 1-bedroom now rents for around $2,100, and that number hasn’t moved for months.

The headline?

The correction is over. Rents have stabilized.

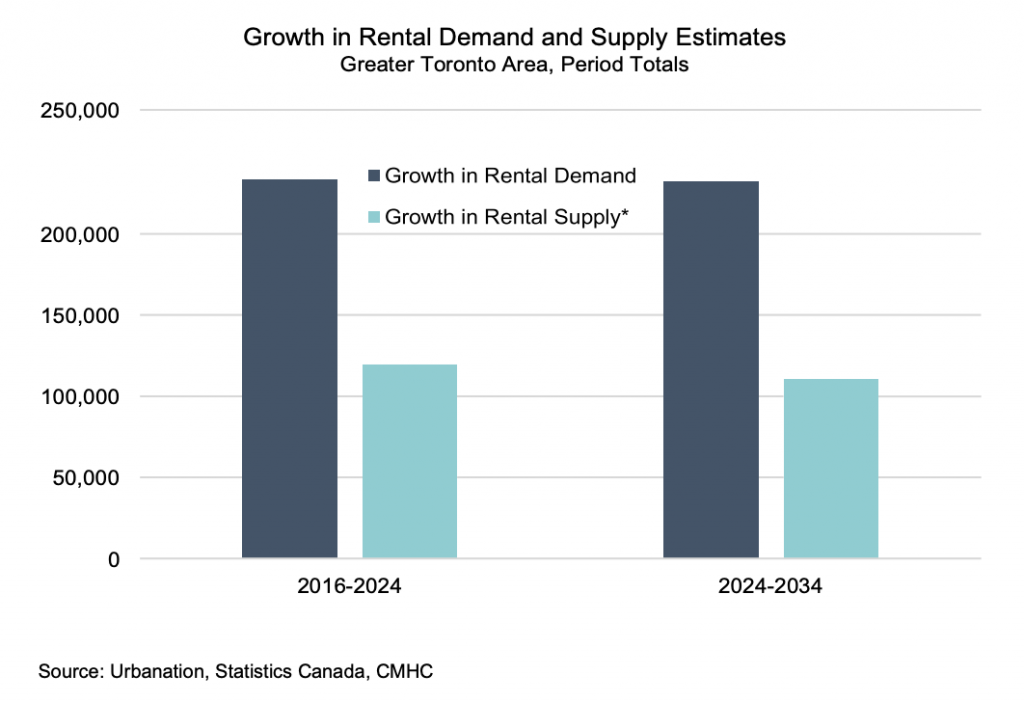

Short-term softness came from new completions flooding the market — not from demand slowing — which means the long-term fundamentals are still strong. Toronto’s renter base continues to grow, and roughly 48% of residents already rent. Add in the projected 230,000 new renter households coming to the GTA over the next decade, and the city simply cannot build fast enough to keep up.

With stability returning to rents and the demand gap widening again, investors are stepping back in — especially those focused on multi-unit income properties.

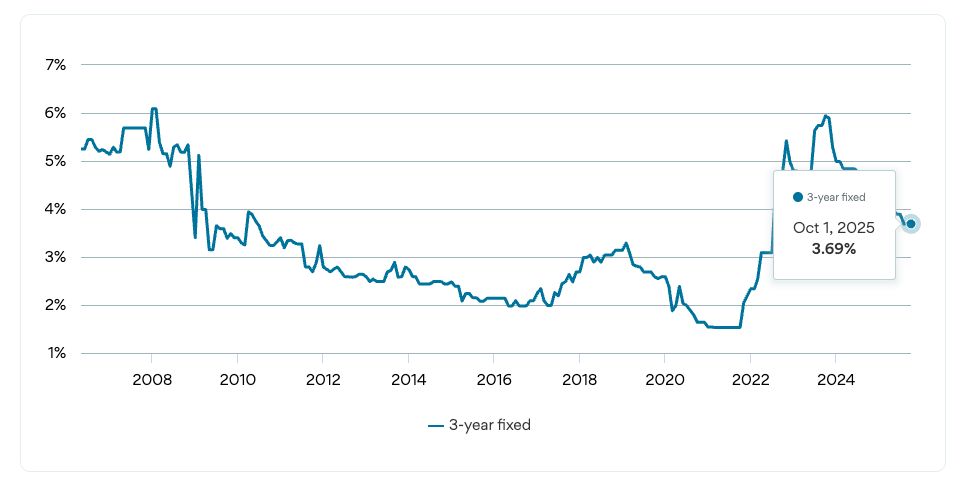

Mortgage Rates Are Finally Helping, Not Hurting

The 3-year fixed rate has fallen 17% in borrowing cost, and it matters. Lower rates improve cash flow, boost qualification power, and make value-add projects far more profitable.

And this isn’t a temporary dip — lenders have been steadily pricing in lower long-term risk as inflation cools. As financing costs ease, more deals pencil out without cutting corners or relying on aggressive rent increases.

The bottom line: Financing is no longer fighting you. It’s finally working with you.

Cash Flow Is Back: Multiplex Performance Jumped 40%

This is the biggest win for Toronto investors.

Multiplex cash flow is up 40% year-over-year thanks to:

- Lower prices

- Lower mortgage rates

- Stable rent demand

- Better zoning that allows more units

That combination hasn’t existed since before the pandemic. Properties that were borderline or negative cash flow in 2023 and 2024 are now performing again — and investors who understand the math are buying quietly while the rest of the market waits for headlines.

If you’re looking for real stability, real control, and real return — multiplexes are where the numbers are actually working right now.

Toronto’s New Density Rules: The Missing Middle Advantage

The biggest long-term opportunity doesn’t come from prices or rates — it comes from zoning.

Toronto has quietly opened the door to real density:

- Legal basement apartments

- Laneway suites

- Garden suites

- Up to four units city-wide

- Sixplexes as-of-right in nine wards

- Up to 60 units along Major Streets

- Retail now allowed inside some residential zones

These changes let investors create value, not wait for the market to hand it to them. And that’s why multiplex investing works so well in this cycle. You can add units, boost rents, increase property value, and refinance sooner — all without relying on appreciation.

Toronto is finally rewarding density, and the investors who understand conversions and construction are pulling ahead fast.

Turnkey vs. Value-Add: What Actually Works in 2025

If you want something turnkey, you’ll need around $300K in capital and a $200K household income to qualify. You’ll land a triplex that cash flows around $500/month on day one.

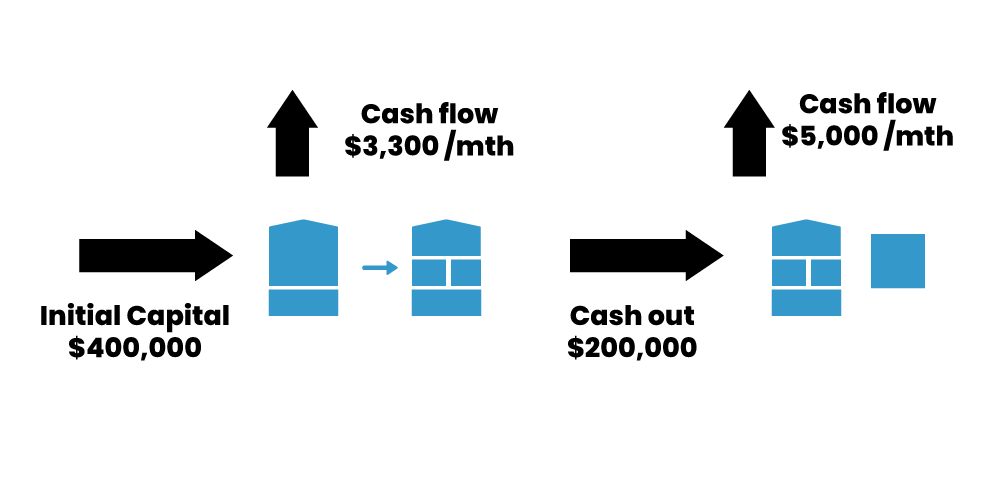

But if you want real lift, the value-add path is unmatched.

Example: Buy a fixer-upper at $900K, spend $200K on a full triplex conversion, and it ends up worth $1.3M. That’s:

- +$200K instant equity

- $2,000+/month cash flow

- A refinance that returns most of your capital

This is exactly why the Missing Middle strategy is so powerful right now. It’s not about buying and hoping — it’s about controlling the value yourself.

Your Next Step Starts With the Right Strategy

If there’s one takeaway from 2025, it’s this: the market finally rewards fundamentals again. Prices are down, rents are stable, financing is cheaper, and the city is encouraging density instead of blocking it. This is exactly the environment real investors want — one where patience, planning, and strong numbers actually win.

If you want support figuring out where you stand, what you can qualify for, and what kind of multiplex strategy makes sense for you, we’re here to help. We use the exact same playbook we apply to our own portfolio, and we guide you through every step.

At Elevate Realty, we understand how tough these calls can be. That’s why we specialize in helping Toronto investors sell smarter and reinvest better. From analyzing the numbers to finding high-performing multiplexes, we help you make moves that actually grow your wealth.

Our brokerage specializes in Toronto multiplexes. We’ll help you find deals, crunch the numbers, and guide you through renovations and management. If you want full support in Toronto multiplex investing, our team can help you:

- Find high-potential properties

- Crunch the numbers so you know exactly where you stand

- Coach you through renovations to maximize returns

- Lock in great tenants

- Provide full property management so your investment runs smoothly

Book a strategy session with us here and let’s map out the smartest move for your portfolio.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!