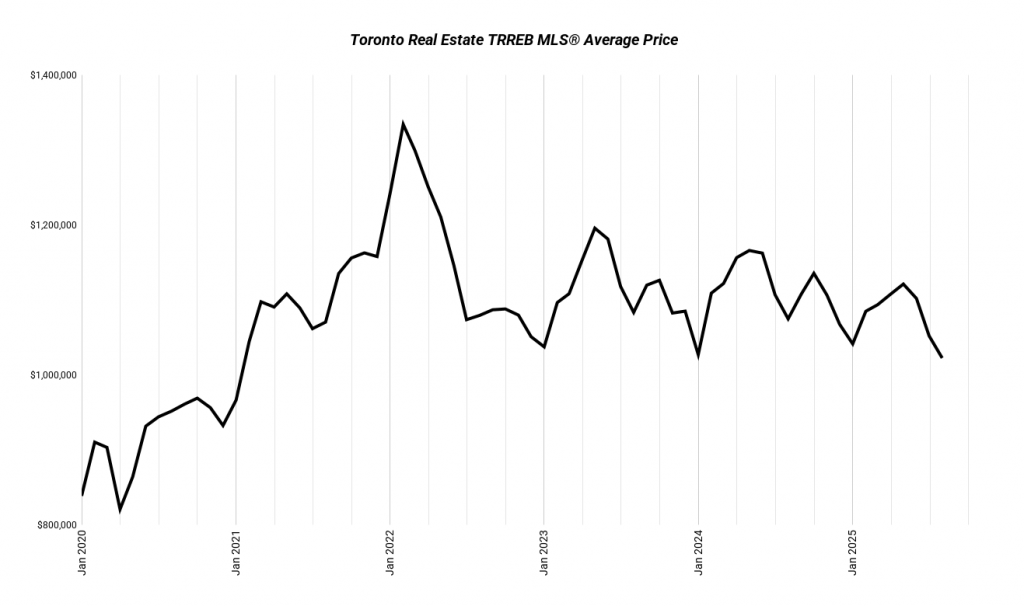

| Metric | Aug 2024 | Jul 2025 | Aug 2025 | YoY | MoM |

|---|---|---|---|---|---|

| Average Price | $1,074,425 | $1,051,719 | $1,022,143 | -5% | -3% |

| Sales | 4,975 | 6,100 | 5,211 | +5% | -15% |

| New Listings | 12,547 | 17,613 | 14,038 | +12% | -20% |

| SNLR | 40% | 35% | 37% | -6% | +7% |

Toronto real estate is still sliding. Prices dipped again, sales slowed compared to July, and buyers remain firmly in control.

But not every property type is moving the same way. Houses have fallen more in price, yet demand for them is still stronger than for condos. Semis stand out as the most resilient, while the suburbs look like they’ll stay weak for longer.

416 Market: Toronto Houses vs Condos

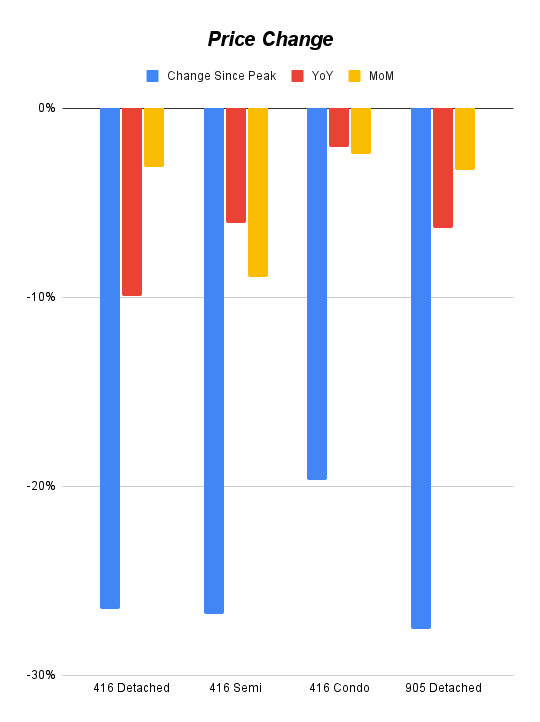

Detached homes in Toronto have taken the steepest price cuts since the 2022 peak. The market is soft, with plenty of choice for buyers. These properties work better for end-users or redevelopment than for investors looking for strong cash flow.

Semis are the strongest class in Toronto right now. They fell sharply last month, but they’re still holding up better than anything else. Cheaper to buy than detached, with similar rental potential, semis give investors the best rent yields and cash flow. They’re also the most likely to rebound first.

Condos have dropped the least since the peak, but that’s exactly the problem. Demand is weakest here, with only about one in three listings selling. Oversupply of one-beds keeps pressure on prices. Condos may still have more room to fall.

| Segment | Peak | Aug 2025 | Change from Peak | YoY | MoM | SNLR |

|---|---|---|---|---|---|---|

| 416 Detached | $2,073,989 | $1,524,066 | -27% | -10% | -3% | 47% |

| 416 Semi | $1,545,447 | $1,131,498 | -27% | -6% | -9% | 59% |

| 416 Condo | $831,351 | $667,660 | -20% | -2% | -2% | 34% |

| 905 Detached | $1,727,963 | $1,251,686 | -28% | -6% | -3% | 35% |

416 vs 905: A Different Story

In the suburbs, market conditions for detached homes look a lot like condos. 905 house prices are down the same amount as 416 houses, but demand is thin, and listings move slowly.

The big difference is supply. The 905 still has land for new builds, which means inventory can keep building up. That makes suburban detached homes more vulnerable to prolonged weakness compared to city houses.

What is SNLR (Sales-to-New-Listings Ratio) and Why It Matters

The Sales-to-New-Listings Ratio (SNLR) shows how hot or cold the market is by measuring how many homes are selling compared to how many are being listed.

- Seller’s Market (SNLR above the dotted line): More buyers than sellers. Homes move fast, competition heats up, and prices usually rise.

- Buyer’s Market (SNLR below the dotted line): More listings than buyers. Homes sit longer, buyers have leverage, and prices tend to soften.

- Balanced Market (SNLR near the dotted line): Supply and demand are in sync. Prices stay relatively stable.

Every market has its own version of that dotted line, but the trend matters most — if SNLR is rising, the market’s tightening. If it’s falling, buyers are gaining ground.

What This Means for Investors

- Condos: Weakest segment. Smallest drop so far, but demand is the lowest. More downside risk.

- 416 Detached: Big price reset, but still sluggish demand. Better for redevelopment than cash flow.

- 416 Semis: Standout. Strongest demand, better yields, best suited for multiplex conversions.

- 905 Detached: Weak like condos. More land means more supply → prolonged softness likely.

Bottom line: 416 semis are the smart play for Toronto real estate investors, especially if you convert it into a multiplex. Condos and 905 detached carry the most risk.

How We Can Help

The market’s messy — but smart investors aren’t waiting on the sidelines. They’re leaning into what actually works.

We zero in on properties with real cash flow, renovation upside, and lasting value. No gambling on appreciation. No praying for rate cuts. Just deals that make sense today and strategies built to hold up in any market.

Want to see what’s possible for you? Book a strategy session with us here.