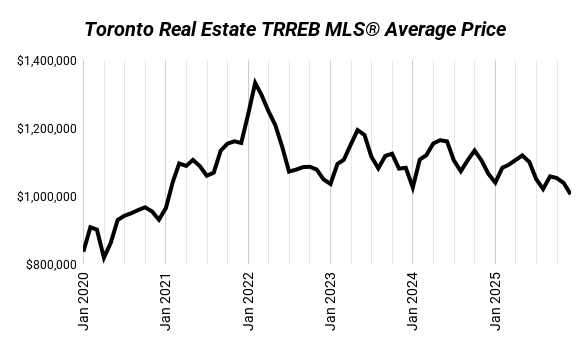

December offered more clarity than change.

Prices edged lower, sales slowed, and some of the headline ratios moved higher. But these shifts weren’t driven by a sudden change in demand. They were largely the result of a market that had already cooled in the fall, combined with the usual holiday slowdown.

In other words, December reflected timing and seasonality more than a new trend.

Market Overview

| Segment | Dec 2024 | Dec 2025 | Change |

|---|---|---|---|

| 416 Detached | $1,624,500 | $1,498,079 | -8% |

| 416 Semi | $1,302,024 | $1,122,309 | -14% |

| 416 Condo | $719,774 | $663,227 | -8% |

| 905 Detached | $1,336,718 | $1,239,882 | -7% |

Why December’s Numbers Look Different

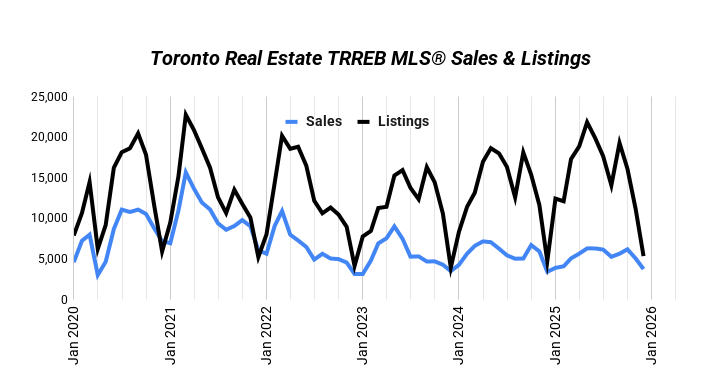

Real estate activity naturally slows in December. Many sellers choose to pause and relist in the new year, while buyers tend to step back unless they are highly motivated. That dynamic reduces both sales and new listings, which can distort ratios like SNLR.

The broader trend remains consistent with what we’ve seen throughout the second half of 2025: a market that has largely adjusted but is still searching for confidence.

| Segment | Dec 2024 | Dec 2025 | Change |

|---|---|---|---|

| 416 Detached | $1,624,500 | $1,498,079 | -8% |

| 416 Semi | $1,302,024 | $1,122,309 | -14% |

| 416 Condo | $719,774 | $663,227 | -8% |

| 905 Detached | $1,336,718 | $1,239,882 | -7% |

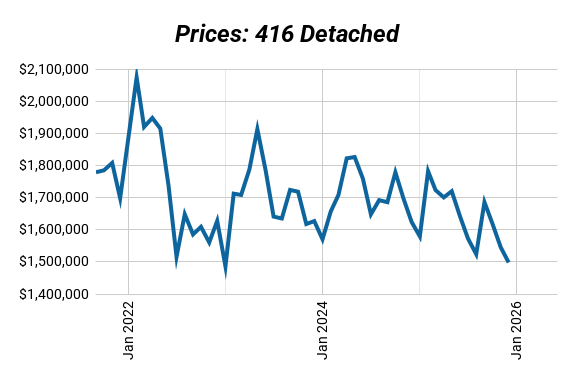

416 Detached

Detached homes in the core continued to see modest price softening, testing lows seen in 2022-2023. After lagging earlier in the correction, this segment appears to be gradually catching up Activity remains selective, with well-priced homes selling while others wait for better homes or lower prices.

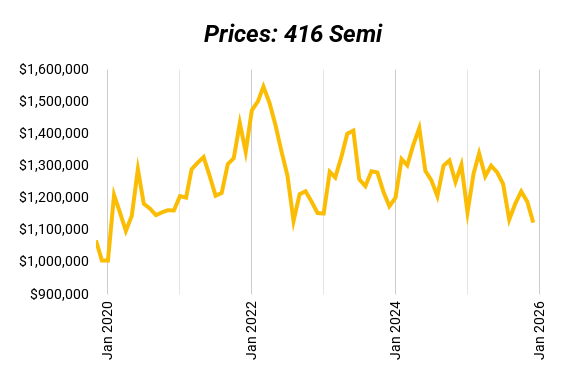

416 Semis

Semis saw sharper movement in December, bringing prices closer to 2022 lows. With very limited holiday inventory, these numbers may overstate the degree of weakness. Given their relative affordability and strong long-term demand, this is a segment worth watching closely as we move into early 2026.

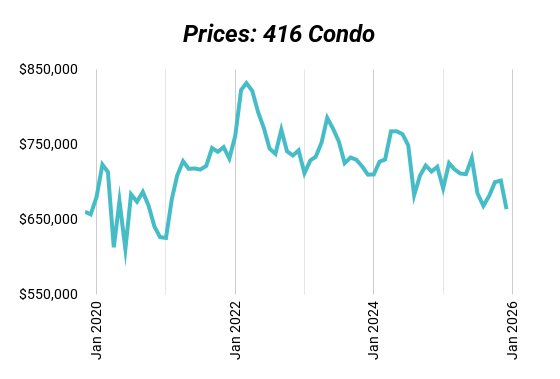

416 Condos

Condo performance remains subdued. Prices continue to trend lower compared to freeholds, and investor activity is limited. December’s data did not suggest a turning point, but rather a continuation of a gradual adjustment that has been underway for some time.

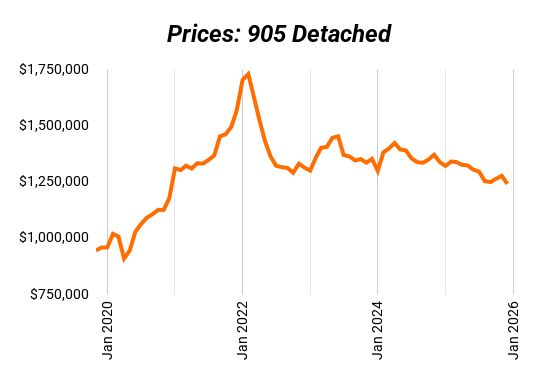

905 Detached

The suburban detached market remains in a later stage of its post-pandemic reset. While the rate of decline has slowed, prices are still working through the excess created during the 2020–2022 period. This segment continues to face more pressure than core freeholds.

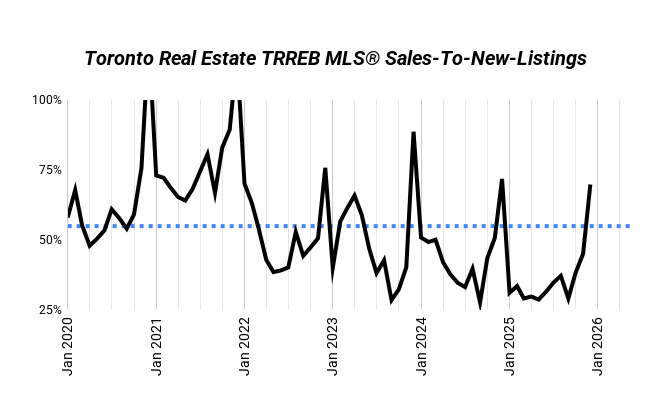

What is SNLR (Sales-to-New-Listings Ratio) and Why It Matters

The Sales-to-New-Listings Ratio (SNLR) shows how hot or cold the market is by measuring how many homes are selling compared to how many are being listed.

- Seller’s Market (SNLR above the dotted line): More buyers than sellers. Homes move fast, competition heats up, and prices usually rise.

- Buyer’s Market (SNLR below the dotted line): More listings than buyers. Homes sit longer, buyers have leverage, and prices tend to soften.

- Balanced Market (SNLR near the dotted line): Supply and demand are in sync. Prices stay relatively stable.

Every market has its own version of that dotted line, but the trend matters most — if SNLR is rising, the market’s tightening. If it’s falling, buyers are gaining ground.

Sales-to-new-listings ratios moved higher in December, but this should be interpreted carefully. With many listings held back during the holidays, SNLR tends to overstate market tightness at year-end. The trend over several months remains more informative than a single December reading.

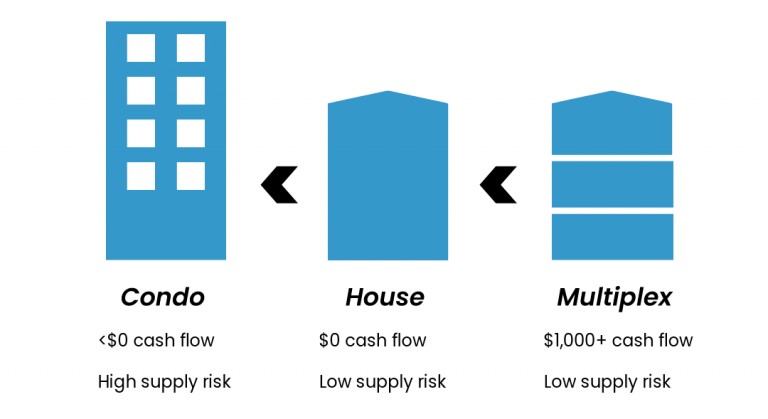

What This Means for Investors

December reinforces the idea that this is a fundamentals-driven market. Price swings have become more measured, and outcomes depend less on timing and more on strategy.

Investors finding success today are focused on:

- Improving assets through renovations or added density

- Enhancing rental income

- Structuring properties for long-term performance rather than short-term appreciation

This environment rewards patience, planning, and execution.

The Big Picture

How We Can Help

At Elevate, value-add isn’t a concept for us — it’s our day-to-day work.

We actively buy, renovate, build, lease, and manage multiplex properties, and we apply the same disciplined, data-driven approach to our clients’ projects as we do to our own.

That means clear numbers, practical planning, and long-term execution — from acquisition through operations.

Want to see what’s possible for you? Book a strategy session with us here.