This is for educational purposes only; it does not guarantee future performance or serve as financial or tax advice.

The Toronto market is quiet. Sellers are wondering whether to suspend listings until fall, rent out and wait another year, or sell now before prices potentially slide further. Buyers are thinking the opposite — hold off until fall in hopes of better deals, or jump now while competition is light.

The reality? This isn’t about interest rates anymore. It’s about confidence, supply, and strategy. Here’s what’s happening and how to navigate it.

The Market Right Now: Deals Are Happening Even After Firm Offers

This summer has shown that even firm deals can be renegotiated.

In one recent case, we had a purchase firmed up with a locked-in price, closing just a week away. Then the sellers couldn’t close on time because of an open permit. The delay could have been a month — maybe two or more — with no guarantee.

We told them: we’ll take on the open permit, but we need a significant discount to make it worthwhile. The result? $85,000 off the purchase price — about 7% — negotiated days before closing.

For our buyer, the risk was manageable because the permit didn’t affect livability, the bank was okay with it, and the potential costs were far less than the discount. For the sellers, it was a way out without months of holding costs and uncertainty. That’s the kind of opportunity that exists in today’s market if you’re ready to act fast and solve problems.

Why Sellers Are Split on Waiting for Fall

Historically, fall has brought more listings — but since 2022, it’s also brought price drops. More supply without matching demand creates competition, which pushes prices down, especially for listings that sit.

If you plan to sell within the next year, getting ahead of that surge could help you net a better price. On the other hand, if you can rent the property and want to wait for stronger market confidence, holding for a year could be the better play.

Why Buyers Are Tempted to Hold Off

Fall can favour buyers: more listings, more choice, and sellers who need to compete.

But waiting isn’t risk-free — the best opportunities often happen when competition is at its lowest, and motivated sellers are willing to negotiate hard. Deals like our $85K price drop example are much harder to get when more buyers are active.

Interest Rates: U.S. vs Canada

In the U.S., the probability of a September rate cut is now over 90%, driven by slowing job growth, cooling inflation, and weaker economic momentum.

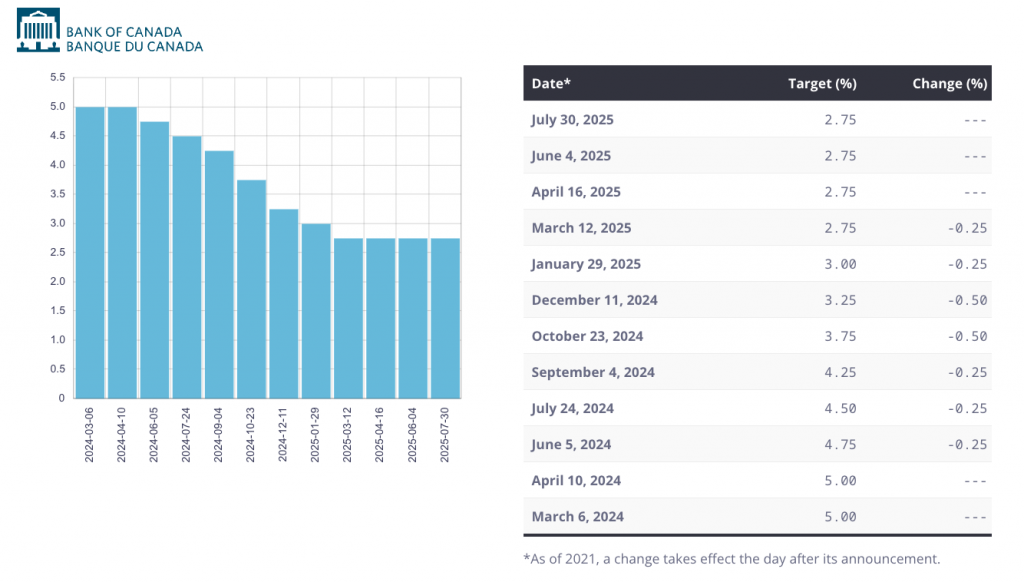

Canada’s Bank of Canada is more cautious. Rates are holding at 2.75% for now, with cuts dependent on inflation staying low and GDP showing further slowing. The next CPI data arrives August 20, and Q2 GDP numbers drop August 29. If growth is weak but not recessionary, a small cut could come this fall. If recession signs strengthen, cuts may still happen — but they won’t necessarily lift the housing market.

Remember, a 25-basis-point cut only boosts borrowing power by about 3%, which is less than normal monthly market swings. Most buyers are on fixed rates anyway.

| Bank | Now | Sep 2025 | Year-End 2025 | Year-End 2026 |

|---|---|---|---|---|

| TD (Updated Jun 2025) | 2.75% | 2.25% | 2.25% | 2.25% |

| CIBC (Updated Jul 2025) | 2.75% | 2.50% | 2.25% | 2.25% |

| BMO (Updated Jul 2025) | 2.75% | 2.50% | 2.25% | 2.00% |

| RBC (Updated Jul 2025) | 2.75% | 2.75% | 2.75% | 2.75% |

| Scotia (Updated Jul 2025) | 2.75% | 2.75% | 2.75% | 2.50% |

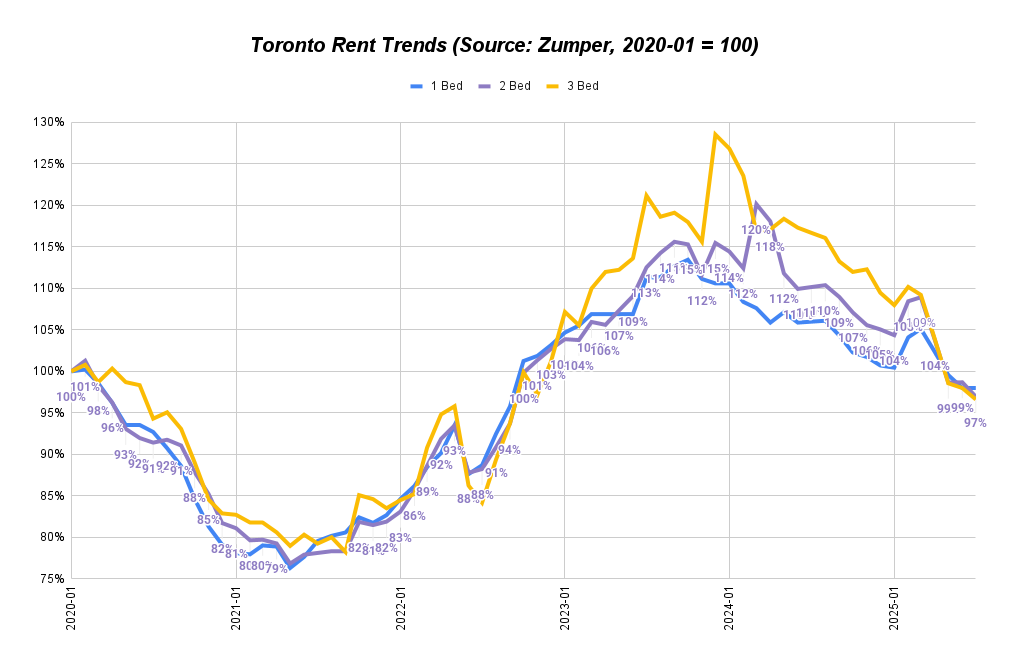

Rental Market: Stabilizing After a Sharp Drop

Rents have fallen about 20% from 2024 highs. The decline started last spring and has been leveling off since late spring 2025.

We expect more rental supply ahead:

- Sellers holding off on sales are listing properties for lease.

- New condo completions are hitting the market.

- Multiplex conversions are adding new units.

For now, rents are stable, but secondary areas could soften further as supply builds. Prime locations will remain more competitive.

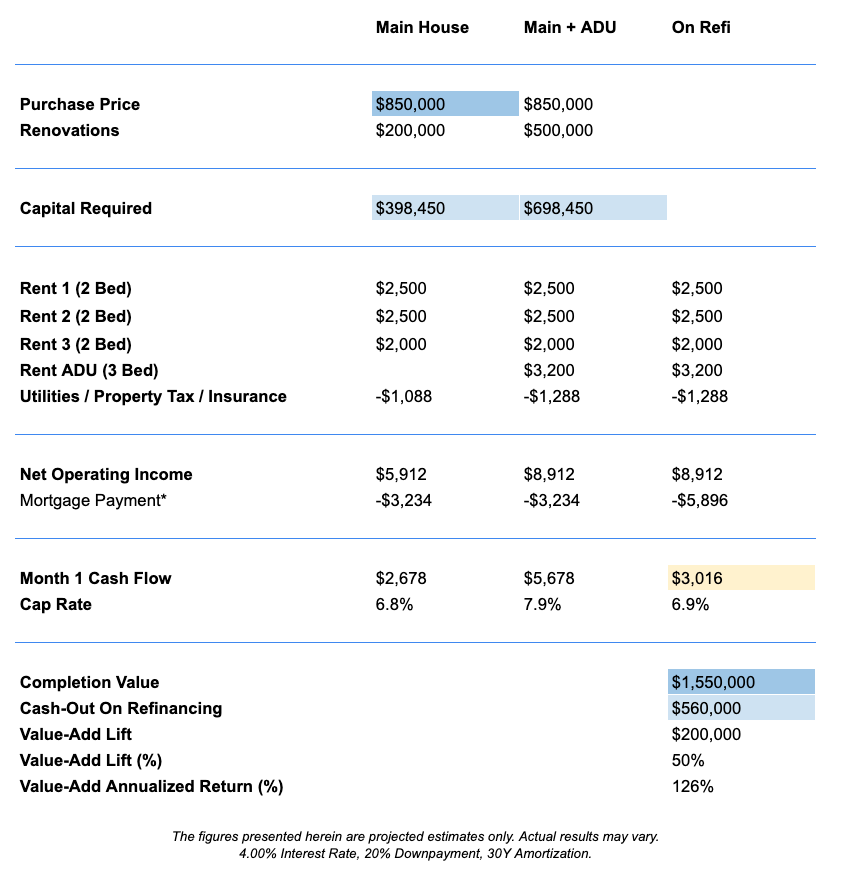

The "Small" Project Play: High Returns Without Big Capital

The best deals right now aren’t massive developments — they’re smaller, lower-risk projects.

Example: Buy a house for ~$850K, invest $200K to convert into a legal triplex, and generate $2,000/month in cash flow. Add a laneway or garden suite to boost that even further. With a refinance, you can often pull out around 80% of your initial capital to fund the next deal.

These projects are easier to finance, quicker to complete, and still deliver strong returns — especially in a flat market.

The Strategy for Fall 2025

Sellers: If you need to sell soon, consider listing before September’s surge in competition. If renting makes financial sense, holding could pay off.

Buyers: Don’t just wait for fall — act when you find the right property at the right price, especially if there’s room to negotiate.

This market is driven by confidence, not just rates. If GDP shows slow growth without recession, buyer sentiment could improve. If recession fears take hold, even rate cuts won’t move the needle much.

The biggest wins right now come from solving seller problems, acting fast, and running the numbers with discipline.

Need Help Deciding Your Next Move?

Whether you’re wondering if now’s the right time to buy, debating whether to sell, or figuring out what kind of property to invest in, having a clear strategy is key.

If you want full support in Toronto multiplex investing, our team can help you:

- Find high-potential properties

- Crunch the numbers so you know exactly where you stand

- Coach you through renovations to maximize returns

- Lock in great tenants

- Provide full property management so your investment runs smoothly

Book a strategy session with us here and let’s map out the smartest move for your portfolio.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!