This is for educational purposes only; it does not guarantee future performance or serve as financial or tax advice.

We’re in Little Italy, steps from Trinity Bellwoods, breaking down a completed triplex-style conversion operating as three self-contained units, with a two-storey laneway suite coming next.

This property started as a single-family semi-detached home. Today, it generates nearly $9,000 per month in gross rent. Phase two is a laneway suite projected to push total income close to $14,000 per month on one downtown Toronto lot. This is a real-world case study in smart density, not theory.

If you’re a Toronto real estate investor, this is the type of execution that matters in today’s market. Not speculation. Not hype. Real numbers, conservative underwriting, and a clear refinance strategy.

Why This Toronto Triplex Conversion Worked

This project worked because of what was already there.

The basement ceiling height was usable. There was separate access. Multiple kitchens were already in place. The lot was deep, with no major trees in the rear. That reduced complexity and future build constraints. In other words, the fundamentals were strong before we ever touched it.

Instead of tearing the house apart, we upgraded structural components, improved HVAC systems, strengthened fire separation, and finished the units properly so they attract quality tenants. This wasn’t a brand-new build. It was a smart repositioning of an underutilized property in a premium neighbourhood.

This distinction is critical for Toronto investors. You do not always need to build from scratch to add density. You need to identify properties that are 70 percent there and execute cleanly.

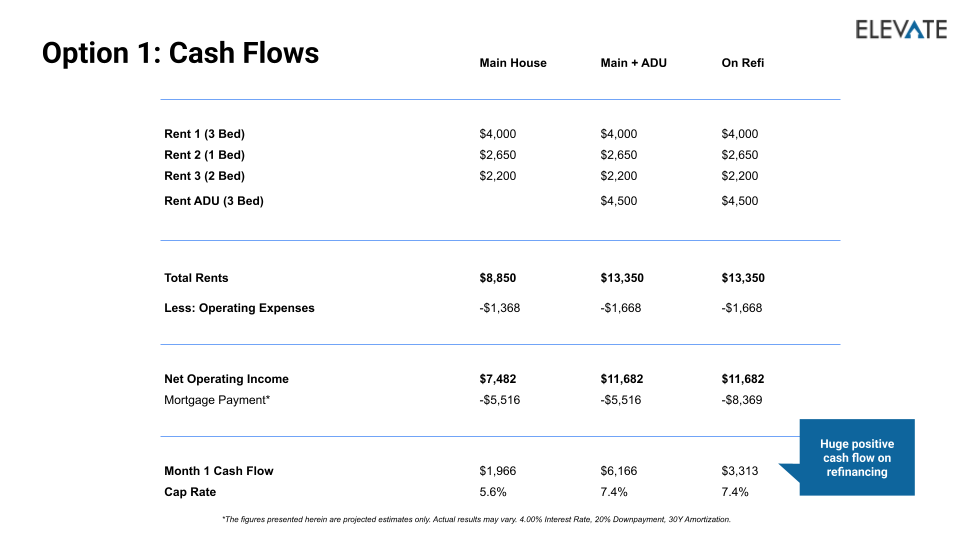

Rental Income Breakdown: Real Numbers in Trinity Bellwoods

Let’s talk actual rents.

Main floor one-bedroom with ensuite laundry: $2,650 per month.

Second and third floor three-bedroom with new rear entrance: $4,000 per month.

Basement two-bedroom with rear access: $2,200 per month.

That brings total gross rent to just under $9,000 per month.

Yes, these are strong rents. And yes, location drives it. Trinity Bellwoods. Streetcar access. Subway nearby. Renovated finishes. Large layouts. Young professionals working downtown will pay a premium for space in a house over a small condo unit.

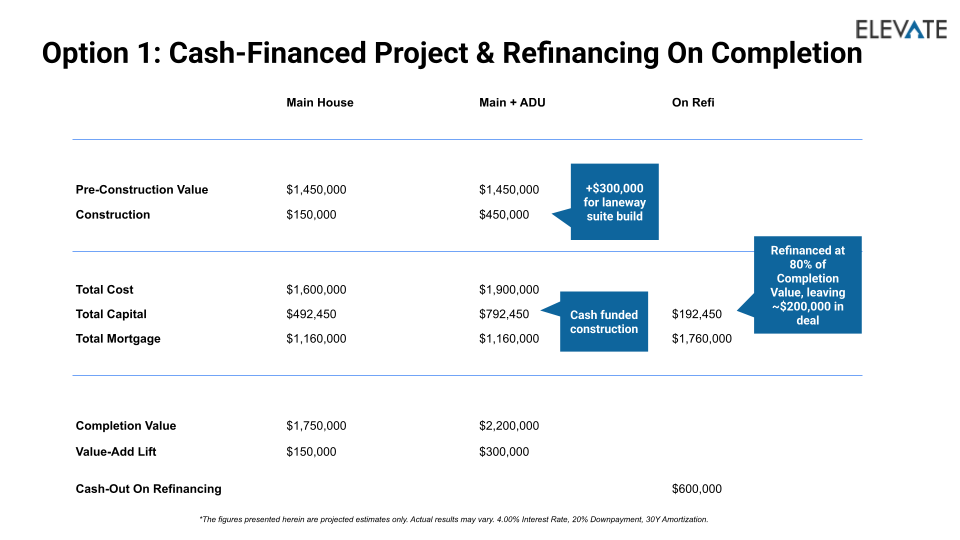

But premium rent comes with a premium entry price. This property was purchased for $1.45M. We spent roughly $150,000 over six months. All in, about $1.6M into the main house.

With 20 percent down and renovations paid in cash, an investor would need close to $500,000 in capital and qualify for roughly a $1.2M mortgage. Once stabilized, the property produces roughly $2,000 per month in positive cash flow before the laneway suite is added.

The Laneway Suite Strategy: Doubling Down on Density

Phase two is where this becomes a true density play.

The lot is deep, has clean rear access, and no major trees limiting construction. That allows for a two-storey, three-bedroom laneway suite.

We underwrite approximately $300,000 in construction cost and about six months to complete. Costs can vary depending on experience and project management. Investors doing this independently should budget conservatively.

Projected rent for the laneway suite is around $4,500 per month.

Once complete, total gross rent across the property would approach $14,000 per month.

This is where Toronto’s missing middle housing policies create opportunity. The city is encouraging gentle density. Investors who understand layout, access, and lot depth can unlock vertical density without buying large development sites.

Valuation and Refinance: Conservative Underwriting

We always underwrite conservatively.

In March 2024, a similar semi with two units and a laneway suite sold for $2.5M. The market has softened since. We estimate a completed value of approximately $2.2M.

Total project cost: about $1.9M.

Conservative value: $2.2M.

Estimated lift: roughly $300,000.

At that valuation, an investor could refinance and pull out approximately $600,000, leaving around $200,000 net capital in the deal once stabilized.

With gross rent close to $14,000 per month, projected cash flow after refinance could exceed $3,000 per month, depending on financing structure.

This is not appreciation-driven speculation. This is income-driven investing with a defined refinance strategy.

Why Many new Investors Miss This Toronto Multiplex Opportunity

Many new investors look at a semi-detached home and see limited potential.

We look at layout, ceiling height, access points, lot depth, tree constraints, and refinance strategy. These factors determine whether density can be added profitably.

Toronto’s multiplex and laneway suite opportunities reward disciplined analysis. You do not need a massive development budget. You need capital, patience, and a clear execution plan.

Buying the right property is more important than overbuilding the wrong one.

The Bottom Line on Toronto Triplex and Laneway Investing

The key takeaway is simple: smart density in premium Toronto neighbourhoods can still produce strong cash flow and equity lift when executed properly.

This is about buying right, stabilizing first, then expanding strategically. It is not about chasing hype or overleveraging. It is about numbers that make sense today.

Our brokerage specializes in Toronto multiplexes. We’ll help you find deals, crunch the numbers, and guide you through renovations and management.

If you want full support in Toronto multiplex investing, our team can help you:

- Find high-potential properties

- Crunch the numbers so you know exactly where you stand

- Coach you through renovations to maximize returns

- Lock in great tenants

- Provide full property management so your investment runs smoothly

Book a strategy session with us here and let’s map out the smartest move for your portfolio.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!