This is for educational purposes only; it does not guarantee future performance or serve as financial or tax advice.

If you’re trying to figure out how to invest in Toronto real estate today, you need more than just price data. You need to see how deals actually perform on the ground.

Here’s a look at what the most successful investors are buying, how they’re adding value, and what kind of returns they’re seeing from multiplex conversions.

Most Investors Are Buying Under $1M — Here’s Why

Deals under $1M are the sweet spot. At that price, financing is more accessible, and there’s usually enough leftover capital to renovate.

Investors are scooping up distressed single-family homes and converting them into 2-3 rental units. That conversion strategy gives a solid boost to rental income and sets the stage for a capital recycle through refinancing.

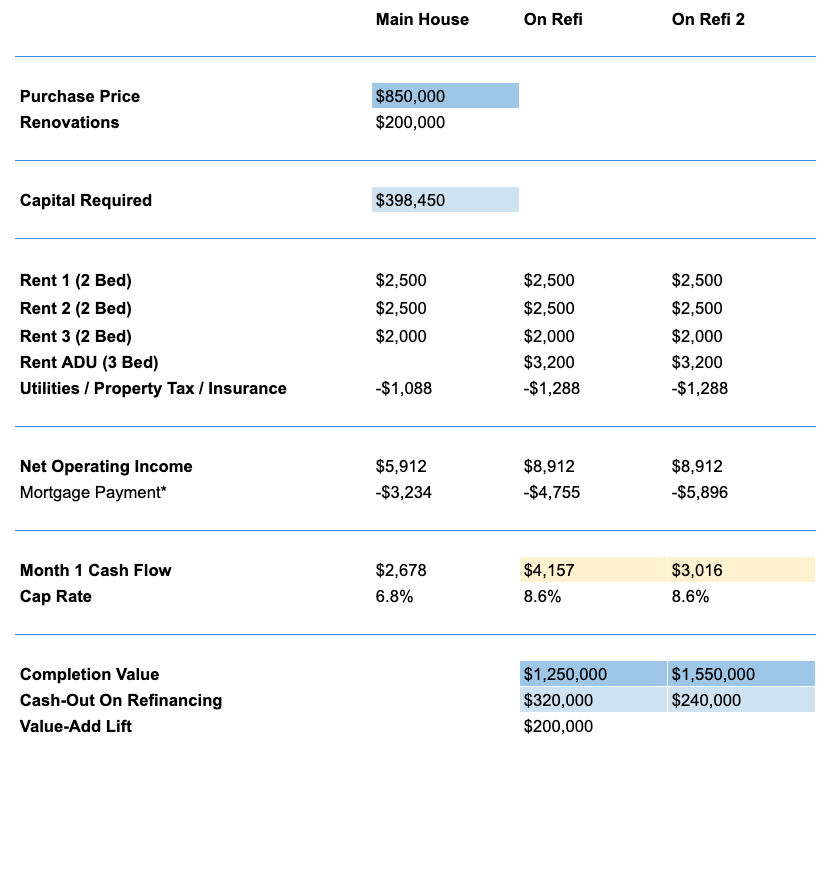

Real Deal: $850K Semi Turned Into 4 Units

One of our clients bought a semi for $850,000 in a gentrifying Toronto neighbourhood with subway access and future transit upgrades. The main house was converted into 3 rental units:

- 2-bedroom unit on second floor

- 2-bedroom unit on main floor

- 2-bedroom unit in the basement

- Plus, there is also space for a future 3-bedroom, 2-storey garden suite.

Renovation Budget: ~$200K All-In for the Main House

The triplex conversion cost about $200,000. From here, the investor had two options:

Refinance Strategy 1: Convert the Main House, Refinance, Then Build Garden Suite

-

Complete and lease the 3 main units first

-

Refinance based on ~$7,000/month in rent

-

Recover most of the $200K renovation cost

That refinance money can then be used to fund the garden suite. This path has lower upfront capital requirements and spreads out the work. Once the garden suite is built, it could generate ~$3,500/month in extra income.

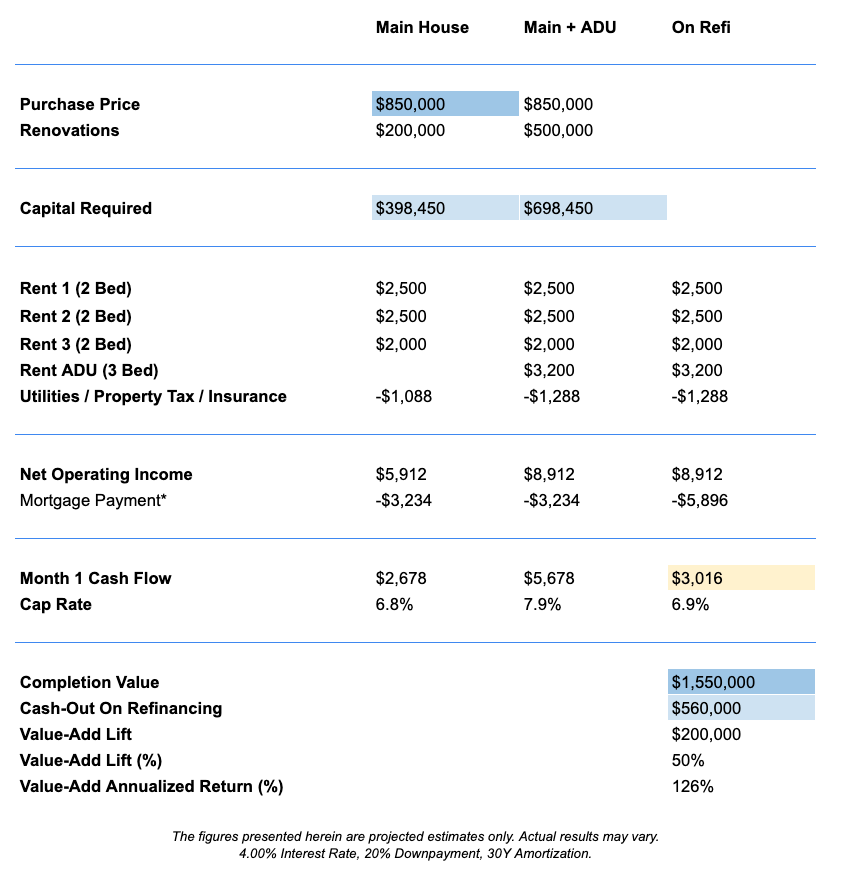

Refinance Strategy 2: Go All-In from Day One

If you have more capital upfront, you can build all four units at once. Once everything is leased, do a single refinance. This path saves time, avoids multiple refinance costs, and gets you to strong cash flow faster.

But it only works if you have the money and bandwidth to handle the full project.

The Key Is Buying Right and Building Smart

This property was bought distressed and below market. That’s how you build in upside from the start. But the real return comes from:

- Adding legal rental units

- Creating strong monthly cash flow

- Using smart refinancing to pull capital back out

Not every house makes a good multiplex. You need the right layout, zoning, and renovation plan. And that’s where having an experienced team matters.

Want Help Finding a Strong Investment?

We’re a full-service real estate sales brokerage that specializes in Toronto multiplexes.

Here’s what it looks like when you work with Elevate:

- Strategy Call: We get clear on your goals and walk you through how to invest smart in Toronto. Straight talk, no fluff.

- Property Search & Purchase: We find the right property that fits your plan — whether it’s turnkey or value-add.

- Renovation Guidance: Need renos? We’ve got trusted contractors, and we’ll coach you through the process so you don’t get burned.

- Leasing & Management: Want help renting it out or managing it long-term? Our team’s got that covered too.

Want to see what’s possible for you? Book a strategy session with us here.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!