This is for educational purposes only; it does not guarantee future performance or serve as financial or tax advice.

Toronto real estate headlines often focus on the big, flashy opportunities — six-plexes, new builds, and massive redevelopment projects.

On paper, the returns can look huge. A million dollars or more in upside sounds exciting, but that doesn’t always mean it’s the smartest move for most investors.

The reality? Real estate is supposed to be simple. When you break down the numbers, timelines, and risks, smaller multiplex conversions — like turning a single-family home into a triplex with the option to add a garden suite — often deliver stronger, more reliable returns.

In this blog, we’ll unpack why we’re investing in triplexes instead of 6-plexes, who’s actually buying them, and what the exit strategies look like once projects are complete.

Why Smaller Multiplexes Beat Bigger Builds

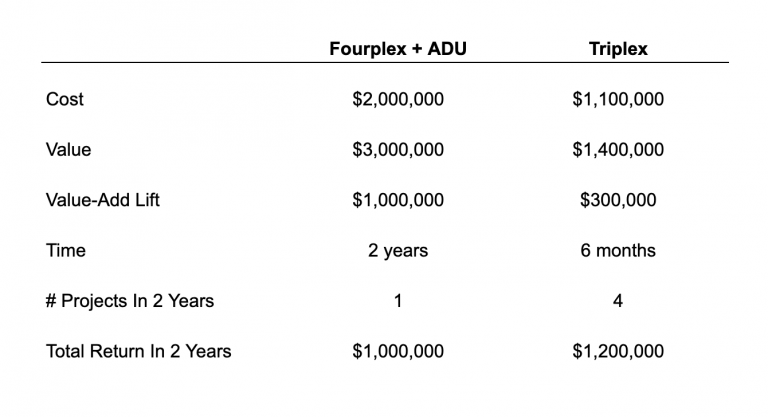

The absolute returns of a 6-plex might look enticing, but they can take years to realize. A major build could require two years and $1M of capital to deliver a $1M profit. Compare that to a triplex conversion: completed in 3–6 months with far less upfront cash.

Over the same two-year period, you could complete multiple smaller projects — stacking the returns, reducing risk, and keeping capital moving. Smaller conversions are also more straightforward to finance and manage, making them a smarter move for most investors.

Condos vs Multiplexes: Comfort, Location, and Lifestyle

Condos dominate Toronto’s skyline, but they aren’t always the best fit for families or long-term renters. Units are small, elevators break down, and parking can be a headache. For young professionals, that lifestyle works — but families often want more.

Multiplexes provide larger, more comfortable units and can be found across the city — in North York, Scarborough, midtown, and downtown neighbourhoods.

They’re not concentrated like condos, which means less competition and more demand in prime residential areas. For families, having a backyard, driveway, and a neighbourhood feel beats high-rise living every time.

Garden Suites: The Hidden Value Booster

One of the biggest advantages of owning land in Toronto is the ability to add density.

A garden suite unlocks that potential. Unlike a condo, which is limited to the unit you buy, a multiplex with a backyard can support a laneway or garden suite, creating new rental income streams and boosting property value.

These units also aren’t subject to rent control, giving investors flexibility to adjust as the market shifts. Over the long term, garden suites transform single lots into multi-unit cash-flowing assets — and with current development charge (DC) waivers, the economics are even more compelling.

Development Charges: Why Timing Matters

Development charges have more than tripled since 2018, with rental units technically set at $50,000 per unit. Non-rental units push that even higher, often to $80K–$90K. For a triplex plus garden suite, that’s $200,000 in fees you’d normally have to pay.

Right now, DCs for rental projects are waived — but that won’t last forever. Investors who move now lock in six-figure savings on builds that would otherwise be unworkable. Combine that with today’s negotiating power on property prices, and it’s one of the strongest windows we’ve seen for multiplex projects.

Who’s Investing In Multiplexes in Toronto?

The buyer pool for multiplexes is shifting. Builders who once focused on condos and subdivisions are moving down-market into conversions, where timelines are shorter and approvals are easier. At the same time, first-time investors are jumping in, often starting with a simple duplex or triplex conversion.

On the resale side, duplexes attract both investors and end users — families who want rental income to help with affordability. Triplexes appeal to house hackers and small investors.

Once you get into fourplexes and beyond, liquidity drops and the buyer pool narrows to seasoned investors. That’s another reason we like smaller projects: they’re easier to sell if you ever need to exit.

Ready to Invest in Toronto Multiplexes?

The takeaway is simple: real estate doesn’t need to be complicated. Smaller multiplex conversions deliver reliable cash flow, appreciation, and strong exit strategies without the delays and risks of big builds.

At Elevate Realty, we’ve been through the process hundreds of times. We’ve made the mistakes so you don’t have to, and we know how to maximize every dollar of your investment.

Our brokerage specializes in Toronto multiplexes. We’ll help you find deals, crunch the numbers, and guide you through renovations and management. If you want full support in Toronto multiplex investing, our team can help you:

- Find high-potential properties

- Crunch the numbers so you know exactly where you stand

- Coach you through renovations to maximize returns

- Lock in great tenants

- Provide full property management so your investment runs smoothly

Book a strategy session with us here and let’s map out the smartest move for your portfolio.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!