This is for educational purposes only; it does not guarantee future performance or serve as financial or tax advice.

Most people assume Toronto real estate only works when prices are rising. After two decades of strong appreciation, it became a game of buying anything and waiting for the market to grow your wealth. But when prices level off or dip, that mindset doesn’t work anymore. Investors are left wondering whether Toronto is still worth it.

The truth is the old playbook is dead. Toronto real estate now rewards those who generate value — not those who sit back and hope for a spike. In today’s market, the biggest opportunities come from strong rental demand, new zoning allowing more units, and hands-on strategies like converting dated properties into legal multiplexes. This shift favours strategic investors who understand how to force returns, and it’s creating some of the best opportunities we’ve seen in years.

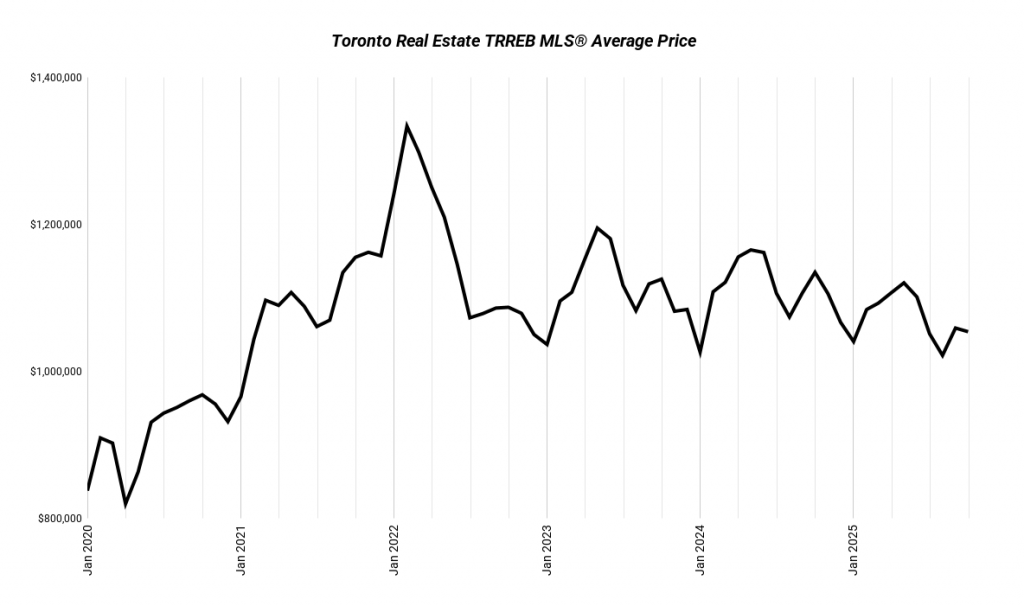

Toronto Prices Have Stabilized — and That’s a Good Thing

Over the past few years, Toronto experienced a major correction. Most of the drop happened in 2022. Since then, prices have moved within a tight range rather than continuing to fall. Properties are still sitting roughly 20 percent below peak values on average, and because it’s a buyer’s market, you can often negotiate even further — sometimes above 30 percent off peak pricing for conditionally negotiated deals.

Investors often ask what happens if prices drop further. That’s a fair concern. But when you consider long-term fundamentals — limited supply of houses and growing demand — house values in Toronto tend to grow in line with inflation over time. There’s no new land, and most new homes replace existing ones. We’re not expecting fast appreciation like before. Instead, the market now favours steady performance backed by real income, not speculation.

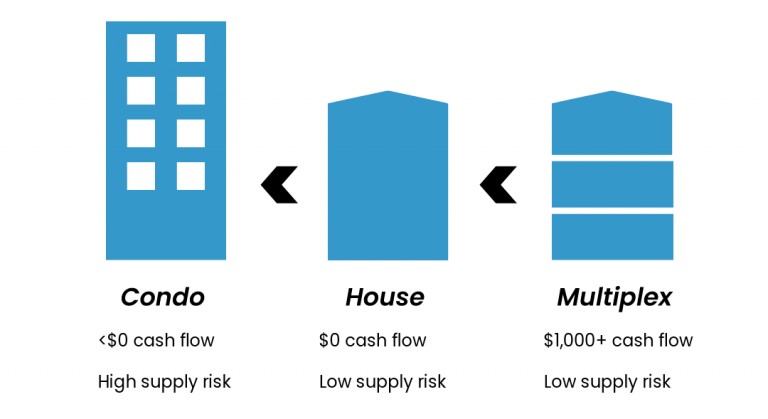

Toronto Real Estate Works Now Because of Rental Income and Density

In previous years, a turnkey multiplex often barely broke even or ran slightly negative when accounting for mortgage payments and operating expenses. Today, the same type of multiplex can generate around $500 in positive cash flow per month right from day one. Rental demand remains strong, and vacancy rates are low.

Zoning changes now allow more units within the same structure. Instead of being capped at two legal units, properties can support up to four interior units, plus a laneway or garden suite. Even if individual unit rents are slightly lower than before, total income per property has increased thanks to added density. This change has redefined affordability and long-term investment performance.

Multiplex Conversion: The Fastest Way to Force Returns

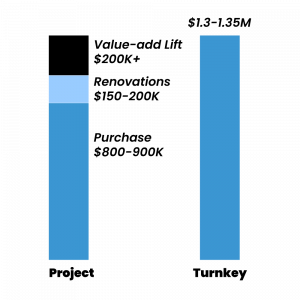

Investors willing to take on renovation projects can leverage Toronto’s high price point to create even greater returns. Construction costs are similar across the country, but Toronto’s higher end values result in bigger lift.

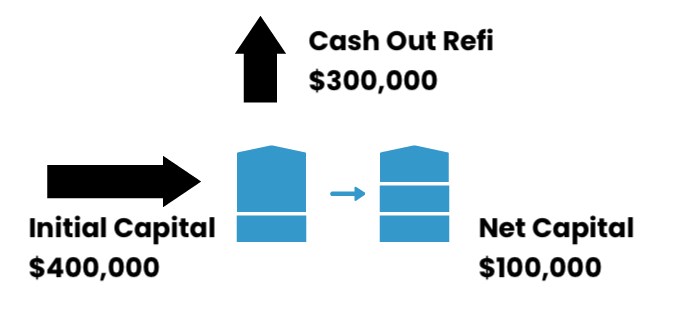

For example, buying a dated semi for around $900,000 and investing $200,000 to convert it into three legal units often yields a finished value around $1.3 million. That’s roughly $200,000 in value-add plus over $2,000 in monthly positive cash flow. With a refinance, you can recycle most of your capital and scale faster. This is how seasoned investors grow even when the market is flat — returns are forced, not waited on.

Once stabilized, you can refinance, pull most of your capital back out, and redeploy it into the next project. You’re not just chasing appreciation—you’re manufacturing it. That’s how Toronto investors can still win in a market that feels impossible to crack.

What You Need to Make This Strategy Work

Multiplex investing isn’t for everyone. You generally need around $200,000 in household income to qualify for financing and about $300,000 in capital for a turnkey multiplex purchase with 20 percent down and closing costs. If you take on a renovation project, long-term returns are higher but you’ll need more cash upfront since renovation costs are paid before any refinance.

If you’re well capitalized and willing to think beyond “buy and wait,” this strategy is one of the most effective ways to build long-term wealth in Toronto real estate today.

The Smart Move Forward

The big takeaway? Toronto real estate still makes sense — but not if you’re relying on market appreciation alone. It works now through rental income, density, and value-add renovations that produce returns even when values are flat. Strategic investors who understand this shift are scaling faster than before.

If you’re ready to invest with a proven approach, we can help you apply these strategies to your situation. We use them in our own projects and with our clients.

Our brokerage specializes in Toronto multiplexes. We’ll help you find deals, crunch the numbers, and guide you through renovations and management. If you want full support in Toronto multiplex investing, our team can help you:

- Find high-potential properties

- Crunch the numbers so you know exactly where you stand

- Coach you through renovations to maximize returns

- Lock in great tenants

- Provide full property management so your investment runs smoothly

Book a strategy session with us here and let’s map out the smartest move for your portfolio.

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!